The Extrapolator MT4 indicator is a powerful trading tool that utilizes six extrapolation methods to predict future price movements of currency pairs. This innovative approach to forecasting provides traders with valuable insights to make informed decisions in the Forex market. This article will explore the Extrapolator indicator’s unique features, the six extrapolation methods, and how traders can leverage this tool for more accurate trading forecasts.

Overview of the Extrapolator MT4 Indicator

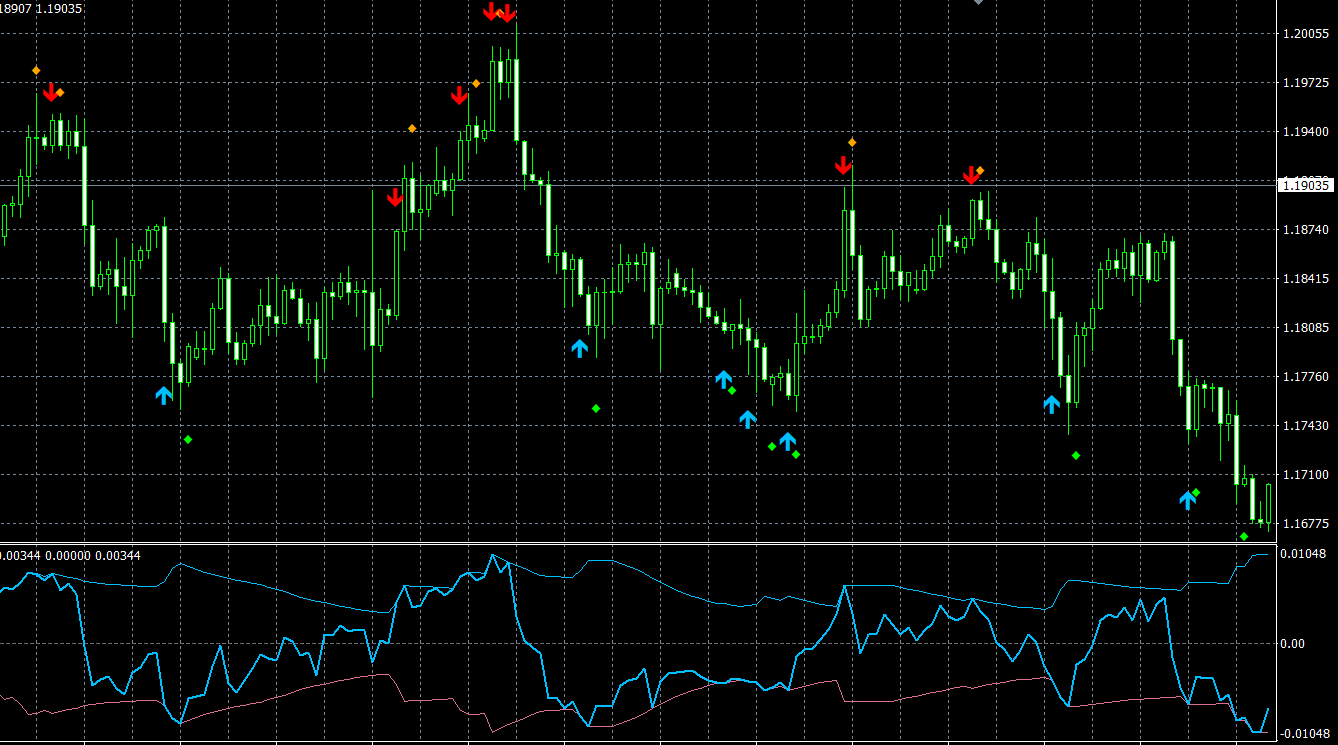

The Extrapolator trading indicator plots a two-color line on the chart, representing the historical price (blue line) and the predicted future price (red line) of a currency pair. By employing six different extrapolation methods, the indicator offers traders a comprehensive and versatile forecasting tool to enhance their trading strategies.

The Six Extrapolation Methods

The Extrapolator indicator relies on six extrapolation methods, configurable through the Method parameter. These methods are:

- Method 1: Extrapolation of Fourier series – Frequencies are calculated using the Quinn-Fernandes Algorithm.

- Method 2: Autocorrelation Method – A linear prediction method that estimates future values based on the correlation between past values.

- Method 3: Weighted Burg Method – A linear prediction method that assigns different weights to past values, giving more importance to recent data.

- Method 4: Burg Method with Helme-Nikias weighting function – A linear prediction method that uses the Helme-Nikias weighting function for improved accuracy.

- Method 5: Itakura-Saito (geometric) method – A linear prediction method that employs a geometric approach to estimate future values.

- Method 6: Modified covariance method – A linear prediction method that considers the covariance between past values to forecast future price movements.

Using the Extrapolator MT4 Indicator for Accurate Trading Forecasts

While the Extrapolator indicator offers a unique approach to predicting future price movements, traders should keep in mind that no predictive indicator can provide a 100% guarantee of accuracy. Here are some tips for using the Extrapolator indicator effectively:

- Combine with Other MT4 Indicators: Enhance the reliability of the Extrapolator indicator by combining it with other technical analysis tools such as trend indicators and oscillators.

- Experiment with Different Extrapolation Methods: Since the Extrapolator indicator offers six extrapolation methods, traders should test each method to determine which one works best for their trading style and strategy.

- Apply Risk Management: As with any trading strategy, it is essential to implement proper risk management techniques to protect your trading capital and minimize losses.

- Continuously Monitor Market Conditions: Keep an eye on the prevailing market conditions and adjust your trading strategy accordingly, as the effectiveness of the Extrapolator indicator may vary depending on market volatility and other factors.

Conclusion

The Extrapolator MT4 indicator is a powerful and versatile trading tool that offers traders a unique approach to forecasting future price movements in the Forex market. By utilizing six extrapolation methods, the indicator provides accurate and insightful trading forecasts to enhance trading decisions.

However, traders should keep in mind that no predictive indicator can guarantee 100% accuracy. It is crucial to combine the Extrapolator indicator with other technical analysis tools, apply proper risk management techniques, and continuously monitor market conditions for optimal trading performance. With the right approach, the Extrapolator indicator can be an invaluable addition to any Forex trader’s toolbox.

Features of Extrapolator MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Extrapolator.zip file you will find:

- Extrapolator.ex4

Download Extrapolator MT4 indicator for free: