In the fast-paced world of forex trading, having the right tools at your disposal can significantly enhance your trading strategy and increase your chances of success. The Trix Indicator, or Triple Exponential Moving Average (TEMA), is one such tool that has garnered attention for its ability to provide clear, momentum-based trading signals. We will explore the Trix Indicator, its functionalities, application in trading strategies, and tips for optimizing its use on the MetaTrader 4 (MT4) platform.

Understanding the Trix Indicator

The Trix Indicator is a sophisticated oscillator that stands out for its use of the triple exponential moving average. Unlike simple moving averages that only take the average of price data over a certain period, the Trix Indicator smoothens price fluctuations and filters out market noise more effectively, thanks to its triple smoothing of the exponential moving averages (EMAs).

How the Trix Indicator Works

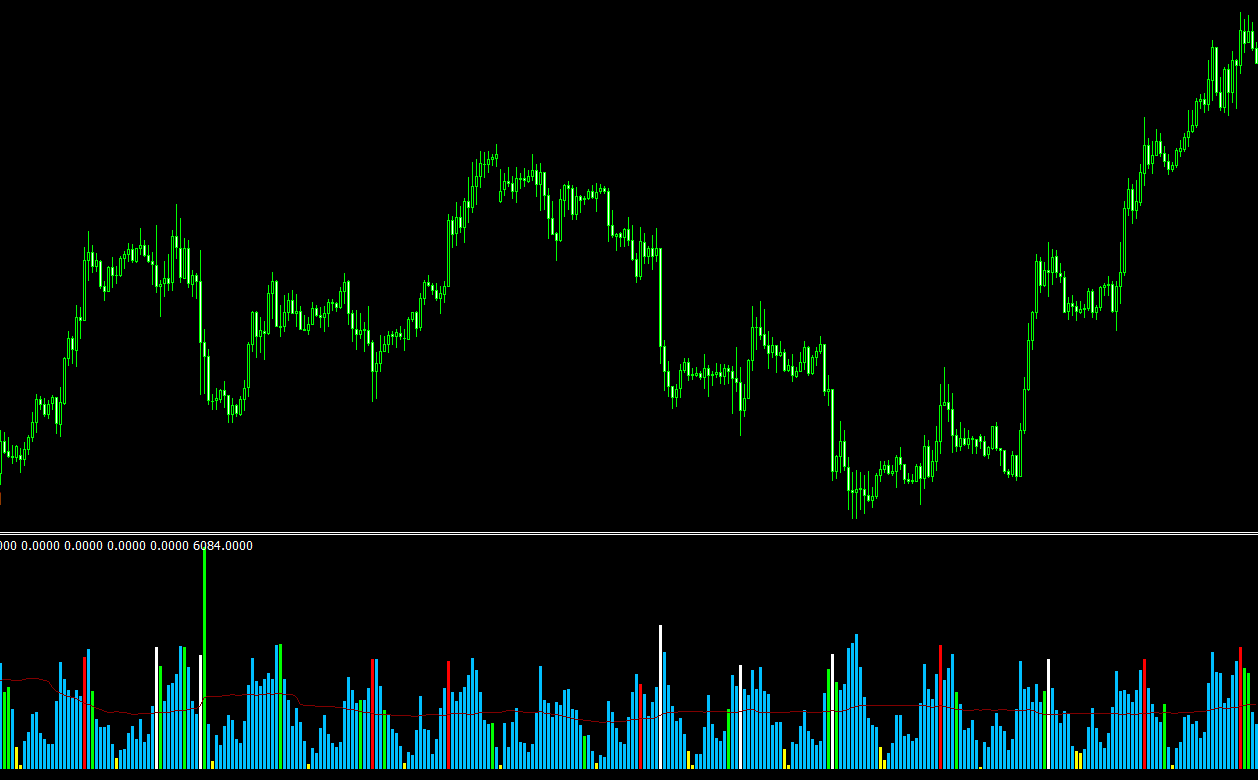

The indicator calculates the rate of change of the triple-smoothed EMA, presenting this data in a separate indicator window below the main price chart. The primary function of the Trix Indicator is to identify changes in market momentum before they are reflected in the price, making it a valuable leading indicator.

Signal Representation:

- Buy Signals: Indicated by yellow arrows, suggesting that the market momentum is shifting upwards and it might be a good time to consider entering a long position.

- Sell Signals: Shown as aqua-colored arrows, indicating a potential downward momentum shift and possibly a good opportunity to enter a short position.

Traders can use these signals to enter and exit trades, holding their positions until an opposite signal is displayed.

Using the Trix Indicator in Forex Trading

1. Identifying Market Trends: The Trix Indicator excels in identifying the beginning of market trends. A positive reversal on the Trix Indicator can precede a bullish market trend, while a negative turn may indicate the start of a bearish trend.

2. Divergence and Reversals: One of the key strengths of the Trix Indicator is its ability to show divergence. When the price of a currency pair is moving in one direction and the Trix Indicator moves in the opposite, it signals a potential price reversal. Recognizing these divergences early can give traders a significant advantage.

3. Overbought and Oversold Conditions: As an oscillator, the Trix Indicator can also help traders identify overbought and oversold market conditions. While the Trix itself does not have fixed overbought or oversold levels, extreme readings can indicate that a reversal might be near.

Strategies for Trading with the Trix Indicator

1. Trend Following: Traders can use the Trix Indicator to confirm the direction of the market trend and enter trades in alignment with this trend, using the color-coded arrows as entry signals.

2. Divergence Trading: Acting on divergences between the Trix Indicator and price can be a powerful strategy. Traders should look for discrepancies where price makes a new high or low that is not confirmed by the Trix Indicator, indicating a possible reversal.

3. Combining with Other Indicators: For enhanced accuracy, the Trix Indicator can be used in conjunction with other technical analysis tools, such as moving averages to confirm trend direction or RSI/Stochastic oscillators to confirm overbought and oversold conditions.

Best Practices for Using the Trix Indicator

- Confirmation Is Key: Always seek confirmation from other indicators or analysis techniques before making a trade based on Trix Indicator signals.

- Understand the Market Context: Be aware of economic news releases and other market events that can influence price action and potentially override the signals provided by the Trix Indicator.

- Practice Risk Management: Use stop-loss orders and manage your trade sizes to protect your trading capital against sudden market moves.

- Customization: Don’t hesitate to adjust the settings of the Trix Indicator to better fit the specific characteristics of the currency pair you are trading.

Conclusion

The Trix Indicator offers forex traders a dynamic and effective tool for assessing market momentum, identifying potential reversals, and confirming trend directions. Its ability to filter out market noise and provide clear, actionable signals makes it a valuable addition to any trader’s arsenal. By understanding how to interpret and apply the signals generated by the Trix Indicator, traders can enhance their trading strategies, making more informed decisions that lead to successful trades. Remember, while the Trix Indicator is powerful, its effectiveness increases when used as part of a comprehensive trading plan complemented by sound risk management practices.

Features of Trix MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Trix.zip file you will find:

- Trix.ex4

Download Trix MT4 indicator for free: