The Darvas Boxes MT4 Indicator, named after its creator, the renowned stock trader Nicolas Darvas, has earned its place in the toolkit of many traders. It merges the concepts of momentum and trend to demarcate potential price movement zones, paving the way for strategic trade setups.

Origins and Principles

Nicolas Darvas, a dancer by profession, delved into stock trading in the 1950s and went on to devise this unique method of tracking stock price movements, which has since been adapted to various trading platforms, including MT4.

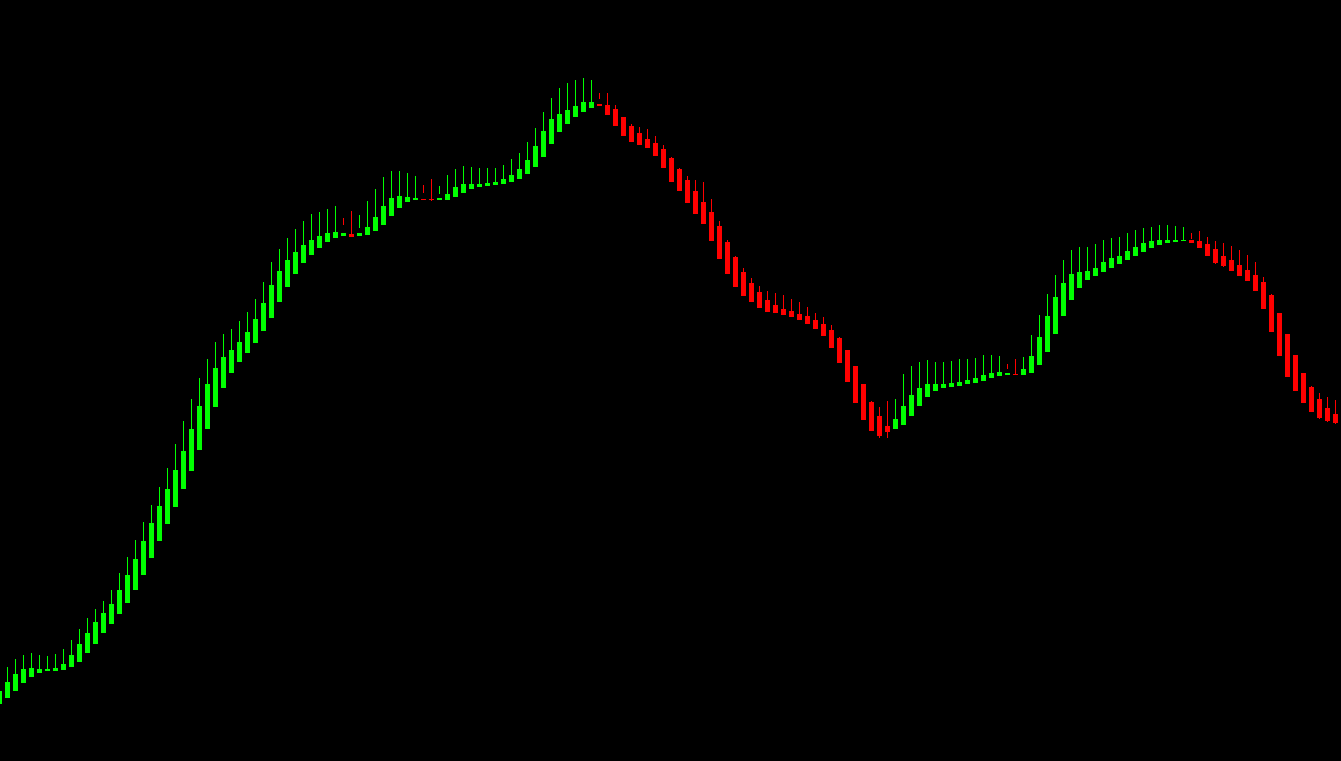

The essence of the Darvas Boxes Indicator is its capacity to draw ‘boxes’ around specific market ranges. These boxes primarily form around new highs and lows. Here’s how it operates:

- The upper line of the box is connected to the new highs.

- The lower line links to recent lows.

- A price is deemed to be within the Darvas box if it makes contact with a previous high but doesn’t surpass the peak price within that box.

What distinguishes the Darvas Boxes indicator is its visual simplicity. The system employs arrows to signal potential entries for both long and short positions when the price exceeds or retreats from the defined box boundaries.

Trading with the Darvas Boxes Indicator

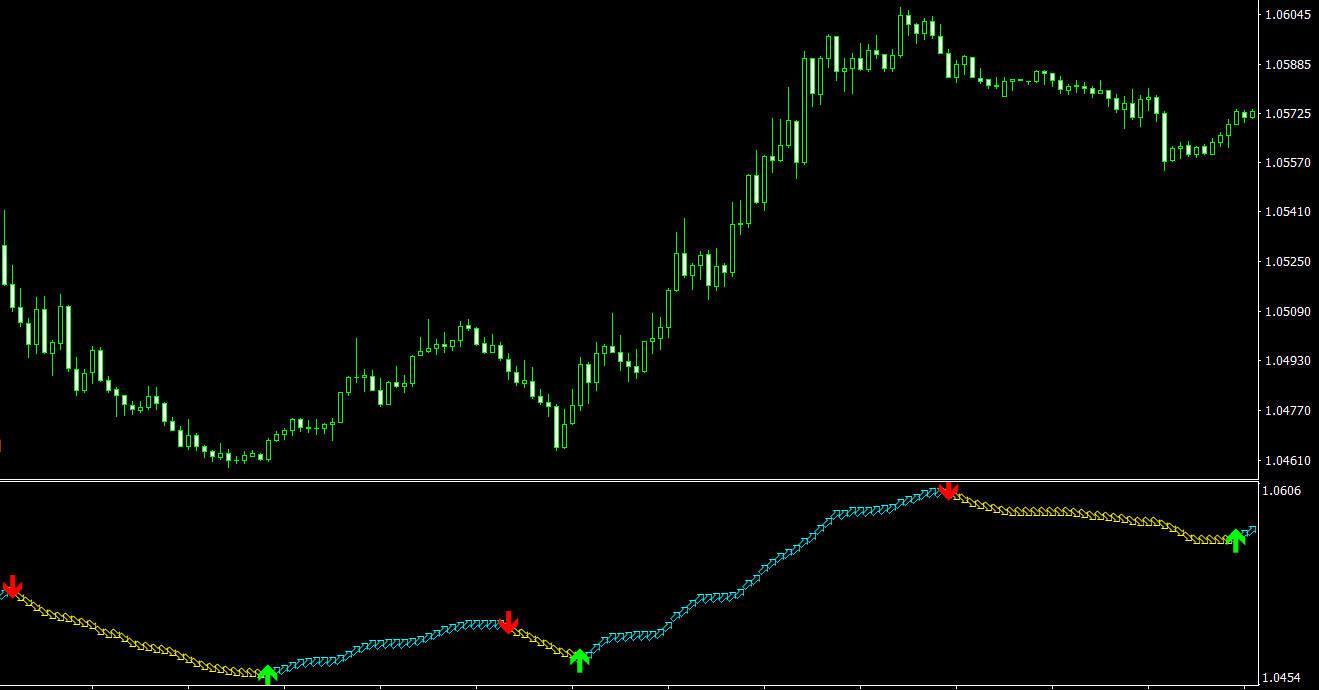

- Buy Signals: Traders ought to scout for scenarios where the price is in a constricted ranging market. The initiation point for a buy trade surfaces when a bullish candle breaches the resistance line of the box. To mitigate risk, it’s advisable to set a stop loss beneath the Darvas box, or a few pips below the entry candle. Exit the trade either when the indicator flags a sell signal, the take profit level is reached, or when the price approaches the subsequent resistance zone.

- Sell Signals: The cue for a potential sell position is provided when the indicator sketches a Darvas box during price consolidation periods. To safeguard the trade, the stop loss should be stationed above the box, preferably above the candle that instigated the entry. The trade may be closed when a buy signal from the indicator is given or once the pre-established profit target is achieved.

Please note that buy and sell arrows appear when the current price moves above or below the Darvas box. However, if the price returns inside of the box within the same candle, the arrows will vanish from the chart. These signal arrows remain fixed on the chart only when the candle concludes its period above or below the box’s boundaries. As a precaution, it’s recommended not to initiate a trade based on the current candle’s movement; instead, wait for the candle to close fully.

Concluding Thoughts

The Darvas Boxes MT4 Indicator is a reflection of Nicolas Darvas’ keen observation and understanding of stock price behaviors. His method, distilled into this indicator, provides traders with a structured approach to identifying potential breakout and breakdown zones.

However, as with all trading tools, the Darvas Boxes indicator is most potent when used in conjunction with other analytical methods, ensuring that traders operate with a holistic view of the market. This dual approach amplifies the chances of success and minimizes the inherent risks of trading.

Features of Darvas Boxes MT4 indicator

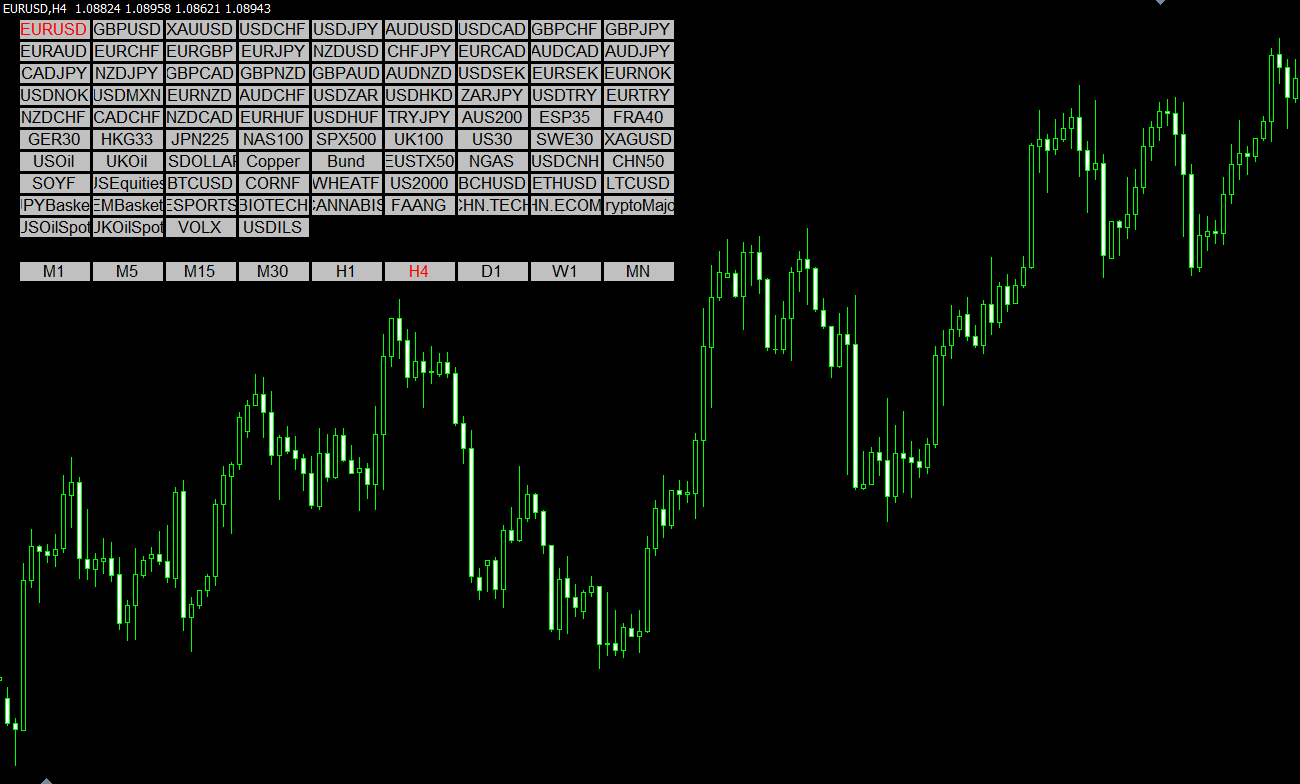

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In DarvasBoxes-nmc.zip file you will find:

- DarvasBoxes-nmc.ex4

Download Darvas Boxes MT4 indicator for free: