The Composite RSI trading indicator is an innovative modification of the well-known Relative Strength Index (RSI) oscillator, designed to accurately identify price reversal points for profitable trades. By incorporating floating levels, the Composite RSI differs from the standard RSI, as it does not rely on overbought and oversold levels. This article will explore the unique features of the Composite RSI MT4 indicator, providing an in-depth understanding of its potential to enhance your trading strategies and performance.

Overview of the Composite RSI MT4 Indicator

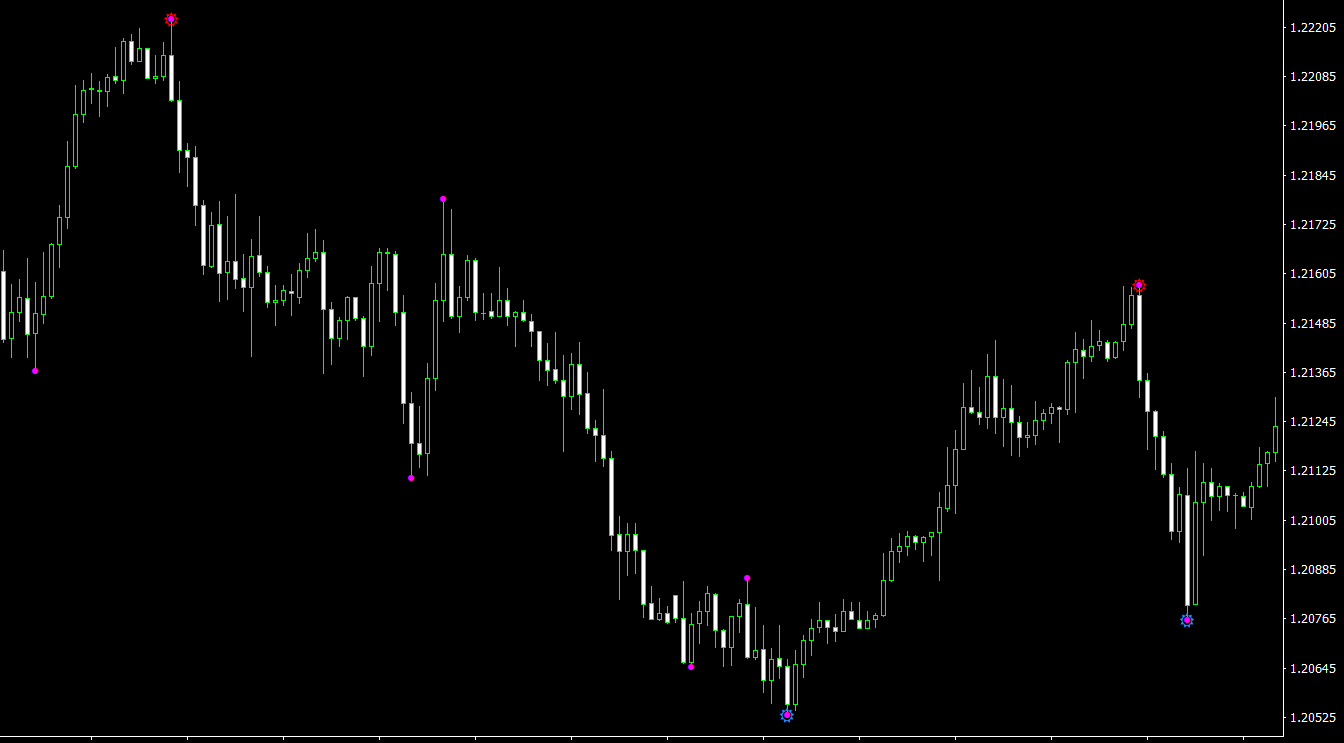

The Composite RSI indicator is an advanced version of the RSI oscillator, featuring the addition of floating levels. Unlike the standard RSI, the Composite RSI indicator does not use overbought and oversold levels. Instead, it focuses on the oscillator line exiting floating levels as a signal for a trend breakout. This unique approach allows the Composite RSI to provide accurate and profitable trading signals, ensuring timely identification of price reversals.

Key Features of the Composite RSI MT4 Indicator

- MTF (Multi-Timeframe) Mode: The Composite RSI indicator incorporates MTF mode, enabling traders to analyze multiple timeframes simultaneously for a more comprehensive understanding of market trends.

- Four Types of Levels: The indicator features four types of levels, providing traders with a wide range of options for optimizing their trading strategies.

- 30 Types of Price Smoothing: The Composite RSI indicator offers 30 different types of price smoothing, allowing traders to fine-tune the indicator according to their preferred trading style and objectives.

- Floating Levels: The addition of floating levels in the Composite RSI indicator helps identify trend breakouts more accurately, offering a distinct advantage over the standard RSI.

Utilizing the Composite RSI MT4 Indicator for Price Reversal Points and Profitable Trades

- Identify Trend Breakouts: The primary function of the Composite RSI indicator is to recognize trend breakouts. When the oscillator line exits the floating levels, it signals a potential trend breakout, providing traders with an opportunity to enter the market.

- Customize Indicator Settings: With four types of levels and 30 types of price smoothing, the Composite RSI indicator offers extensive customization options. Traders should optimize the indicator settings to suit their individual trading preferences and strategies.

- Combine with Other MT4 Indicators: To enhance the effectiveness of the Composite RSI indicator, traders can combine it with other technical analysis tools such as support and resistance levels, moving averages, or oscillators.

- Apply Proper Risk Management: As with any trading strategy, implementing appropriate risk management techniques is crucial to protect trading capital and minimize potential losses.

Conclusion

The Composite RSI MT4 indicator presents a powerful and effective modification of the traditional RSI oscillator, focusing on floating levels to identify trend breakouts and price reversal points accurately. With its unique features, including MTF mode, four types of levels, and 30 types of price smoothing, the Composite RSI indicator provides traders with extensive optimization possibilities to enhance their trading performance.

To maximize the potential of the Composite RSI indicator, traders should combine it with other technical analysis tools, practice proper risk management, and remain vigilant in monitoring market conditions. With the right approach, the Composite RSI MT4 indicator can significantly improve trading strategies and results in the Forex market.

Features of Composite RSI MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Composite-Rsi.zip file you will find:

- Composite Rsi 1.9.ex4

Download Composite RSI MT4 indicator for free: