Price reversals are crucial moments in the market that present profitable trading opportunities for traders. Identifying these reversals is essential for successful trading strategies. The Reversal Navi MT4 indicator is designed to pinpoint price reversal points using reversal bars and interpret them as market entry points. By incorporating the Reversal Navi indicator into your trading strategies, you can improve your ability to recognize potential reversals and capitalize on them.

Understanding the Reversal Navi MT4 Indicator

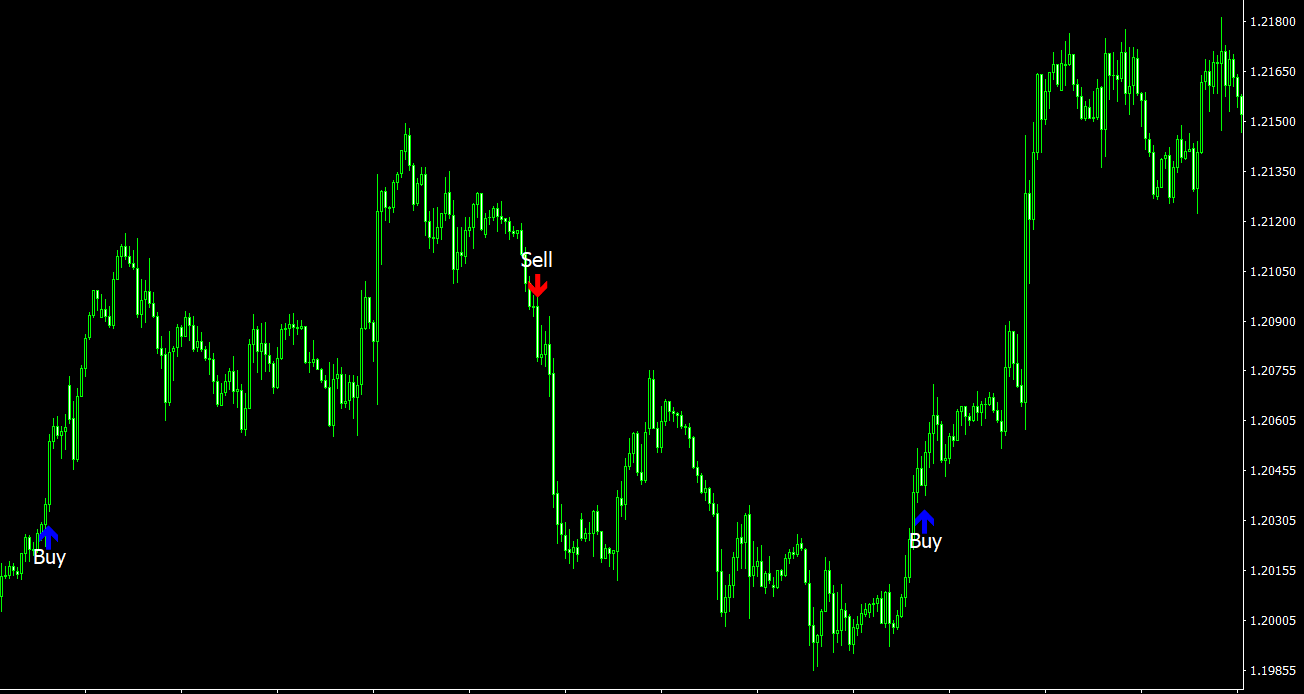

The Reversal Navi indicator is a Forex tool that searches for reversal bars to determine price reversal points and market entry levels. The indicator provides a visual representation of these reversal points on the price chart, enabling traders to make informed decisions about market entry and exit points.

The Reversal Navi indicator displays the following elements on the price chart:

- Blue/red dot: Indicates that a price reversal has occurred, signaling a potential trading opportunity.

- Blue/red arrow: Represents the reversal bar, which is a specific candlestick pattern that suggests a price reversal is imminent.

- Blue/red line: Shows the midpoint of the range formed after the reversal bar, providing traders with a reference point for potential entry or exit levels.

Using the Reversal Navi MT4 Indicator in Trading Strategies

While the Reversal Navi indicator is a valuable tool for identifying price reversal points, it is essential to use it in conjunction with other technical MT4 indicators to confirm its signals and enhance trading decisions. Here are some ways to combine the Reversal Navi indicator with other indicators:

- ADX: The Average Directional Index (ADX) is a technical indicator that measures the strength of a trend. By incorporating the ADX into your trading strategy, you can determine whether a price reversal identified by the Reversal Navi indicator is likely to result in a strong or weak trend.

- RSI: The Relative Strength Index (RSI) is an oscillator that measures the speed and change of price movements. By combining the RSI with the Reversal Navi indicator, you can determine whether a price reversal is overbought or oversold, providing additional confirmation for your trading decisions.

- MACD: The Moving Average Convergence Divergence (MACD) is a momentum indicator that can help confirm the validity of the signals generated by the Reversal Navi indicator. When the MACD line crosses the signal line in the direction of the price reversal identified by the Reversal Navi indicator, it provides additional confirmation of the reversal signal.

Conclusion

The Reversal Navi MT4 indicator is a powerful tool for identifying price reversal points and market entry levels by searching for reversal bars. By incorporating this indicator into your trading strategies, you can improve your ability to recognize potential reversals and capitalize on profitable trading opportunities.

However, it is essential to use the Reversal Navi indicator in conjunction with other technical indicators such as ADX, RSI, and MACD to confirm its signals and enhance your trading decisions. By combining the Reversal Navi indicator with these additional tools, you can create a robust and reliable trading strategy that maximizes your potential for success in the Forex market.

Features of Reversal Navi MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In ReversalNavi.zip file you will find:

- ReversalNavi.ex4

Download Reversal Navi MT4 indicator for free: