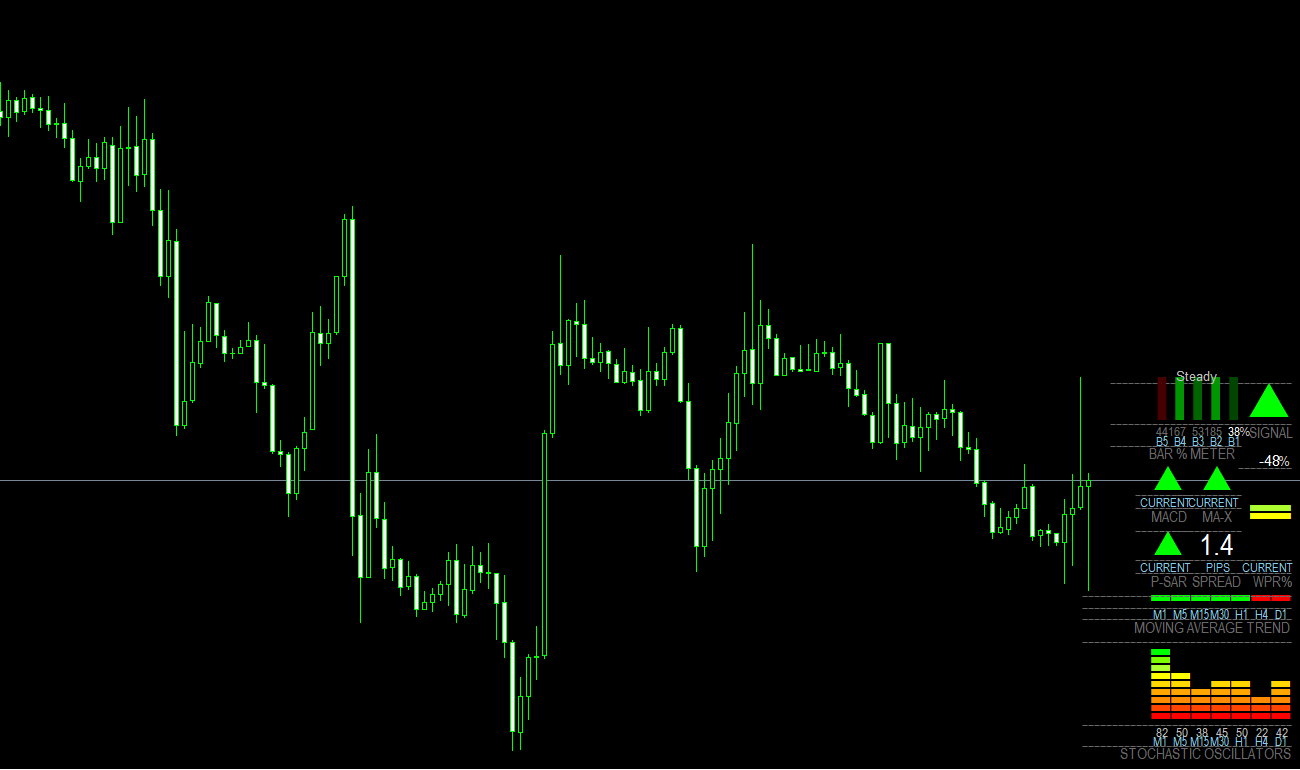

The FX Multi Meter MT4 Indicator is an innovative and versatile tool for traders who use the MetaTrader 4 platform. This indicator amalgamates various indicators into a single dashboard, offering a holistic view of the market. By combining the values from momentum and average-based indicators, it delivers a final BUY or SELL signal for the currency pair under consideration. We will explore the components of the FX Multi Meter MT4 Indicator and discuss how traders can effectively utilize this tool.

Breakdown of Components

1. Bar Meter

The Bar Meter displays the percentage change in the current price compared to the closing prices of the previous four bars. This information helps traders understand the short-term momentum and direction of the price movement.

2. MACD (Moving Average Convergence Divergence)

This component signifies the direction of the MACD signal cross-over in the current chart. MACD is a popular trend-following momentum indicator, which helps traders identify the strength, direction, momentum, and duration of a trend in a stock’s price.

3. MA-X (Moving Average Crossover)

MA-X demonstrates the crossover direction between Linear Weighted Moving Average and Simple Moving Average. The crossover of these moving averages can be used to identify potential buying or selling opportunities.

4. William’s Percentages

William’s Percentages are derived from the momentum-based William’s Percentage Range indicator. It shows overbought or oversold levels, helping traders make decisions about entering or exiting trades.

5. Parabolic Stop and Reverse Indicator (PSAR)

This component indicates the direction of the PSAR, which is used to ascertain potential points where an asset’s trend might change. Traders can use this for setting stop-loss levels.

6. Moving Averages

The Moving Averages component displays the trend direction from the M1 (1-minute) to D1 (1-day) time frames of the currency pair. This information is crucial for understanding the overall direction of the market.

7. Stochastic Oscillator

This element shows the Stochastic Oscillator values from M1 to D1 time frames. It helps traders gauge whether the market is overbought or oversold, thus indicating potential reversal points.

8. Current Spread

Finally, the Current Spread component displays the spread of the currency pair, which is the difference between the bid and the ask price. This information is important for cost considerations in trading.

Application in Trading

The FX Multi Meter MT4 Indicator is essentially a composite dashboard of various indicators, which assists traders in making informed decisions by considering multiple factors.

Comprehensive Analysis

Instead of analyzing multiple indicators separately, traders can view all essential data in one place. This comprehensive analysis can lead to more informed and efficient trading decisions.

Final Trading Signals

The final BUY or SELL signal provided by the FX Multi Meter is based on a combination of all the indicators. This consolidated signal takes into account various aspects of the market, potentially increasing the reliability of the signal.

Customization and Flexibility

Traders can tailor the FX Multi Meter according to their preferences and trading strategy, focusing on the indicators that align with their methodology.

Conclusion

The FX Multi Meter MT4 Indicator is a powerful, multifaceted tool that combines multiple indicators into a single, user-friendly dashboard. By providing an encompassing view of various market aspects and simplifying the decision-making process with consolidated signals, it proves to be an invaluable asset for traders aiming to enhance their trading efficiency and effectiveness. However, as with any tool, it is vital to employ proper risk management and consider external factors that might affect the markets.

Features of FX Multi Meter MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In FX_Multi-Meter.zip file you will find:

- FX_Multi-Meter.ex4

Download FX Multi Meter MT4 indicator for free: