The MACD Histogram Divergence Indicator is a modification of the traditional MACD (Moving Average Convergence Divergence) indicator, specifically designed for identifying divergences in the Forex market. This powerful tool can help traders detect potential trend reversals, thereby enhancing their trading strategies.

Understanding MACD Histogram Divergence MT4 Indicator

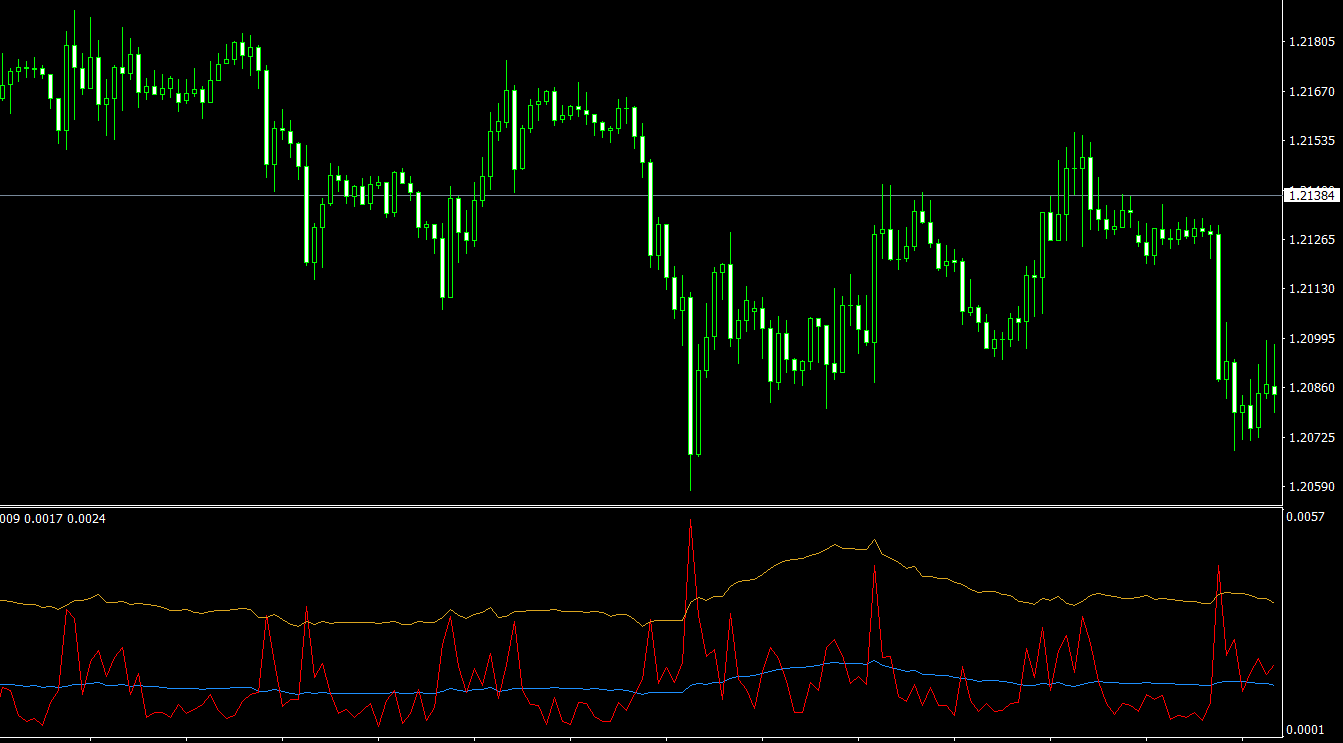

The MACD Histogram Divergence Indicator consists of two main components:

- MACD Histogram: This is the difference between the MACD Line and the Signal Line, which reflects the divergence convergence of these two lines.

- Signal Line: This is a moving average of the MACD Line, which serves as a baseline for comparison with the MACD Histogram.

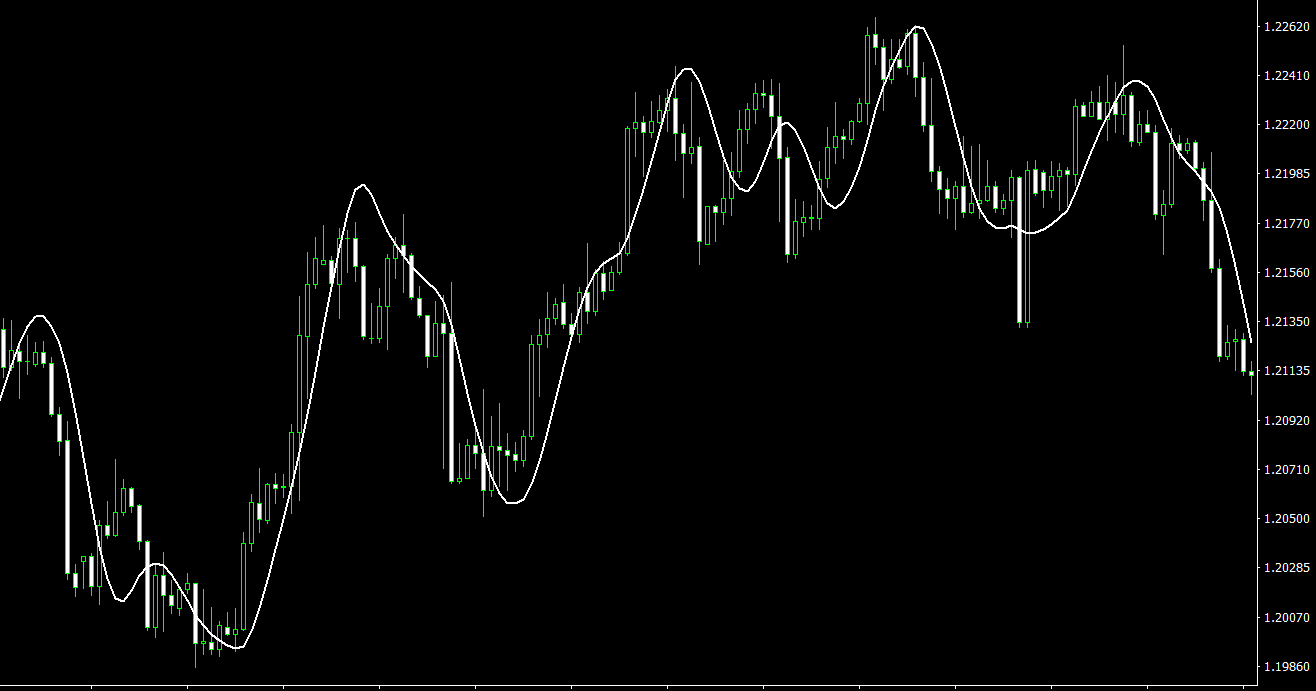

The primary function of the MACD Histogram Divergence Indicator is to identify divergences between the MACD Histogram and the price action of an asset. Divergences occur when the direction of the price action differs from the direction of the MACD Histogram, which can signal potential trend reversals.

Types of Divergences

The MACD Histogram Divergence Indicator is particularly adept at detecting three types of divergences:

- Classic Divergence:

- Bullish Classic Divergence: This occurs when the price action forms a lower low, while the MACD Histogram forms a higher low. This type of divergence can signal a potential trend reversal to the upside.

- Bearish Classic Divergence: This occurs when the price action forms a higher high, while the MACD Histogram forms a lower high. This type of divergence can signal a potential trend reversal to the downside.

- Hidden Divergence:

- Bullish Hidden Divergence: This occurs when the price action forms a higher low, while the MACD Histogram forms a lower low. This type of divergence can indicate a potential continuation of the existing uptrend.

- Bearish Hidden Divergence: This occurs when the price action forms a lower high, while the MACD Histogram forms a higher high. This type of divergence can indicate a potential continuation of the existing downtrend.

- Extended Divergence:

- Bullish Extended Divergence: This occurs when the price action forms a double or triple bottom, while the MACD Histogram forms a series of higher lows. This type of divergence can signal a strong reversal to the upside.

- Bearish Extended Divergence: This occurs when the price action forms a double or triple top, while the MACD Histogram forms a series of lower highs. This type of divergence can signal a strong reversal to the downside.

Application of the MACD Histogram Divergence MT4 Indicator

Traders can use the MACD Histogram Divergence Indicator to enhance their trading strategies by identifying classic, hidden, and extended divergences:

- Trend Reversals: Traders can use classic and extended divergences to anticipate potential trend reversals and enter long or short positions accordingly.

- Trend Continuations: Hidden divergences can help traders identify potential trend continuations, enabling them to hold onto existing positions or enter new positions in the direction of the ongoing trend.

- Confirmation Tool: The MACD Histogram Divergence Indicator can be used in conjunction with other technical analysis tools and indicators to confirm or refute potential trading signals, reducing the likelihood of false signals and increasing the overall effectiveness of a trading strategy.

MACD Histogram Divergence MT4 indicator settings

In the indicator MACD Histogram Divergence, advanced settings are implemented, as well as a notification system about the detected divergence.

- Fast EMA Period – period of the fast exponential moving average;

- Slow EMA Period – the period of the slow exponential moving average;

- Signal SMA Period – the period signal exponential moving average;

- MACD line – enable display of the MACD line;

- Signal line – enable display of the signal line.

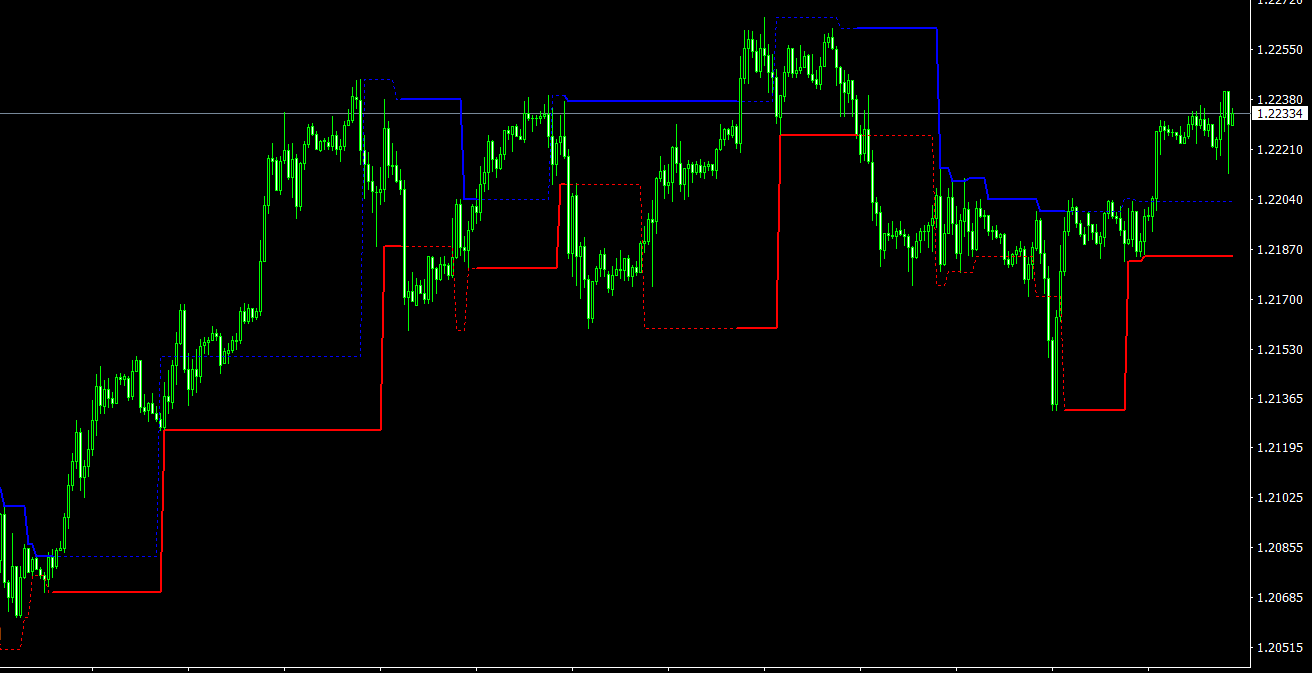

Divergence search settings

- MACD Histogram divergence indicator – enable search for divergences with histogram;

- MACD Line divergence indicator – enable searching for divergences with the MACD line;

- Search classical – enable search for classical divergences;

- Search hidden – enable search for hidden divergences;

- Search extended – enable search for extended divergences;

- Show trend lines – enable display of divergence trend lines;

- Show divergence indicator – enable display of the divergence indicator;

- Show alerts – enable alerts when divergence is found on the current bar.

It is important to note that the MACD Histogram Divergence Indicator is not a standalone indicator and should be used in conjunction with other MT4 indicators and price action analysis. Traders should also consider the overall market conditions and economic factors that can impact the asset they are trading.

Conclusion

The MACD Histogram Divergence MT4 Indicator is a powerful tool for traders who want to identify potential trend reversals. By detecting divergences between the MACD Histogram and the price action of an asset, traders can enter or exit trades with greater confidence. However, it is important to use the indicator in conjunction with other technical analysis tools and to consider the overall market conditions when making trading decisions.

Features of MACD Histogram Divergence MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In MASi_MACDHist.zip file you will find:

- MASi_MACDHist.ex4

Download MACD Histogram Divergence MT4 indicator for free: