The RAVI MT4 Indicator is an oscillator that bears similarities to the MACD oscillator, with its own unique features. This powerful tool helps traders timely identify the beginning of trend movements in the forex market. By analyzing the difference between two moving averages calculated as a percentage, the RAVI indicator offers valuable insights into market trends and potential trading opportunities. In this article, we will delve into the workings of the RAVI indicator, its recommended settings, and how to effectively use it in your forex trading strategy.

Understanding the RAVI MT4 Indicator

The RAVI indicator is based on the following formula:

RAVI = 100 * (SMA(7) – SMA(65)) / SMA(65)

This formula calculates the difference between a short-term 7-period simple moving average (SMA) and a long-term 65-period SMA, expressed as a percentage. The RAVI indicator typically uses levels of -0.3% and +0.3% or -0.1% and +0.1% to identify trend movements.

Using the RAVI Indicator in Your Trading Strategy

The RAVI indicator offers valuable insights into market trends and can be effectively incorporated into your trading strategy:

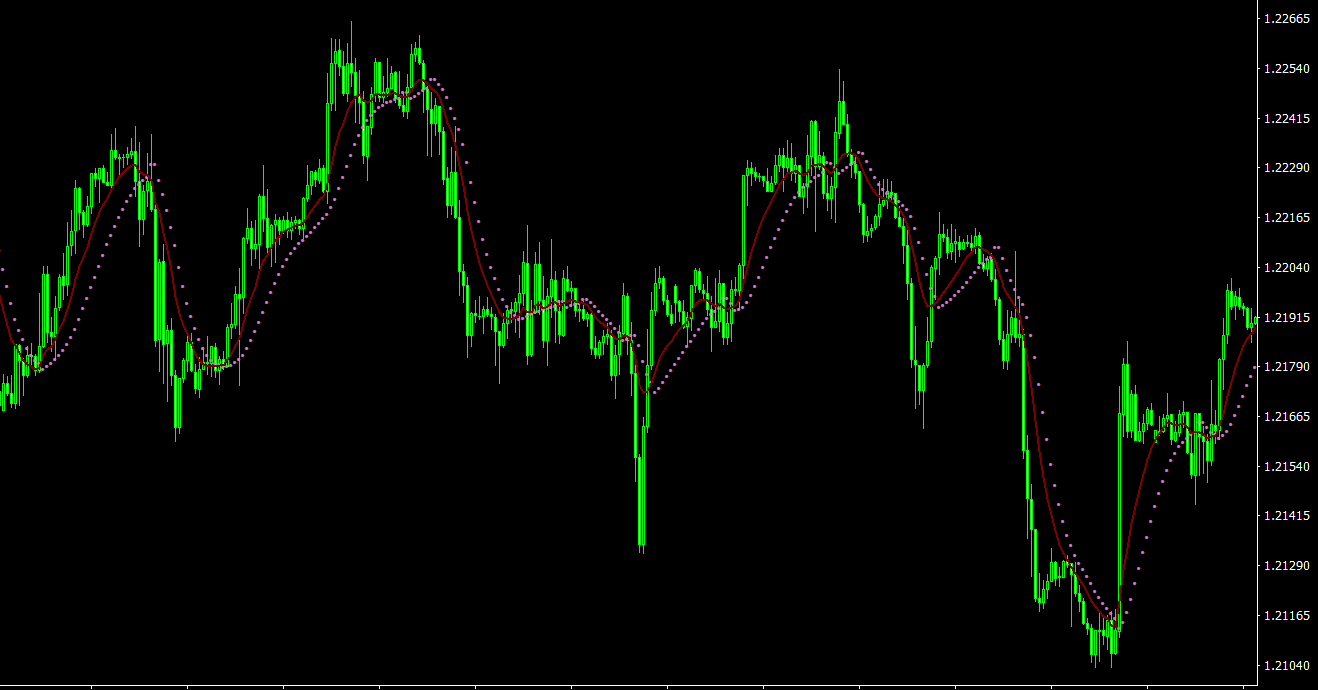

- Identifying trend beginnings: When the RAVI histogram crosses the upper level from bottom to top, it signals the beginning of an upward trend. Conversely, when the histogram crosses the lower level from top to bottom, it indicates the start of a downward trend.

- Assessing trend continuation: An uptrend is considered ongoing as long as the RAVI line continues to rise, while a downtrend is regarded as persisting as long as the RAVI line keeps falling. The RAVI indicator highlights bullish trend areas in green and bearish trend areas in red, with non-trend or uncertain zones appearing gray. These colors can be customized in the indicator settings.

- Identifying trend cessation and resumption: When the RAVI indicator approaches the zero line, it suggests that the trend has stopped, and a flat zone has begun. However, if the indicator reverses without entering the interval between the established levels, it signals that the trend has resumed.

- Detecting convergence-divergence areas: The RAVI indicator can also be employed to identify areas of convergence and divergence, providing additional insights into potential market movements.

Tips for Effective RAVI MT4 Indicator Application

To optimize the use of the RAVI indicator in your forex trading strategy, consider the following tips:

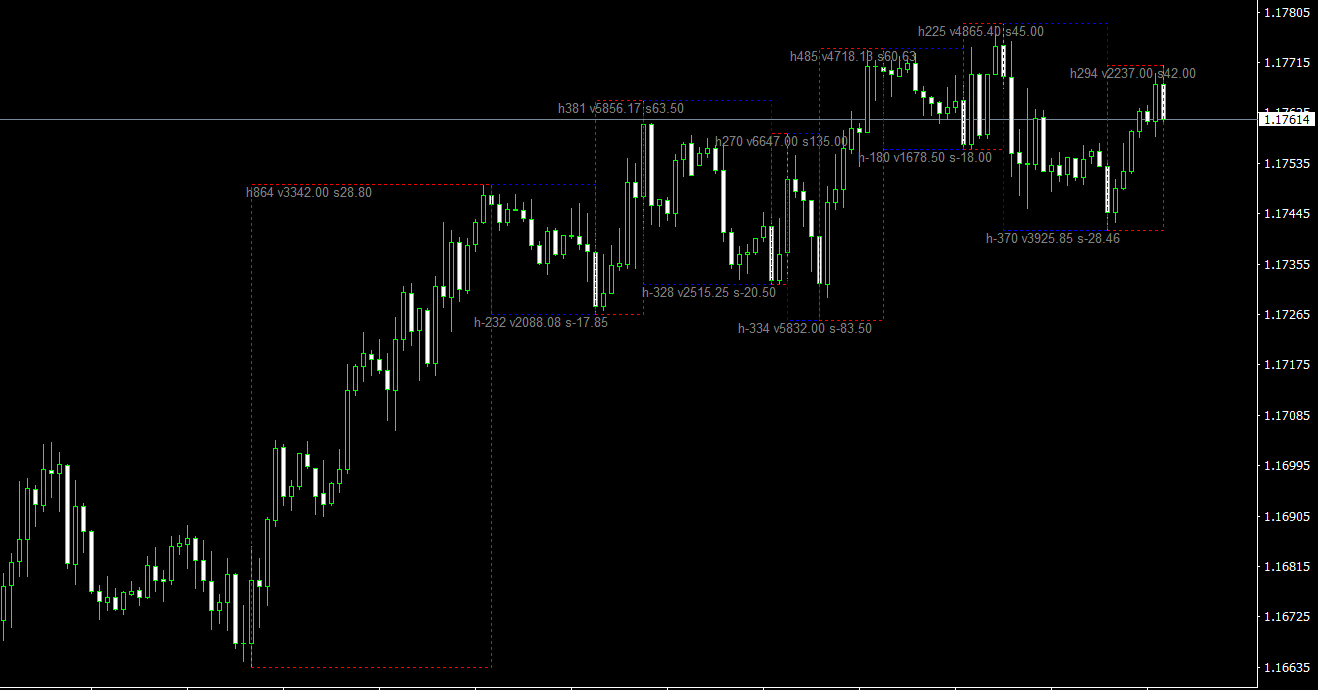

- Confirm signals with additional technical MT4 indicators: Enhance the accuracy of your trading signals by combining the RAVI indicator with other technical indicators, such as moving averages, RSI, or Stochastic oscillators.

- Employ a solid risk management strategy: Use the RAVI indicator to identify potential trading opportunities, and incorporate a robust risk management strategy to protect your capital and maximize returns.

- Test your strategy on a demo account: Before implementing the RAVI indicator on a live account, thoroughly test your trading strategy on a demo account to ensure its effectiveness.

Conclusion

The RAVI MT4 Indicator is a powerful oscillator that allows traders to timely identify the beginning of trend movements in the forex market. By using the RAVI indicator effectively in conjunction with other technical indicators and a robust risk management strategy, traders can capitalize on market trends and enhance their overall trading performance. Whether you’re a novice or experienced trader, incorporating the RAVI indicator into your forex trading strategy can provide valuable insights into market movements and help you make more informed trading decisions.

Features of RAVI MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In RAVI.zip file you will find:

- RAVI.ex4

Download RAVI MT4 indicator for free: