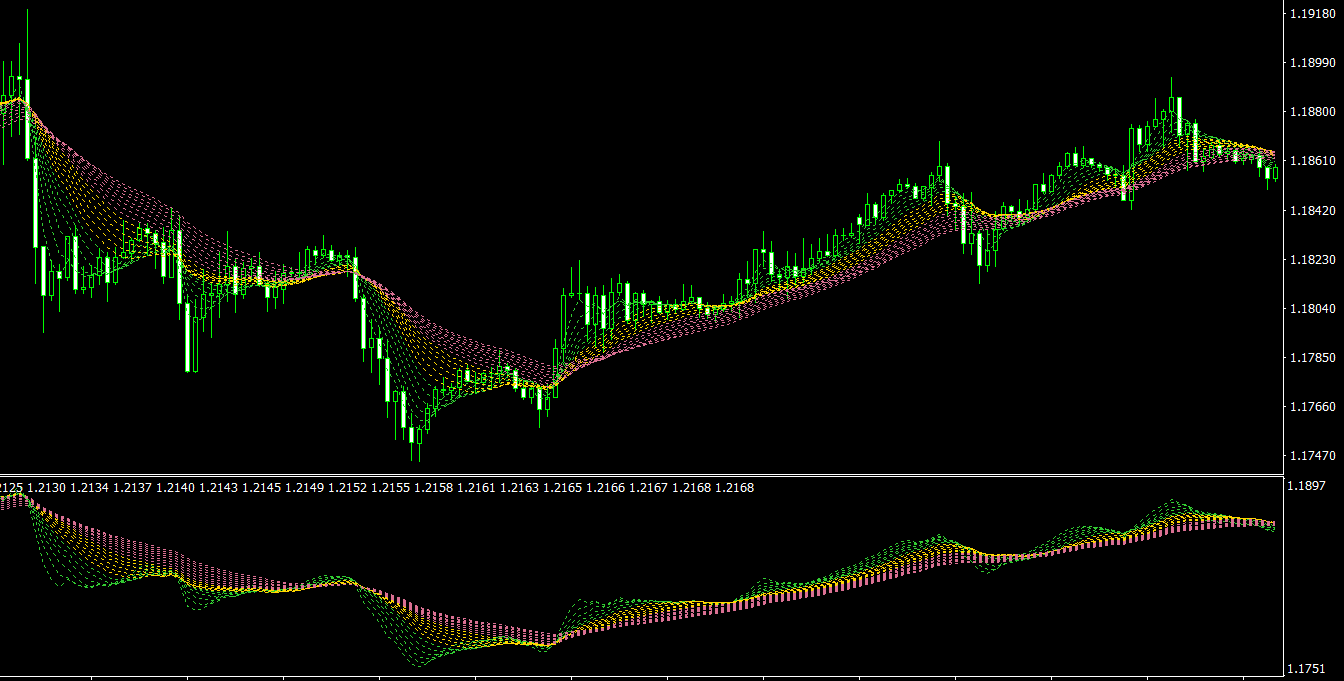

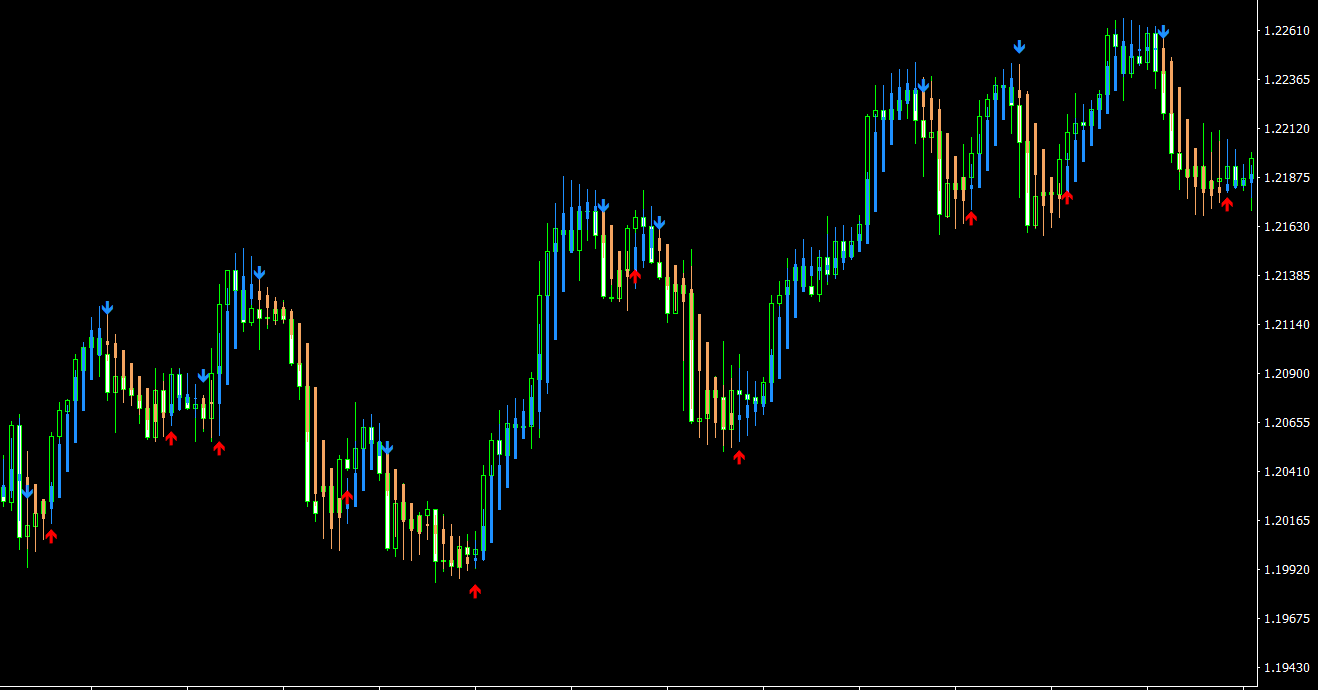

Wolfe Waves, often viewed as advanced iterations of Elliot Waves, have gained traction among forex traders due to their ability to forecast impending trend changes, predict future price movements, and estimate the timing for achieving specific price targets. This comprehensive guide aims to explore the Wolfe Waves MT4 Indicator, elaborating on its criteria, usage, and best practices for optimizing trading outcomes.

What Are Wolfe Waves?

Wolfe Waves build on the foundational principles of Elliot Waves to offer a more natural trading pattern that enables traders to identify upcoming trend changes, foresee future price actions, and predict the time required to attain desired price levels. Like their Elliot Wave counterparts, Wolfe Waves consist of a sequence of waves, but they incorporate unique conditions for trend identification.

Criteria for Identifying Wolfe Waves

A pattern must satisfy specific conditions to qualify as a Wolfe Wave. The most critical criteria are:

- Wave Formation within Channels – The third and fourth waves in a Wolfe Wave pattern should appear within the channel outlined by the first and second waves.

- Time Consistency – Wolfe Waves should also manifest at uniform time intervals, implying that there must be a balanced symmetry between the first and second waves.

How to Use Wolfe Waves MT4 Indicator Effectively

Employing the Wolfe Waves MT4 Indicator is not a complex task, although it does demand substantial patience from traders. The process involves observing the pattern until the fourth wave forms, which typically suggests an imminent price reversal.

Identifying the Waves

The first step is to let the indicator sketch the initial four waves. Once this is done, the trader can prepare to execute a trade that aligns with the direction of the forthcoming fifth wave.

Entering a Trade

For instance, if the fourth wave manifests as part of an uptrend, the fifth wave is expected to be bearish, signaling a potential entry point for a short position. Conversely, if the fourth wave is bearish, a bullish fifth wave is anticipated, indicating a possible entry point for a long position.

Setting Stop Loss and Take Profit

When entering a trade, setting a stop loss is crucial for risk management. In an uptrend, place the stop loss beneath the recent swing low, and in a downtrend, set it above the recent swing high. Your take-profit target should align with the trend line formed by the preceding waves in the channel.

Best Practices for Trading with Wolfe Waves MT4 Indicator

Manage Risks Wisely

A proper risk management strategy is crucial, which means using stop losses effectively to minimize potential losses.

Multiple Timeframe Analysis

Using Wolfe Waves in conjunction with multiple timeframe analysis can provide better insights into the prevailing market trends.

Be Patient

The indicator requires time to form accurate patterns, so patience is a crucial element for successful trading using this method.

Conclusion

The Wolfe Waves MT4 Indicator offers an enhanced version of Elliot Waves for predicting price movements and trends in the forex market. Meeting specific criteria and adhering to the guidelines can significantly improve your trading decisions. Though straightforward in its application, the Wolfe Waves indicator necessitates a disciplined and patient approach for maximizing its potential benefits.

Features of Wolfe Waves MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In wolfe-waves-indicator.zip file you will find:

- wolfe-waves-indicator.ex4

Download Wolfe Waves MT4 indicator for free: