In the foreign exchange (forex) market, the ability to identify and capitalize on market trends is crucial to a trader’s success. Trend indicators are technical analysis tools that help traders determine the direction and strength of a market trend, providing valuable insights that can enhance their trading strategies. By understanding and utilizing trend indicators in their forex trading, traders can make more informed decisions and potentially increase their profitability. This article will discuss what trend indicators are and how traders can use them effectively in forex trading.

What are Trend Indicators?

Trend indicators are a type of technical analysis tool designed to help traders identify the direction and strength of a market trend. By analyzing historical price data, trend indicators can provide insights into the underlying market dynamics and sentiment, enabling traders to make better-informed decisions.

There are various types of trend indicators, each with its unique method of representing and interpreting market trends. Some of the most popular trend indicators include:

- Moving Averages: Moving averages are calculated by averaging the closing prices of a currency pair over a specific period, smoothing out price fluctuations and highlighting the underlying trend direction. Popular types of moving averages include simple moving averages (SMA), exponential moving averages (EMA), and weighted moving averages (WMA).

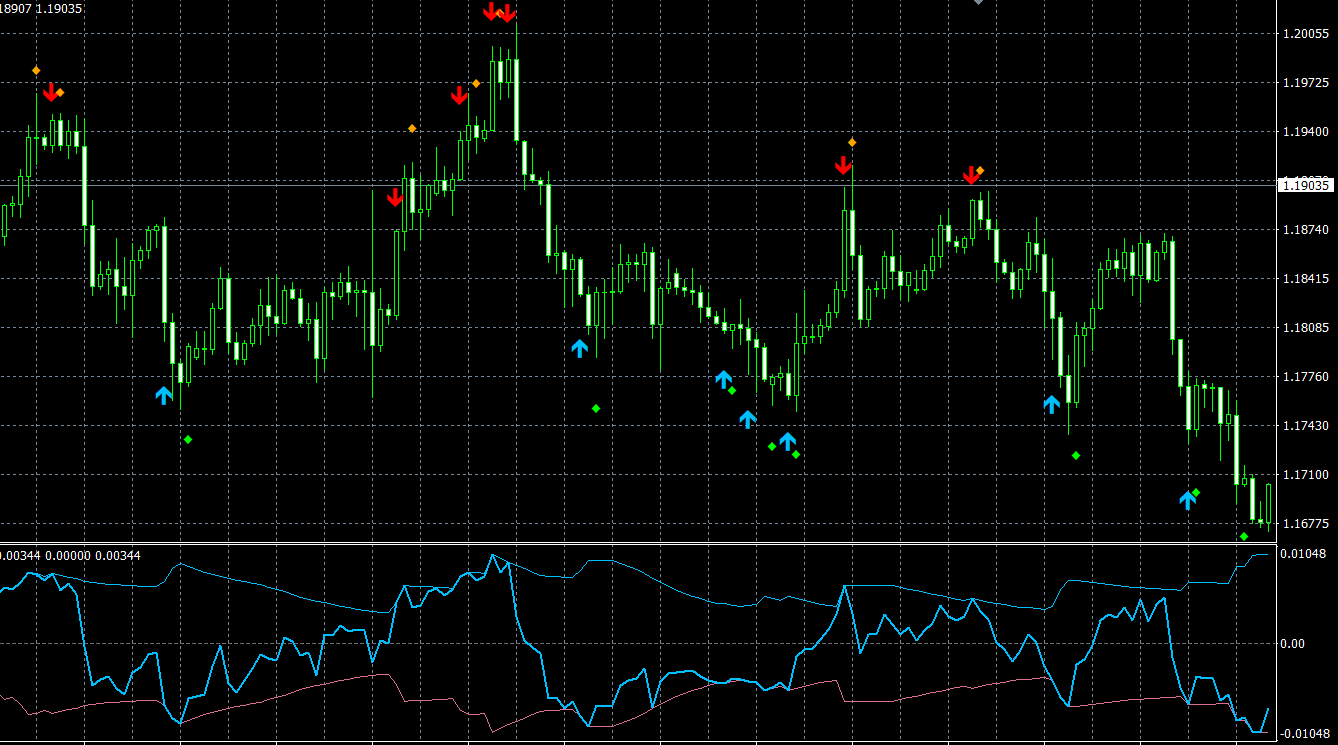

- Moving Average Convergence Divergence (MACD): The MACD indicator is an oscillator that measures the difference between two moving averages, typically the 12-day EMA and the 26-day EMA. It also includes a signal line, usually a 9-day EMA of the MACD line, which is used to generate trading signals.

- Parabolic Stop and Reverse (Parabolic SAR): Parabolic SAR is a trend-following indicator that plots a series of dots or points above or below the price chart, indicating potential reversals or the continuation of the current trend.

- Average Directional Index (ADX): ADX is a non-directional indicator that measures the strength of a trend. It is typically used in conjunction with the Directional Movement Index (DMI) to determine the trend’s direction.

Using Trend Indicators in Forex Trading

Incorporating trend indicators into your forex trading strategy can provide valuable insights into market conditions and improve your decision-making process. Here are some ways to use trend indicators in forex trading:

- Identifying Trend Direction: Trend indicators can help traders determine the overall trend direction in a currency pair, allowing them to align their trading strategies with the prevailing trend for potentially higher returns.

- Confirming Trend Strength: By analyzing trend indicators, traders can gain a better understanding of the strength of a trend, helping them decide whether to enter, exit, or hold a position.

- Generating Trading Signals: Trend indicators, such as the MACD and Parabolic SAR, can provide trading signals, indicating potential entry and exit points for trades based on the direction and strength of the trend.

- Combining with Other Technical Analysis Tools: Trend indicators can be effectively combined with other technical analysis tools, such as support and resistance levels, chart patterns, and oscillators, to create a comprehensive trading strategy.

Conclusion

Trend indicators are an essential component of technical analysis in forex trading, offering valuable insights into market trends, direction, and strength. By understanding and utilizing trend indicators in their trading strategies, forex traders can make more informed decisions, manage risk more effectively, and potentially increase their profitability. Integrating trend indicators with other technical analysis tools can create a more robust and effective trading strategy, allowing traders to navigate the complexities of the forex market and capitalize on opportunities presented by changing market conditions.