The forex market offers a variety of technical indicators and tools that help traders analyze price movements, identify trends, and make informed trading decisions. One such tool is the Elliott Wave Count indicator, a popular custom indicator available for the MetaTrader 4 trading platform. This article will provide an in-depth understanding of the Elliott Wave Count indicator, its underlying principles, and how it can be used effectively in forex trading.

What is the Elliott Wave Count Indicator?

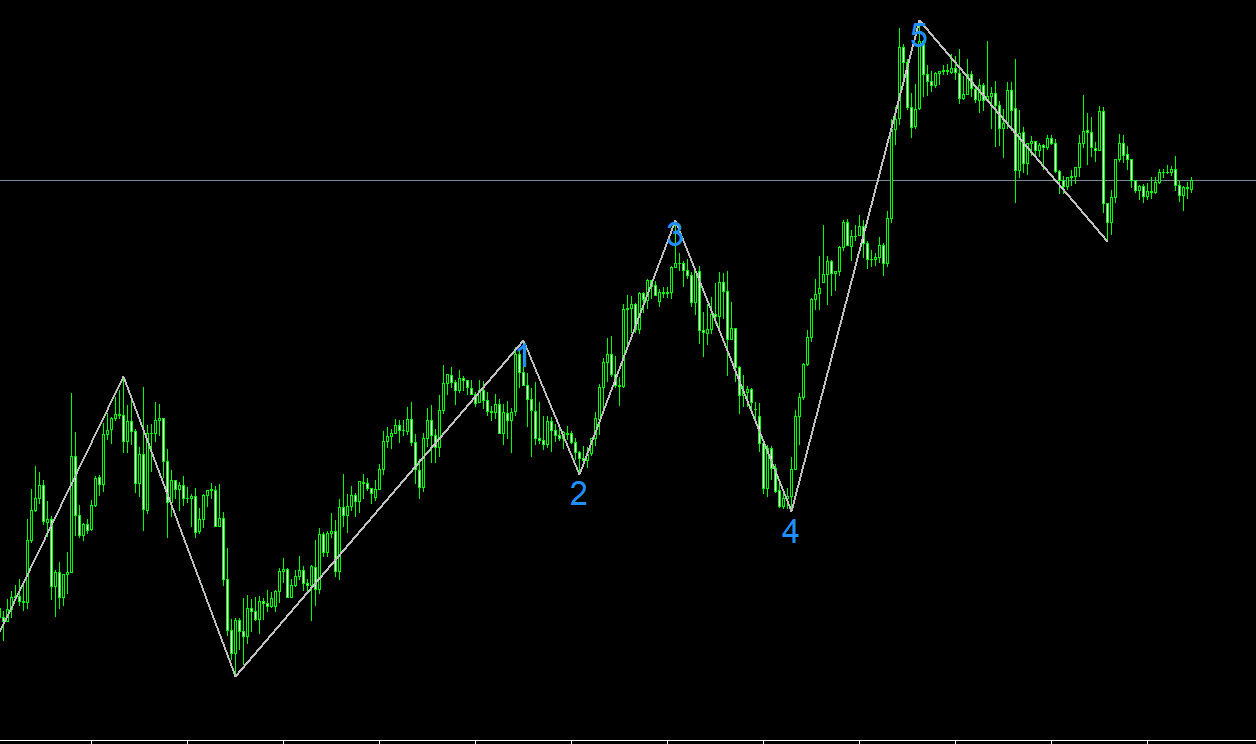

The Elliott Wave Count indicator is a custom technical analysis tool for the MetaTrader 4 platform that helps traders identify and plot Elliott Wave patterns on a chart. Developed by Ralph Nelson Elliott in the 1930s, the Elliott Wave Theory postulates that market prices unfold in repetitive patterns called waves, which are driven by market participants’ collective psychology.

According to Elliott Wave Theory, there are two types of waves:

- Impulse Waves: These are the waves that move in the direction of the prevailing trend and consist of five sub-waves.

- Corrective Waves: These waves move against the prevailing trend and consist of three sub-waves.

The Elliott Wave Count indicator is designed to help traders identify these wave patterns in real-time, providing valuable insights into the market’s potential future movements.

How the Elliott Wave Count Indicator Works

The Elliott Wave Count indicator automatically detects and plots the Elliott Wave patterns on a forex chart by analyzing the price data. It typically identifies the start and end points of impulse and corrective waves, labeling them accordingly using numbers and letters (1-5 for impulse waves and A-C for corrective waves).

By plotting these wave patterns, the Elliott Wave Count indicator helps traders anticipate future price movements based on the theory’s principles. For example, if the indicator identifies the completion of a five-wave impulse pattern, traders can expect a three-wave corrective pattern to follow.

Using the Elliott Wave Count Indicator in Forex Trading

To effectively use the Elliott Wave Count indicator in forex trading, traders need to understand the principles of Elliott Wave Theory and how it can generate trading signals. Here are some practical examples:

- Trading with the Trend

According to Elliott Wave Theory, impulse waves move in the direction of the prevailing trend, while corrective waves move against it. By identifying these wave patterns using the Elliott Wave Count indicator, traders can trade in the direction of the prevailing trend, maximizing their chances of success.

Example: A trader observes a completed five-wave impulse pattern in the EUR/USD currency pair using the Elliott Wave Count indicator. As the impulse waves are indicative of the prevailing trend, the trader decides to open a buy position, expecting the trend to continue.

- Trading Wave Corrections

Once the indicator identifies a completed impulse wave, traders can expect a corrective wave to follow. By anticipating the start of a corrective wave, traders can open positions against the prevailing trend and capture gains during the retracement.

Example: A trader using the Elliott Wave Count indicator notices the completion of a five-wave impulse pattern in the GBP/USD currency pair, followed by the beginning of a corrective wave. The trader decides to open a sell position, expecting the price to retrace during the corrective wave.

- Setting Stop Loss and Take Profit Levels

The Elliott Wave Count indicator can also help traders set appropriate stop loss and take profit levels based on the wave patterns. For instance, traders can place their stop loss above the start of a corrective wave when shorting, or below the start of an impulse wave when going long. Similarly, take profit levels can be set at potential reversal points identified by the wave patterns.

Conclusion

The Elliott Wave Count indicator is a powerful tool in the hands of forex traders who understand the principles of Elliott Wave Theory. By providing real-time insights into market trends and potential price reversals, this custom indicator for the MetaTrader 4 platform can significantly enhance a trader’s ability to capitalize on market opportunities. However, it is important to remember that no single indicator can guarantee success in the market. Combining the Elliott Wave Count indicator with other technical analysis tools and a robust risk management strategy can help traders develop a more comprehensive and effective trading approach. Ultimately, mastering the Elliott Wave Count indicator and its application in forex trading can lead to more informed trading decisions and increased profitability.

Features of Elliott Wave Count MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Elliott-Wave-Count.zip file you will find:

- Elliott-Wave-Count.ex4

Download Elliott Wave Count MT4 indicator for free: