The Foreign Exchange Market (Forex) is the largest and most liquid market in the world, where the exchange of currencies takes place. Traders take advantage of the constantly changing exchange rates to make profits. Among the numerous tools and strategies used by Forex traders, one that has generated significant interest and attention is the Elliott Wave Theory. In this article, we will delve deep into the world of Forex Elliott Wave, its principles, and how traders can use it to improve their trading decisions with examples of long and short trades.

What is a Forex Elliott Wave?

The Elliott Wave Theory is a technical analysis tool, which was developed by Ralph Nelson Elliott in the 1930s. Elliott discovered that financial markets, including the Forex market, move in repetitive patterns, called waves. He proposed that these waves are driven by the collective psychology of market participants, which is influenced by their emotions such as fear, greed, and optimism.

Elliott Wave Theory is based on the idea that market prices move in a series of five waves in the direction of the main trend (impulse waves) and three waves against the trend (corrective waves). This pattern, known as the 5-3 pattern, is the basis for identifying market cycles and forecasting future price movements.

If you are trading on Metatrader4 platform, you may download Elliott Wave Count MT4 Indicator here.

The Five Wave Pattern

According to the Elliott Wave Theory, the five-wave pattern consists of:

- Wave 1: An initial upward movement driven by a relatively small number of informed traders who recognize a new market trend early.

- Wave 2: A downward correction caused by profit-taking, which retraces a portion of Wave 1 but does not surpass its beginning.

- Wave 3: A strong upward movement, typically the longest and most powerful wave, driven by a large number of market participants who recognize the new trend.

- Wave 4: Another downward correction, which is usually less severe than Wave 2, as traders still have confidence in the uptrend.

- Wave 5: The final upward movement, driven by the last group of traders who buy into the trend, often resulting in a peak before the market reverses.

The Three Corrective Waves

Following the completion of the five-wave pattern, the market usually experiences a three-wave corrective pattern, which consists of:

- Wave A: A downward movement, as traders who participated in the uptrend begin to take profits.

- Wave B: A partial retracement of Wave A, driven by traders who believe the uptrend will resume.

- Wave C: A final downward movement, usually surpassing the end of Wave A, as the market acknowledges the end of the previous trend.

How to Use Elliott Wave in Forex Trading

Identifying Elliott Waves in the Forex market can provide valuable insights into the direction of the market and potential turning points. Traders can use this information to make informed trading decisions, such as when to enter or exit trades, set stop-loss orders, and determine profit targets.

Here’s a step-by-step guide on how to use Elliott Wave in Forex trading:

- Identify the Trend: Analyze the market to determine whether it is in an uptrend or a downtrend. This can be done by using trend lines, moving averages, or other technical analysis tools.

- Spot the Wave Pattern: Look for the 5-3 wave pattern on your Forex charts. Remember that the impulse waves (1, 3, and 5) move in the direction of the trend, while the corrective waves (2 and 4) move against it. Keep in mind that the waves can vary in size and duration, and may not always be easily identifiable.

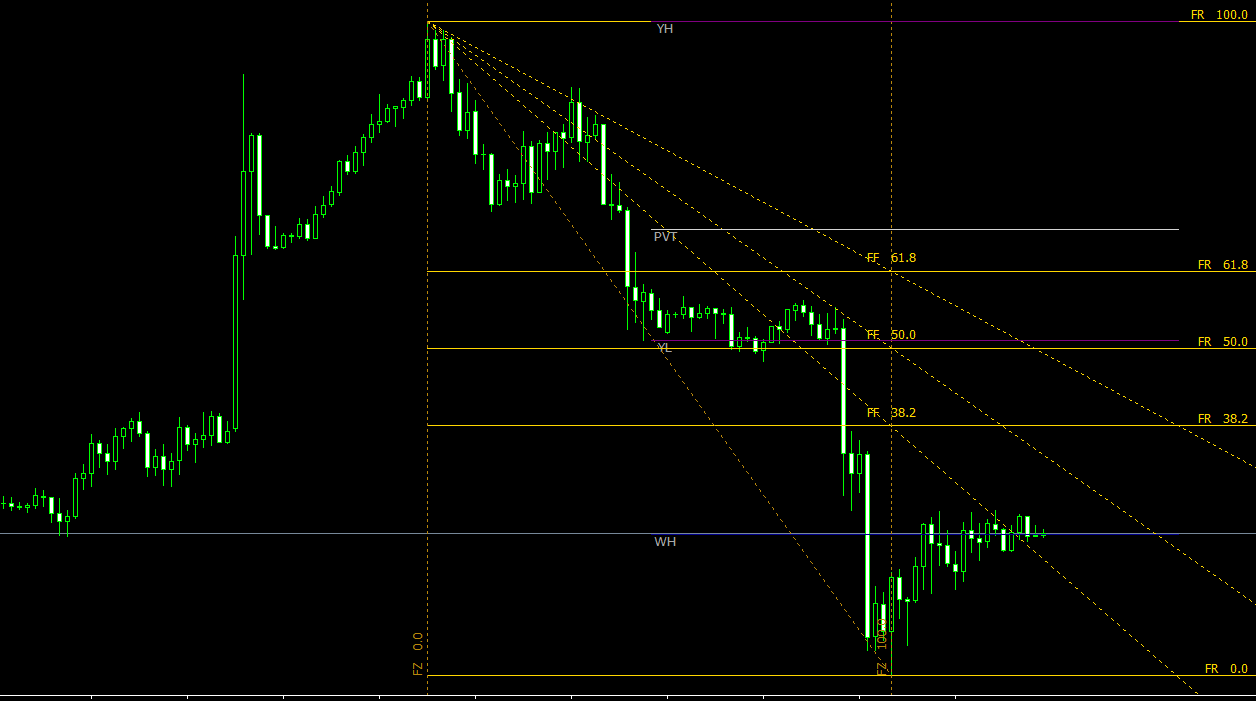

- Apply Fibonacci Ratios: Elliott Wave Theory is closely associated with Fibonacci ratios, which can help predict the extent of retracements and projections of the waves. Common Fibonacci ratios used in Elliott Wave analysis include 38.2%, 50%, 61.8%, and 100%. These ratios can be applied to the waves to estimate potential turning points and price targets.

- Enter the Trade: Once you have identified the Elliott Wave pattern and potential turning points, you can enter a trade in the direction of the trend. For example, if you recognize that the market is in an uptrend and currently in Wave 2, you could enter a long trade at the end of Wave 2, anticipating that Wave 3 will propel the market higher.

- Set Stop-Loss Orders: To protect yourself from potential losses, it is crucial to set stop-loss orders when trading with Elliott Wave. A common approach is to place stop-loss orders below the end of Wave 2 when entering a long trade or above the end of Wave 2 when entering a short trade.

- Determine Profit Targets: You can use the Fibonacci ratios to estimate price targets for each wave. For example, if you enter a long trade at the end of Wave 2, you could set your profit target at the 100% Fibonacci extension of Wave 1, which is often considered a conservative target for Wave 3.

Examples of Long and Short Trades

- Long Trade Example:

Assume that the EUR/USD currency pair is in an uptrend, and you have identified the following Elliott Wave pattern:

- Wave 1: The price moves from 1.1000 to 1.1200.

- Wave 2: The price retraces 50% of Wave 1, moving back to 1.1100.

- Wave 3: Anticipated wave.

In this scenario, you could enter a long trade at the end of Wave 2 (1.1100) with a stop-loss order placed just below the beginning of Wave 1 (1.0990). Your profit target could be set at the 100% Fibonacci extension of Wave 1, which is 1.1300 (1.1100 + (1.1200 – 1.1000)).

- Short Trade Example:

Assume that the USD/JPY currency pair is in a downtrend, and you have identified the following Elliott Wave pattern:

- Wave 1: The price moves from 110.00 to 108.00.

- Wave 2: The price retraces 38.2% of Wave 1, moving back to 109.24.

- Wave 3: Anticipated wave.

In this scenario, you could enter a short trade at the end of Wave 2 (109.24) with a stop-loss order placed just above the beginning of Wave 1 (110.10). Your profit target could be set at the 100% Fibonacci extension of Wave 1, which is 107.24 (109.24 – (110.00 – 108.00)).

Conclusion

The Elliott Wave Theory is a powerful tool that can help Forex traders better understand market behavior and make more informed trading decisions. By identifying the 5-3 wave pattern, applying Fibonacci ratios, and following the step-by-step guide outlined in this article, traders can improve their ability to predict potential turning points and price targets. However, it is essential to remember that no trading strategy is foolproof, and traders should always use proper risk management techniques and combine Elliott Wave analysis with other technical and fundamental analysis tools to maximize their chances of success.