Fundamental analysis is a method used by forex traders to assess the intrinsic value of a currency by examining various economic, political, and social factors that can impact its demand and supply. This analysis helps traders make informed decisions about whether a currency is overvalued or undervalued and predict potential future price movements. In this article, we will explore the concept of fundamental analysis in forex trading, discuss the various factors that influence currency values, and provide guidance on how to effectively use fundamental analysis in your forex trading strategy.

Understanding Fundamental Analysis in Forex Trading

Fundamental analysis is based on the premise that a currency’s value is determined by the overall health of its issuing country’s economy. By examining various economic indicators, political developments, and other factors, traders can assess the strength or weakness of an economy and determine the potential impact on its currency. Some key aspects of fundamental analysis include:

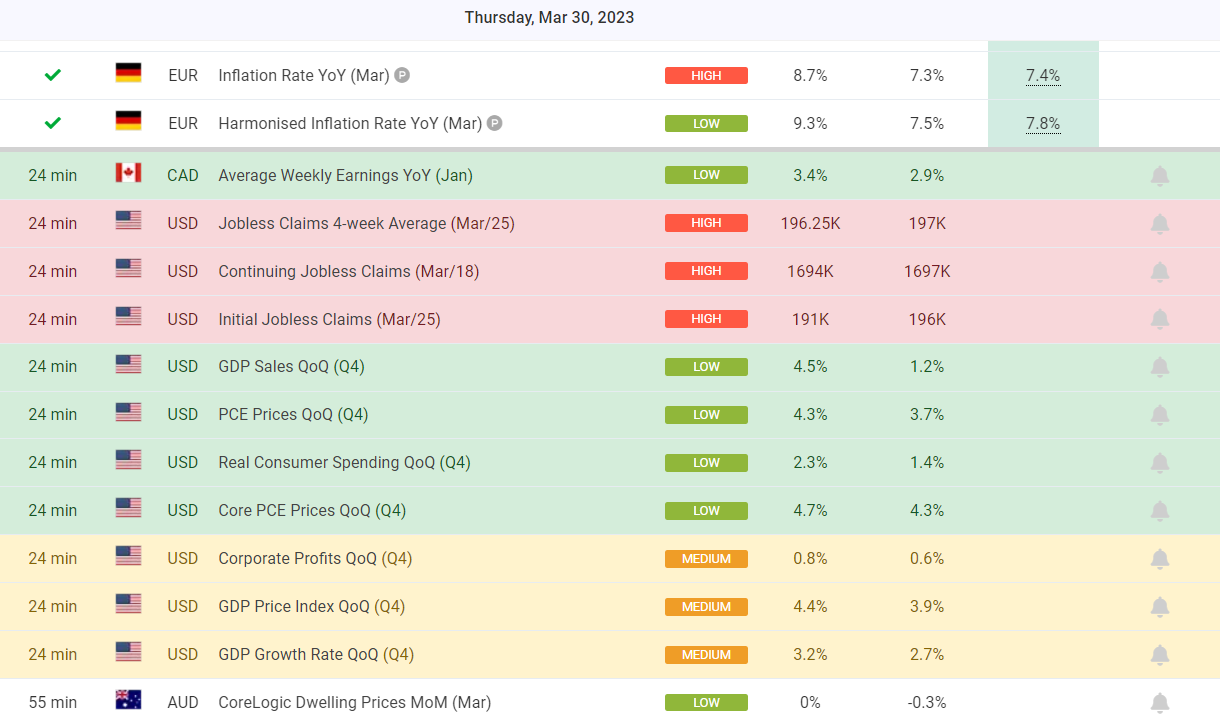

- Economic indicators: Economic indicators are statistical data that provide insights into the economic health of a country. They can be broadly classified into leading, lagging, and coincident indicators. Examples of key economic indicators include Gross Domestic Product (GDP), employment reports, inflation reports, and retail sales data.

- Interest rate decisions: Central banks often use interest rate adjustments as a tool to manage inflation and stimulate economic growth. Changes in interest rates can have a significant impact on currency values, as higher rates typically attract foreign investment, while lower rates can lead to capital outflows.

- Political events: Elections, geopolitical tensions, and policy changes can all influence the forex market. Political stability is often seen as a positive factor for a country’s currency, while uncertainty or unrest can lead to depreciation.

- Social factors: Demographics, social unrest, and other societal factors can also impact the forex market, although they typically have a more indirect effect compared to economic and political factors.

Key Economic Indicators in Fundamental Analysis

When conducting fundamental analysis in forex trading, traders should pay close attention to several key economic indicators, including:

- Gross Domestic Product (GDP): GDP represents the total value of goods and services produced by a country within a specific period, typically measured quarterly or annually. It is a crucial indicator of the overall economic health of a country, and strong GDP growth can lead to an appreciation of its currency.

- Employment reports: Employment reports, such as the U.S. Non-Farm Payrolls (NFP), provide insights into the labor market conditions in a country. High employment levels are generally seen as positive for a country’s economy and currency, while high unemployment levels can signal weakness.

- Inflation reports: Inflation measures the rate at which the general price level of goods and services is rising in an economy. Central banks often target specific inflation rates to maintain price stability, and changes in inflation can influence interest rate decisions. High inflation rates can lead to currency depreciation, while low inflation rates can have the opposite effect.

- Retail sales data: Retail sales data reflects the total sales of goods and services to consumers within a country. Strong retail sales can signal consumer confidence and economic growth, potentially leading to currency appreciation.

- Trade balance: The trade balance represents the difference between a country’s exports and imports. A positive trade balance (trade surplus) indicates that a country exports more than it imports, which can be beneficial for its currency. Conversely, a negative trade balance (trade deficit) can lead to currency depreciation.

How to Use Fundamental Analysis in Forex Trading

To effectively use fundamental analysis in forex trading, follow these steps:

- Stay informed: Regularly follow financial news and stay updated on the latest economic indicators, interest rate decisions, and political events that can impact the forex market.

- Develop a comprehensive understanding: Gain a thorough understanding of how various economic indicators, interest rate decisions, and political events can influence currency values. This knowledge will help you interpret news and data releases and anticipate their potential impact on the forex market.

- Create an economic calendar: An economic calendar is a useful tool for tracking important economic data releases, central bank meetings, and other events that can affect currency values. By keeping an economic calendar, you can be prepared for market-moving events and develop appropriate trading strategies in response.

- Analyze individual currencies: Conduct a detailed analysis of the currencies you are interested in trading, focusing on the economic health of their issuing countries. Examine key economic indicators, interest rate decisions, and other relevant factors to determine the overall strength or weakness of each currency.

- Develop a trading strategy: Use your fundamental analysis to develop a forex trading strategy that considers the potential impact of economic, political, and social factors on currency values. Your strategy should outline clear entry and exit points, as well as risk management guidelines to protect your capital.

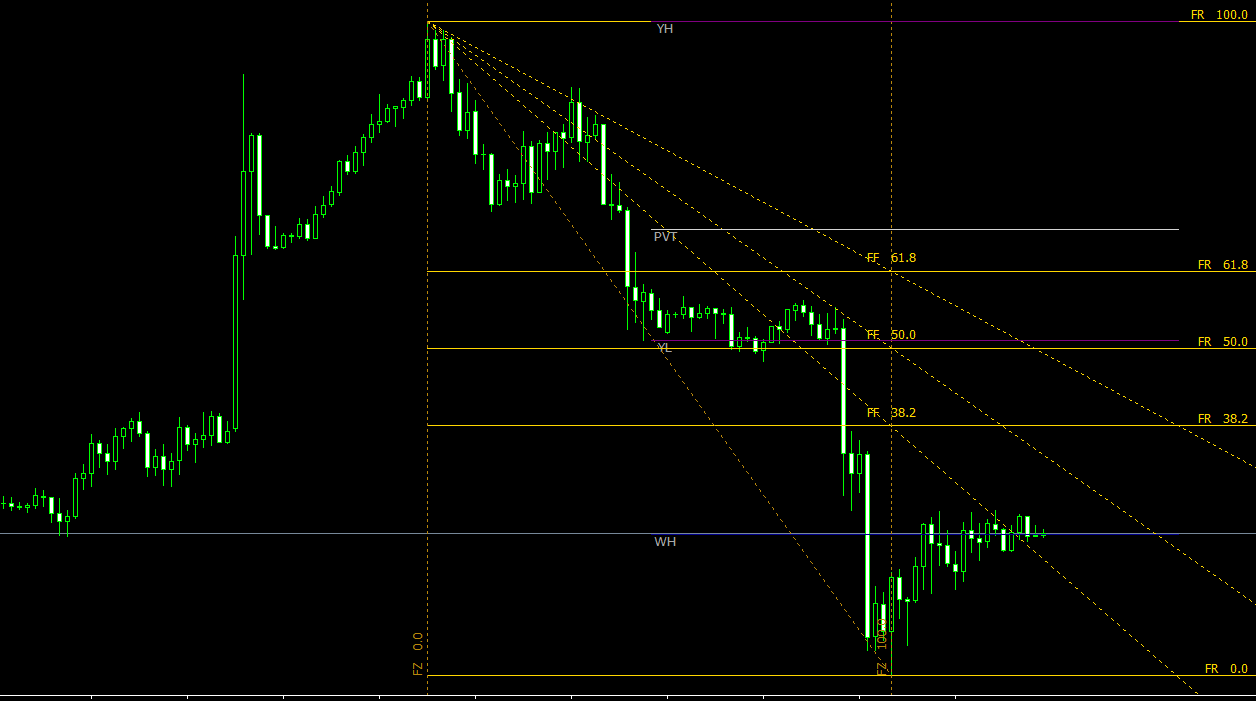

- Combine with technical analysis: While fundamental analysis can provide valuable insights into the underlying factors affecting currency values, it is essential to combine it with technical analysis to develop a well-rounded trading strategy. Technical analysis can help you identify optimal entry and exit points, as well as assess the overall market sentiment and momentum.

- Monitor and adjust your strategy: Continuously monitor your fundamental analysis and trading strategy to ensure that they remain relevant in the face of changing market conditions. Be prepared to adjust your strategy if new information or events suggest that your initial assumptions are no longer valid.

Benefits and Limitations of Fundamental Analysis in Forex Trading

Fundamental analysis offers several benefits to forex traders, including:

- Informed decision-making: By examining the underlying factors that influence currency values, fundamental analysis can help traders make more informed trading decisions based on the overall economic health of a country.

- Long-term perspective: Fundamental analysis focuses on the long-term drivers of currency values, making it particularly useful for traders with a longer-term investment horizon.

- Risk management: By understanding the potential impact of economic, political, and social factors on currency values, traders can better manage their risk and protect their capital.

However, there are also limitations to fundamental analysis in forex trading:

- Complexity: Fundamental analysis can be complex and time-consuming, as it requires a thorough understanding of various economic indicators, interest rate decisions, and political events.

- Subjectivity: Interpreting economic data and other fundamental factors can be subjective, leading to varying conclusions and predictions among traders.

- Inability to predict short-term price movements: While fundamental analysis can provide insights into the long-term drivers of currency values, it may not be as effective in predicting short-term price fluctuations that are influenced by market sentiment and technical factors.

Conclusion

Fundamental analysis is a valuable tool for forex traders looking to assess the intrinsic value of a currency by examining the economic, political, and social factors that can impact its demand and supply. By staying informed, developing a comprehensive understanding of these factors, and incorporating fundamental analysis into their trading strategy, traders can make more informed decisions and potentially generate consistent profits.

However, it is essential to recognize the limitations of fundamental analysis and combine it with technical analysis to develop a well-rounded trading strategy. By understanding the principles behind fundamental analysis and effectively applying it in their trading, forex traders can enhance their overall performance and navigate the dynamic world of forex trading with confidence.