The Heiken Ashi DS AwP MTF trading indicator is an advanced modification of the popular Heiken Ashi indicator, designed to improve trend analysis for traders. It includes an MTF (multi-timeframe mode), double smoothing, and additional prices to deliver a more comprehensive view of the market. In this article, we will delve into the key features of the Heiken Ashi DS AwP MTF indicator and explore how traders can optimize its use in their trading strategies.

Understanding the Heiken Ashi DS AwP MTF MT4 Indicator

The Heiken Ashi DS AwP MTF indicator builds upon the original Heiken Ashi indicator, which is known for its ability to filter out market noise and provide a clearer view of market trends. The modified indicator incorporates several enhancements, including MTF mode, double smoothing, and additional price lines, to deliver more accurate and reliable trading signals.

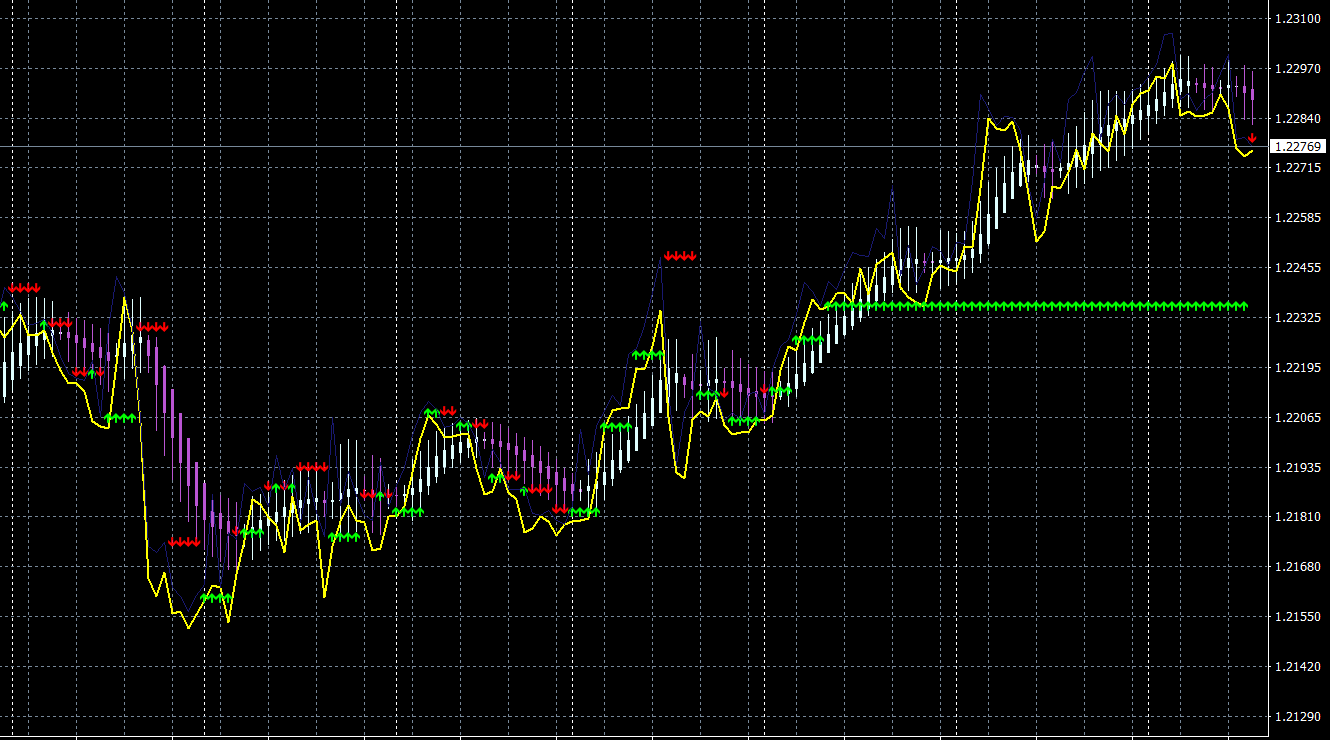

The Heiken Ashi DS AwP MTF indicator generates signals based on the relationship between the price and the pivot level. If the price closes above the pivot level, green arrows suggest that the trend is going up. Conversely, if the price closes below the pivot level, red arrows indicate that the trend is going down.

Key Features of the Heiken Ashi DS AwP MTF Indicator

- Yellow Line: The yellow line represents the price, which is calculated using three different methods. This provides traders with a comprehensive view of the price dynamics in the market.

- Horizontal Arrow Line: The horizontal line of arrows is the pivot level of the higher timeframe, offering insights into market trends from a broader perspective.

- MTF Mode: The multi-timeframe mode allows traders to view trend information from multiple timeframes simultaneously, facilitating more informed decision-making.

- Double Smoothing: The indicator employs double smoothing techniques to further reduce market noise and enhance the clarity of trend signals.

- Additional Price Line: The inclusion of an additional price line enhances the accuracy of trend signals and provides traders with a more comprehensive understanding of market dynamics.

Optimizing the Heiken Ashi DS AwP MTF Indicator in Your Trading Strategy

To maximize the benefits of the Heiken Ashi DS AwP MTF indicator, traders should consider the following optimization tips:

- Timeframe Selection: Choose the appropriate timeframes for your trading strategy, as this will directly impact the pivot levels and trend signals generated by the indicator.

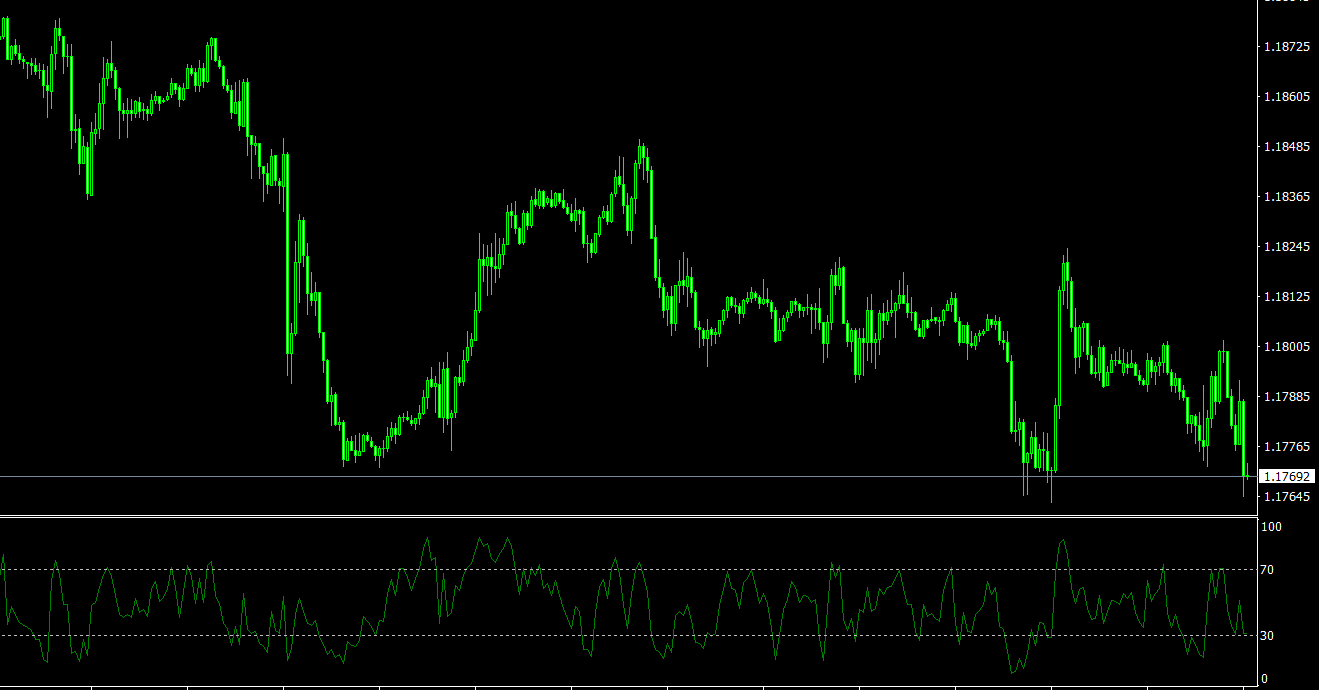

- Confirmation with Other Indicators: To improve the accuracy of trading signals and minimize false entries, consider using the Heiken Ashi DS AwP MTF indicator in conjunction with other technical analysis tools, such as oscillators and support/resistance indicators.

- Risk Management: Regardless of the indicator used, always employ proper risk management techniques to protect your trading capital and minimize losses.

Conclusion

The Heiken Ashi DS AwP MTF trading indicator offers an enhanced version of the original Heiken Ashi indicator, providing traders with a more comprehensive and accurate tool for trend analysis. Its MTF mode, double smoothing, and additional price line make it an indispensable tool for traders seeking to improve their trading performance.

By optimizing the use of the Heiken Ashi DS AwP MTF indicator and incorporating other technical analysis tools, traders can generate more accurate trading signals, identify crucial pivot levels, and make more informed decisions. Whether used on its own or in combination with other indicators, the Heiken Ashi DS AwP MTF indicator is a valuable addition to any trader’s arsenal.

Features of Heiken Ashi DS AwP MTF MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Heiken-Ashi-DS-AwP-MTF.zip file you will find:

- Heiken Ashi DS AwP MTF.ex4

Download Heiken Ashi DS AwP MTF MT4 indicator for free: