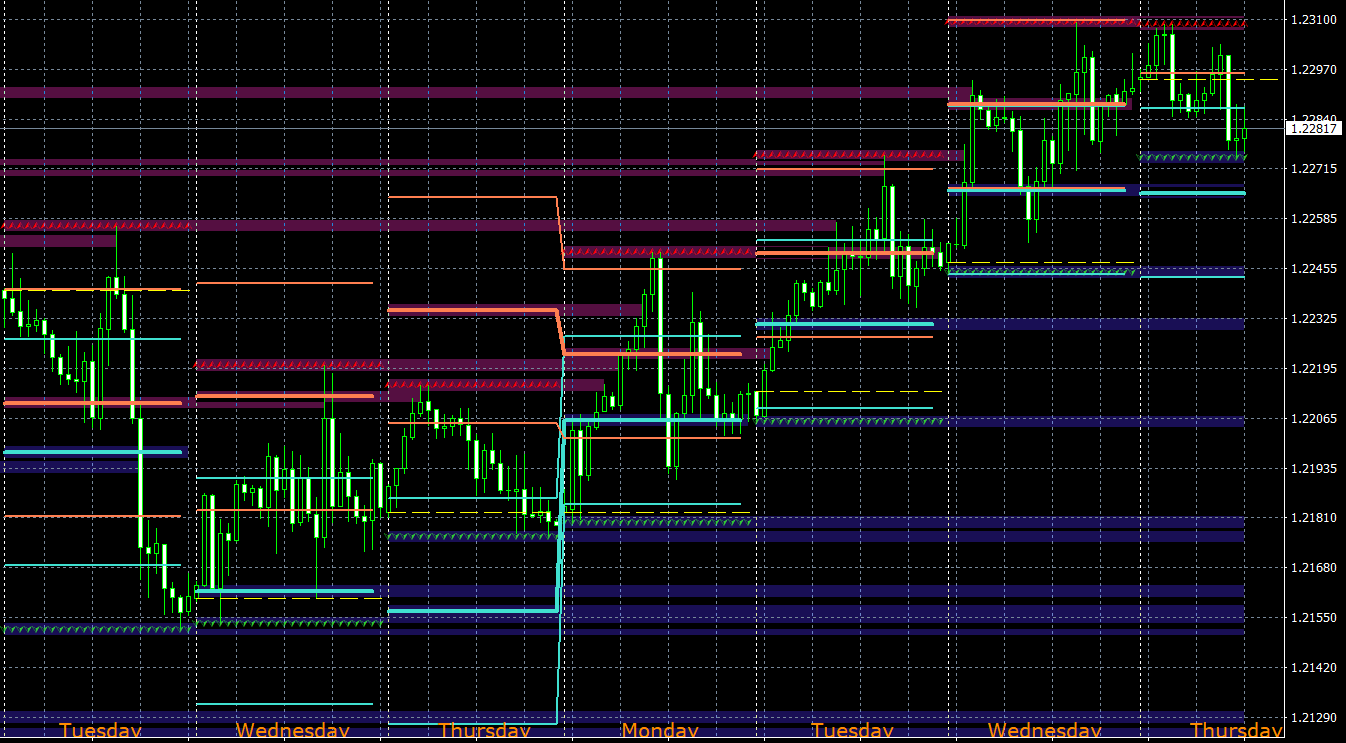

The Forex Volatility Levels MT4 indicator is a versatile trading tool designed for displaying volatility levels using two distinct calculation methods without repainting. Volatility plays a crucial role in trading, as it characterizes the magnitude of price fluctuations relative to a simple average. In this article, we will explore the key features of the Forex Volatility Levels indicator, its benefits, and how to optimize its use in your trading strategy.

Understanding the Forex Volatility Levels Indicator

The Forex Volatility Levels indicator calculates the High and Low prices on a specified timeframe and constructs three volatility levels, both upwards and downwards. By analyzing these levels, traders can gain valuable insights into market dynamics and potential trading opportunities.

Key Features of the Forex Volatility Levels Indicator

- Multiple Volatility Ratios: The Forex Volatility Levels indicator offers three volatility ratios, providing traders with a comprehensive view of market volatility and enabling them to make better-informed decisions.

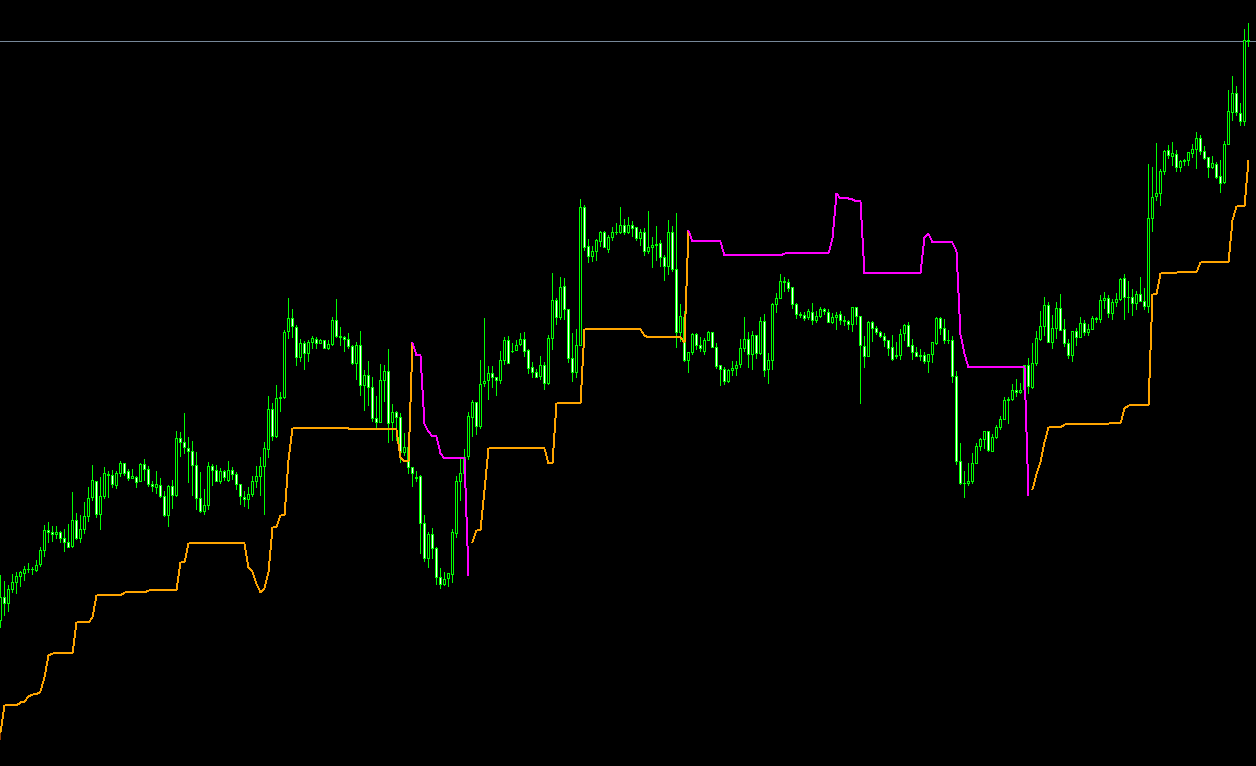

- Two Calculation Methods: The indicator boasts two distinct types of calculation, allowing traders to choose the method that best suits their trading style and preferences.

- Strike Level: The Strike level determines the touch of the High/Low prices to the previous/current levels, providing traders with additional insights into market dynamics.

- No Repainting: While the indicator may repaint levels on the zero bar (DATABAR = 0), there will be no repainting on the first bar (DATABAR = 1), ensuring accurate and reliable trading signals.

Optimizing the Forex Volatility Levels Indicator in Your Trading Strategy

To fully harness the potential of the Forex Volatility Levels indicator, traders should consider the following optimization tips:

- Timeframe Selection: Choose an appropriate timeframe for your trading strategy, as this will directly impact the High and Low price calculations and, consequently, the volatility levels generated by the indicator.

- Calculation Method: Experiment with the two available calculation methods to find the one that best suits your trading style and preferences. Different calculation methods may yield varying results, so it is essential to find the one that provides the most accurate and reliable trading signals for your specific strategy.

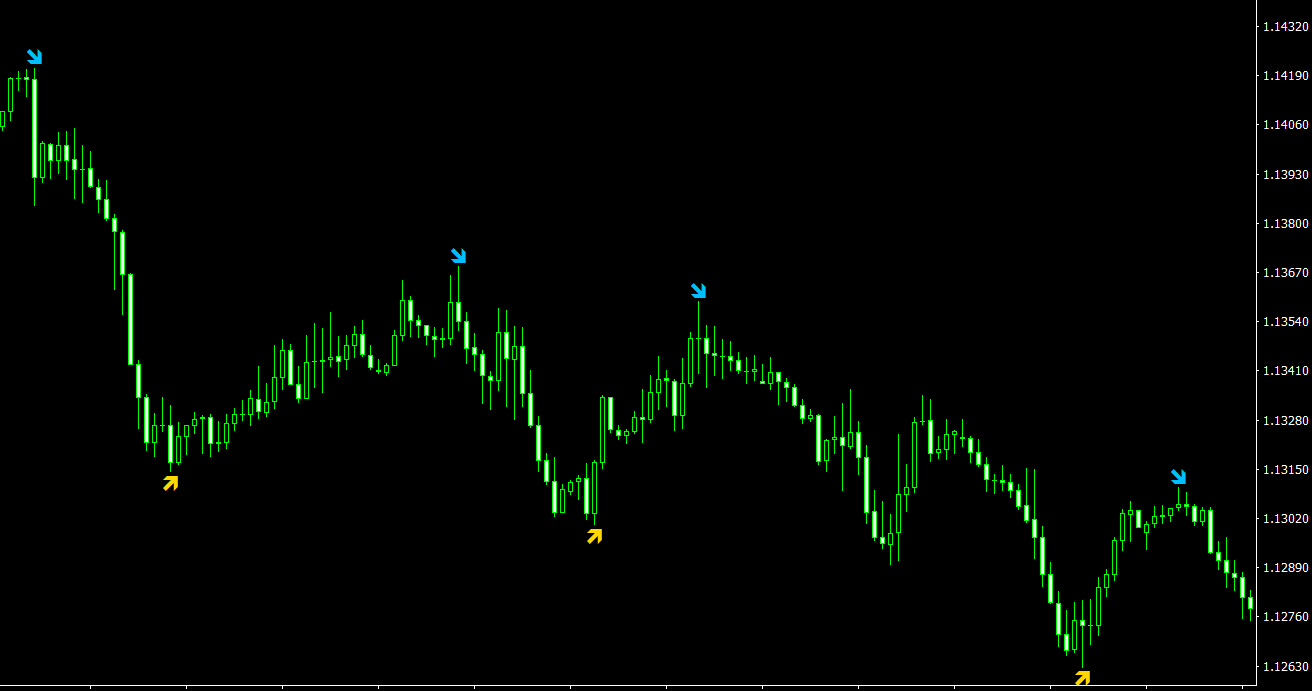

- Support and Resistance Levels: Use the Forex Volatility Levels indicator to identify crucial support and resistance levels, which can serve as potential entry and exit points for your trades.

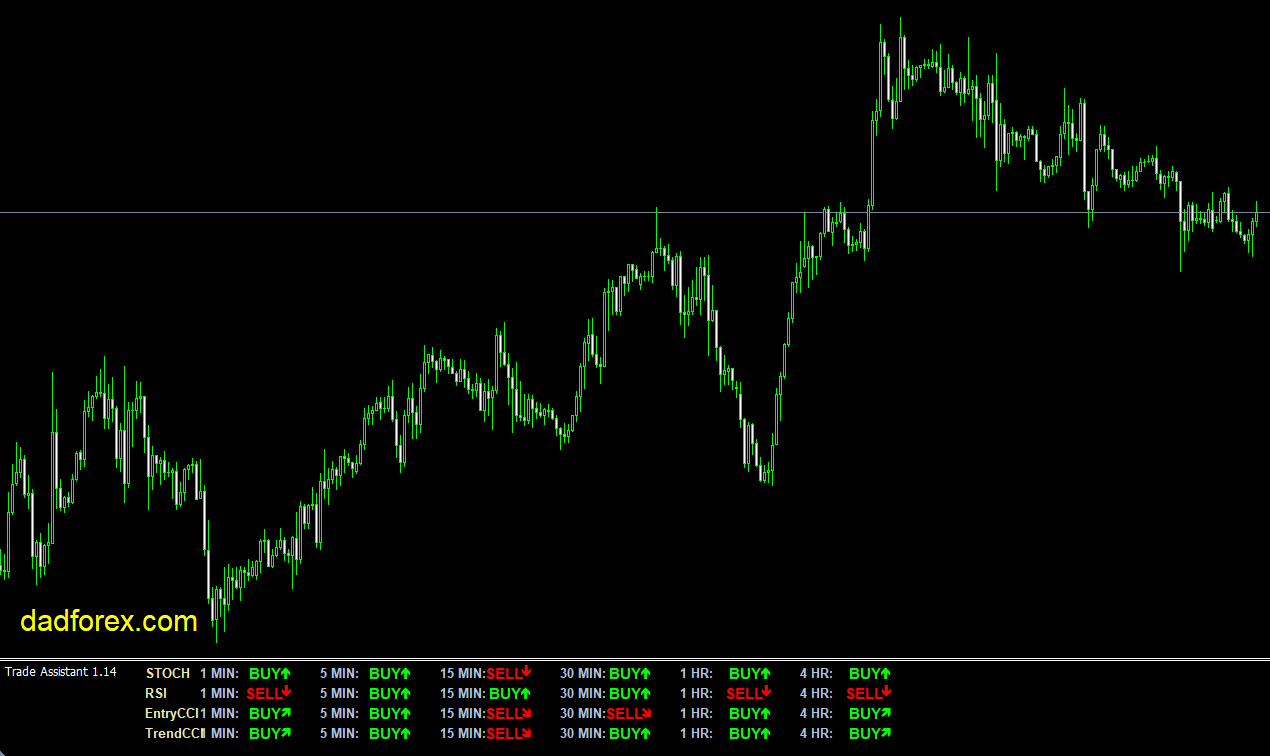

- Combine with Other MT4 Indicators: To enhance the accuracy of your trading signals and improve overall trading performance, consider combining the Forex Volatility Levels indicator with other technical analysis tools, such as trend indicators and oscillators.

Conclusion

The Forex Volatility Levels MT4 indicator offers a unique approach to analyzing market volatility and identifying potential trading opportunities. With its multiple volatility ratios, two calculation methods, and no repainting on the first bar, this indicator serves as a valuable tool for any trader looking to improve their trading strategy.

By optimizing the use of the Forex Volatility Levels indicator and incorporating other technical analysis tools, traders can generate more accurate trading signals, identify crucial support and resistance levels, and maximize their profit potential. Whether used on its own or in combination with other indicators, the Forex Volatility Levels indicator is an essential addition to any trader’s toolkit.

Features of Forex Volatility Levels MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Forex-Volatility-Levels-SD-TT.zip file you will find:

- Forex Volatility Levels SD+TT.ex4

Download Forex Volatility Levels MT4 indicator for free: