The forex market is riddled with volatility and unpredictability, necessitating the use of sophisticated tools and indicators to navigate its uncertain waters. One such tool that has emerged as a reliable guide for traders is the Ku Klux MT4 indicator. This article delves into the Ku Klux indicator, explaining its functionality, and providing a detailed insight into how it can be harnessed for optimal trading results.

Understanding the Ku Klux MT4 Indicator:

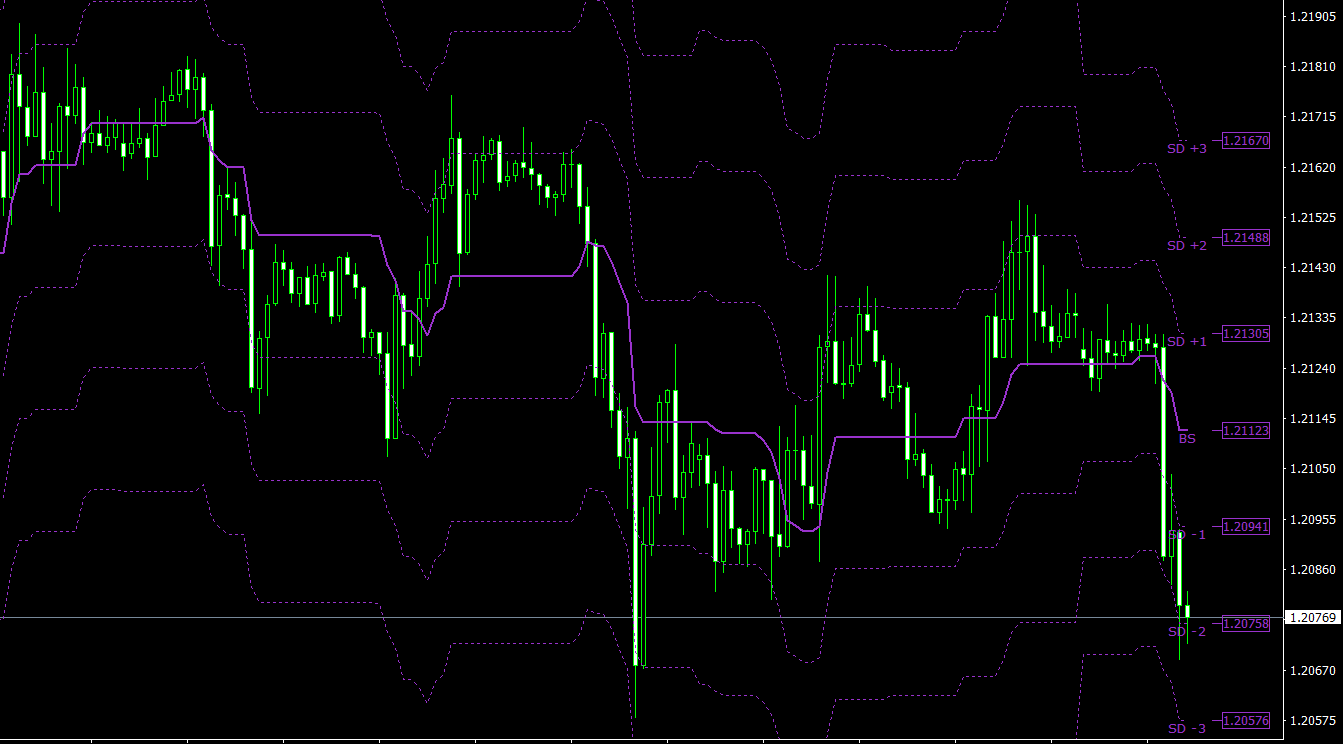

The Ku Klux indicator is more than just a tool that identifies market trends. It is a near-comprehensive trading strategy. The core principle behind this indicator is leveraging the volatility of the previous day to forecast potential entry and exit points in the market.

Mechanism:

The strength of the Ku Klux indicator lies in its ability to calculate the optimal entry and exit points based on the volatility of the preceding day and the current trend direction. This ensures that the trader is well-informed about potential market movements and can position themselves accordingly.

Trading Rules with the Ku Klux Indicator:

To harness the full potential of the Ku Klux indicator, one needs to adhere to specific trading rules:

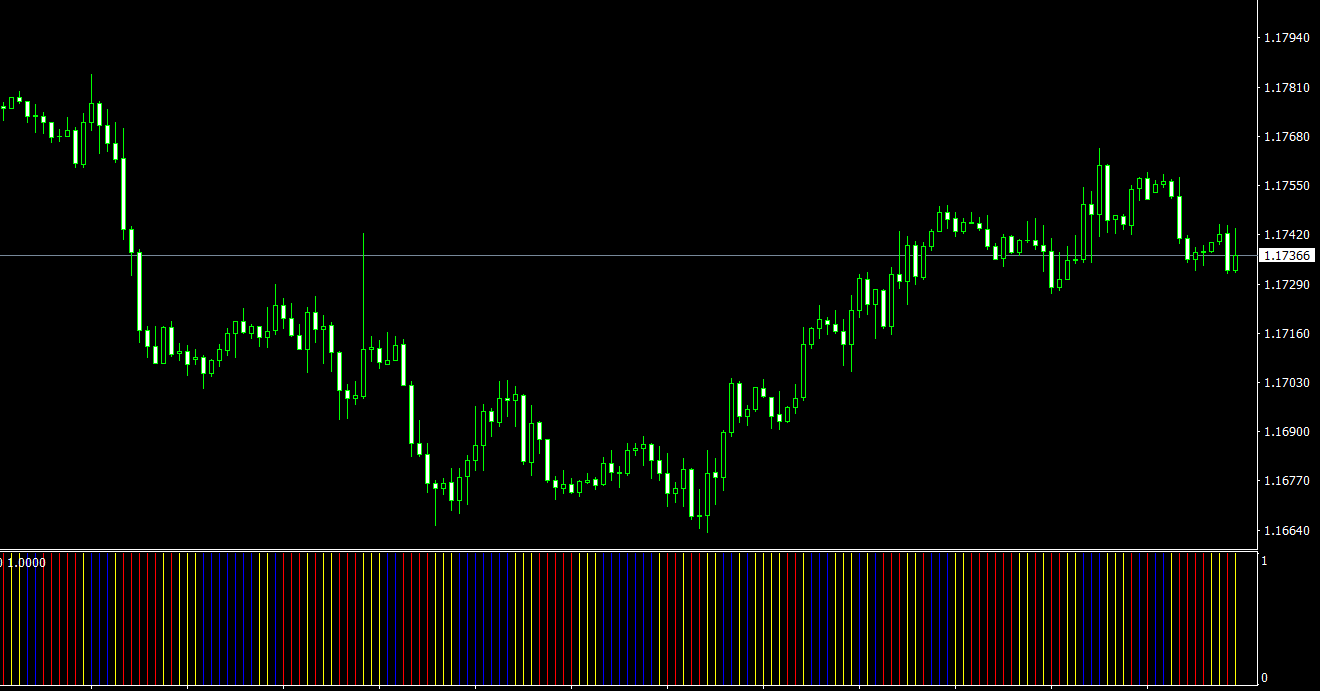

- Pending Orders: Once the indicator has been applied, it will provide distinct Buy and Sell levels on the chart. Based on these, the trader should place pending orders. For a potential upward trend, the order is set at the Buy level, and for a potential downtrend, it’s set at the Sell level.

- Setting a Stop Loss: Risk management is pivotal in forex trading, and the Ku Klux indicator aids in this regard by suggesting Stop Loss levels. For a buy order, the stop loss should be set at the BSL (Buy Stop Loss) level, and for a sell order, at the SSL (Sell Stop Loss) level. These are visually represented on the chart for ease of reference.

- Profit Targets: The Ku Klux indicator is also beneficial in setting profit targets. For long positions, the BT1 level represents the first target, and once achieved, part of the position can be closed, shifting the stop loss to breakeven. The BT2 level signifies the second target. The same logic applies for short positions, with ST1 and ST2 as the respective targets.

Combining the Ku Klux with Other Indicators:

One of the advantages of the Ku Klux indicator is its compatibility with other forex indicators. Traders can use other MT4 indicators in tandem with the Ku Klux to refine their entry and exit points further. These secondary indicators can act as filters, confirming or disputing the signals from the Ku Klux, leading to a more informed trading decision.

Conclusion:

The Ku Klux MT4 indicator, with its emphasis on volatility and trend direction, offers traders a structured and strategic approach to forex trading. While no indicator guarantees success, by adhering to the trading rules set by the Ku Klux and possibly integrating other complimentary indicators, traders can significantly enhance their prospects in the dynamic forex market. As with all trading strategies, it’s essential to remember that past performance is not indicative of future results, and it’s crucial to practice sound risk management techniques.

Features of Ku Klux MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Ku-Klux.zip file you will find:

- Ku-Klux.ex4

Download Ku Klux MT4 indicator for free: