The Keltner Channel MT4 Indicator is a popular technical analysis tool used by forex traders to identify potential trade opportunities and manage risk. Developed by Chester W. Keltner, this indicator consists of three lines that form a channel around the price action. The Keltner Channel is similar to Bollinger Bands, but it uses Average True Range (ATR) instead of standard deviation to determine the channel’s width. In this article, we will explore the Keltner Channel MT4 Indicator in depth, its various applications in forex trading, and practical examples of how to use it effectively.

Overview of the Keltner Channel MT4 Indicator

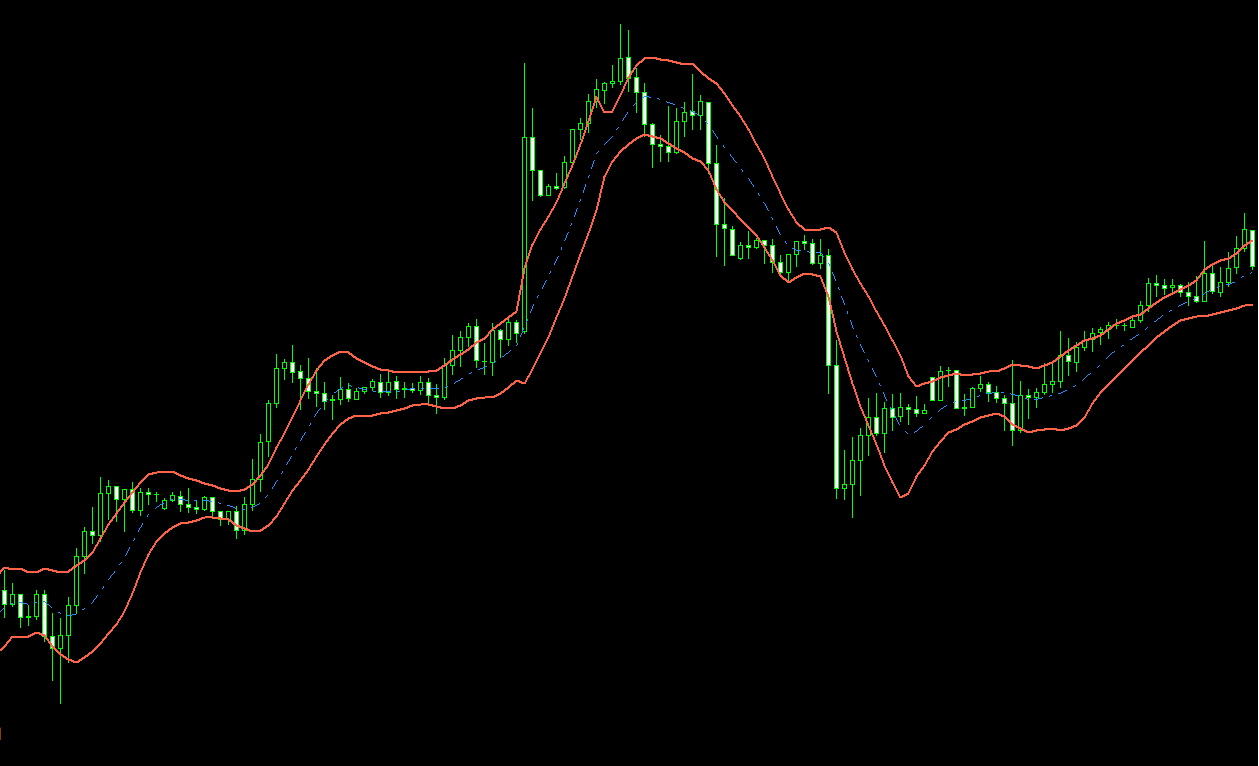

The Keltner Channel MT4 Indicator is a technical analysis tool that helps forex traders identify trends, potential trade opportunities, and manage risk. The indicator consists of three lines that form a channel around the price action: a middle line, which represents the moving average of the price, and two outer lines that are a specified number of Average True Range (ATR) units away from the middle line.

Key Features of the Keltner Channel MT4 Indicator

1. Moving Average-based Center Line

The center line of the Keltner Channel is a moving average of the price, typically an Exponential Moving Average (EMA) or a Simple Moving Average (SMA). The chosen moving average period determines the sensitivity of the indicator to price movements.

2. Average True Range-based Channel Width

The outer lines of the Keltner Channel are determined by the Average True Range (ATR), which is a measure of market volatility. A specified multiple of the ATR is added and subtracted from the center line to create the upper and lower boundaries of the channel.

3. Identifying Trends and Potential Trade Opportunities

When the price action is consistently above or below the center line, the Keltner Channel can be used to identify the prevailing market trend. Additionally, when the price touches or crosses the outer lines, potential trade opportunities arise as the market may be overextended.

Using the Keltner Channel MT4 Indicator in Forex Trading

1. Identifying Trends

The Keltner Channel can be used to identify trends in the forex market. When the price consistently stays above the center line, it indicates an uptrend, and when it remains below the center line, it signals a downtrend. Traders can use this information to trade in the direction of the prevailing trend, increasing the likelihood of success.

2. Trade Entry and Exit Points

The Keltner Channel can help traders identify potential entry and exit points for trades. When the price touches or crosses the upper line, it may indicate that the market is overbought, presenting a potential short-selling opportunity. Conversely, when the price touches or crosses the lower line, it may signal that the market is oversold, presenting a potential buying opportunity.

In addition to trade entries, the Keltner Channel can also be used to set stop-loss and take-profit levels. A stop-loss can be placed below the lower line for long positions or above the upper line for short positions. Take-profit levels can be set near the opposite channel line, allowing traders to capture potential reversals.

Example:

Suppose the EUR/USD currency pair is in an uptrend, with the price consistently staying above the center line of the Keltner Channel. A trader could enter a long position when the price touches the lower line, setting a stop-loss below the lower line and a take-profit level near the upper line. This trade would capitalize on the potential price bounce from the lower line while minimizing risk with a well-defined stop-loss.

3. Filtering False Breakouts

The Keltner Channel can also be used to filter false breakouts in the forex market. False breakouts occur when the price momentarily moves outside the channel before quickly reversing direction. By waiting for additional confirmation before entering a trade, such as a candlestick pattern or another technical indicator signal, traders can reduce the likelihood of being caught in a false breakout.

Example:

Assume the GBP/USD currency pair is in a downtrend, with the price consistently staying below the center line of the Keltner Channel. The price breaks above the upper line, suggesting a potential reversal. However, a trader might wait for additional confirmation, such as a bearish engulfing candlestick pattern, before entering a short position. This additional confirmation helps to filter out false breakouts and increases the probability of a successful trade.

Installing and Configuring the Keltner Channel MT4 Indicator

1. Installation

To install the Keltner Channel MT4 Indicator, download the indicator file below and save it to your computer. Open the MetaTrader 4 platform and click on “File” > “Open Data Folder.” Locate the “MQL4” folder and then the “Indicators” folder. Copy the downloaded indicator file into the “Indicators” folder. Restart the MetaTrader 4 platform, and the Keltner Channel MT4 Indicator should now appear in the “Navigator” panel.

2. Applying the Indicator to Charts

To apply the Keltner Channel MT4 Indicator to a chart, simply drag and drop the indicator from the “Navigator” panel onto the desired chart. Right-click on the chart, select “Indicators List,” choose the Keltner Channel MT4 Indicator, and click “Properties” to adjust the indicator’s settings.

3. Customizing the Settings

Once the indicator is applied to the chart, you can customize its period to suit your preferences. You can also change the colors and styles of the lines to make them more visually appealing and easier to interpret.

Advantages and Limitations of the Keltner Channel MT4 Indicator

Advantages:

- Versatility: The Keltner Channel MT4 Indicator is a versatile tool that can be used for various purposes in forex trading, including trend identification, trade entry and exit points, and filtering false breakouts.

- Ease of use: The Keltner Channel is relatively easy to understand and implement in trading, making it suitable for both beginners and experienced traders.

Limitations:

- Not a standalone tool: The Keltner Channel MT4 Indicator should not be used as a standalone tool in forex trading. Combining it with other technical analysis methods and employing sound risk management practices will yield better results.

- Potential for false signals: Like any other technical indicator, the Keltner Channel may sometimes generate false signals, leading to potential losses. It is crucial to seek additional confirmation before making trade decisions based on these signals.

Conclusion

The Keltner Channel MT4 Indicator is a powerful and versatile tool for forex traders, providing valuable insights into market trends, potential trade opportunities, and risk management. By understanding how to use the Keltner Channel effectively, traders can enhance their decision-making process and increase their chances of success in the dynamic world of forex trading. However, it is important to remember that the Keltner Channel should not be used as a standalone tool. Combining it with other technical analysis methods and employing sound risk management practices will maximize its potential and help traders achieve consistent results.

Features of Keltner Channel MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Keltner-Channel.zip file you will find:

- Keltner-Channel.ex4

Download Keltner Channel MT4 indicator for free: