STO EMA scalping strategy is designed for active trading on 1 minute charts in the European session. The rules of operation are generally simple and do not require special knowledge in signal processing, so even novice traders can explore this strategy.

To execute this strategy, you will need a Metatrader4 platform, a currency pair with a small spread and good fluctuations in the European session. Optimal currency pairs are EURUSD or GBPUSD.

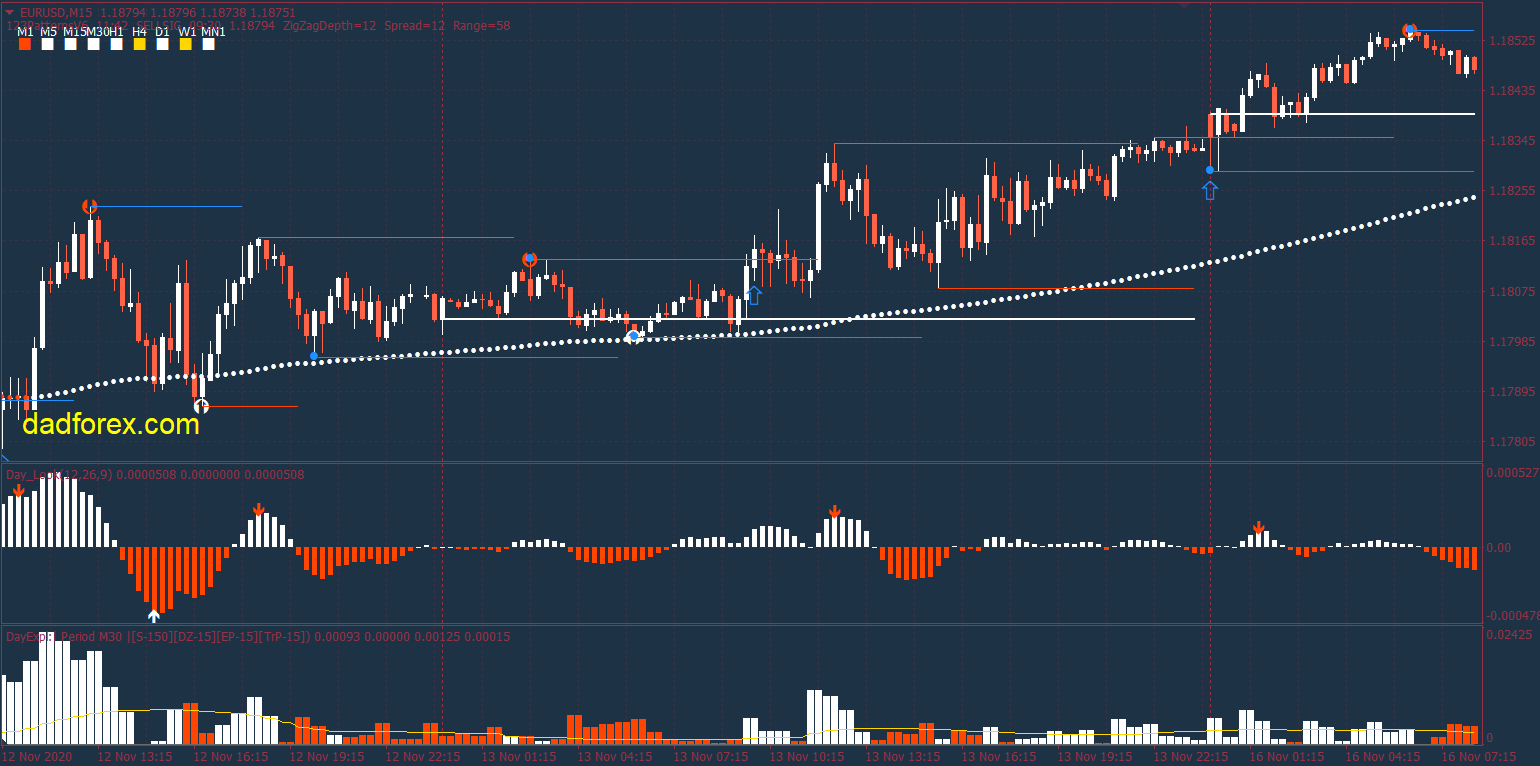

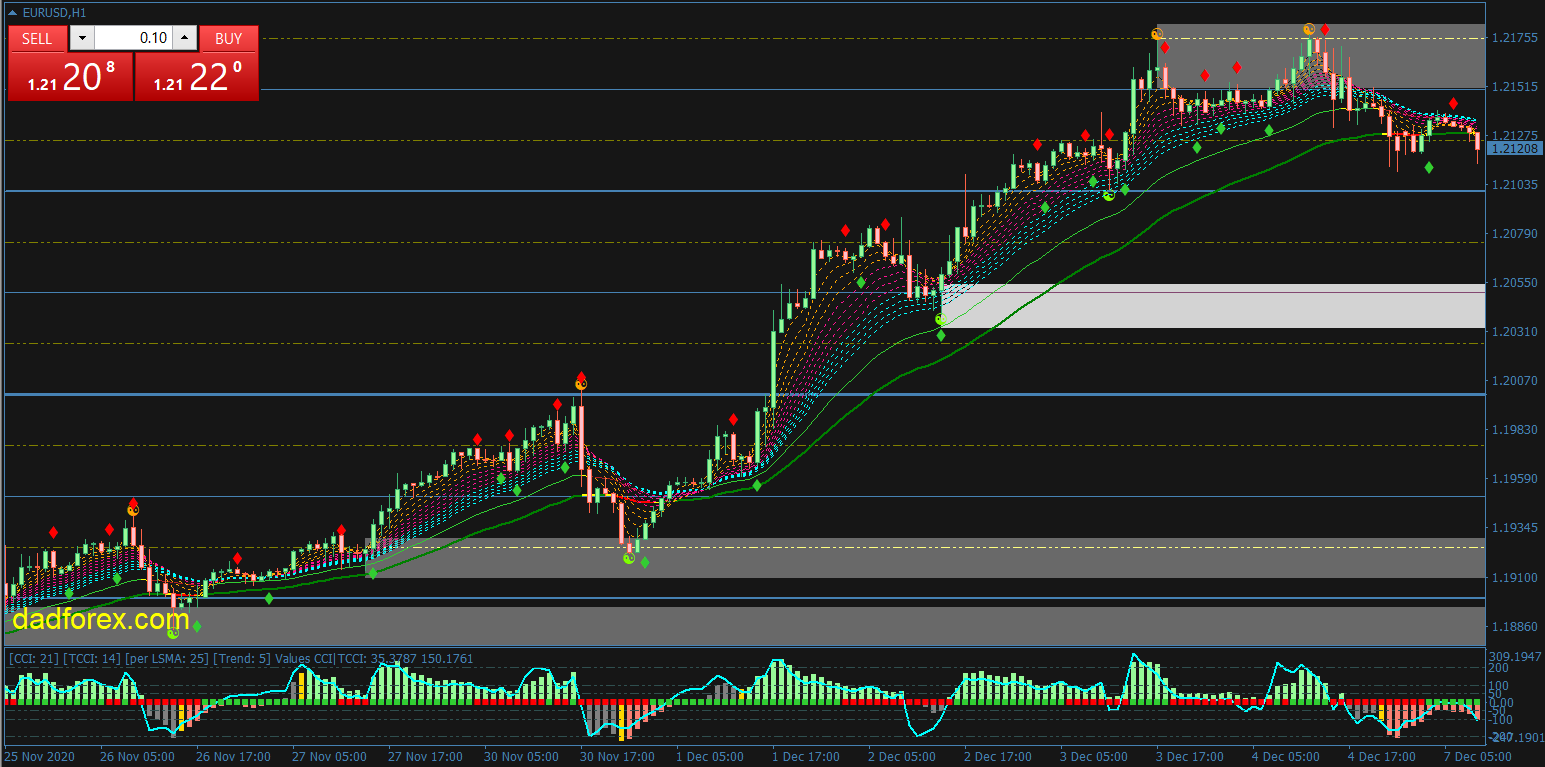

The scalping strategy incorporates three EMA moving averages with periods of 63, 102, and 165, as well as two stochastic indicators with parameters (15, 3, 9) and (30, 6, 18). Upon downloading the strategy files below, you will be able to load the template directly onto your chart with the appropriate indicator parameters.

Scalping Strategy Rules for 1 Minute Chart

The moving averages guide us in the direction of potential entries. They should be in the correct order, ascending for a BUY signal and descending for a SELL signal. If the EMAs are jumbled or intersected, we should ignore any signals. The price’s position relative to the moving averages is immaterial; it can be either above or below or inside the indicators. The crucial aspect is that they are in order and do not intersect. The entry signals are based on Stochastics. It is crucial to follow these rules strictly to enhance the strategy’s effectiveness.

Signals Indicating the Opening of a Buy Position

- EMA (63) is above EMA (102), which is above EMA (165).

- Slow Stochastic (30, 6, 18) entered the oversold zone (below level 10).

- Fast Stochastic (15, 3, 9) is in the oversold zone and crosses the level 20 from the bottom up.

Signals Indicating the Opening of a Sell Position

- EMA (63) is bellow EMA (102), which is bellow EMA (165).

- Slow Stochastic (30, 6, 18) entered the overbought zone (above 90).

- Fast Stochastic (15, 3, 9) is in the overbought zone and crosses the level 80 from the top down.

Setting Stop Loss and Take Profit

- Stop loss is set above / below the previous local high / low;

- Take profit is set at a ratio of 2:1 to stop loss.

- If you prefer a simpler approach, you may opt for a 5-pip stop-loss and 10-pip take-profit.

Risk Management

Please bear in mind that this strategy may occasionally provide inaccurate signals. It is crucial to practice good risk management by selecting a lot size that ensures the risk does not exceed 1-3% of the deposit per trade. Additionally, it is recommended to maintain a risk/reward ratio of at least 1. This approach will enable you to earn a profit, even if your success rate is only 50%.

Strategy Parameters

- Currency pairs: any with a low spread, EURUSD, GBPUSD recommended

- Timeframe: M1 recommended

- Trading time: European Session recommended

- Platform: Metatrader 4

Indicators used

- 3 EMAs

- StochasticColor

Installing indicators and system template

- Unpack the zip archive with template and indicator

- Copy the indicator to the MQL4 folder -> indicators

- Copy the templates to the templates folder

- Restart the MT4 terminal

- Open the chart of the required currency pair

- Install a template named STO EMA Scalping.tpl

In STO-EMA-scalping.zip file you will find:

- StochasticColor.ex4

- STO-EMA-scalping.tpl

Download STO EMA Scalping strategy files for free: