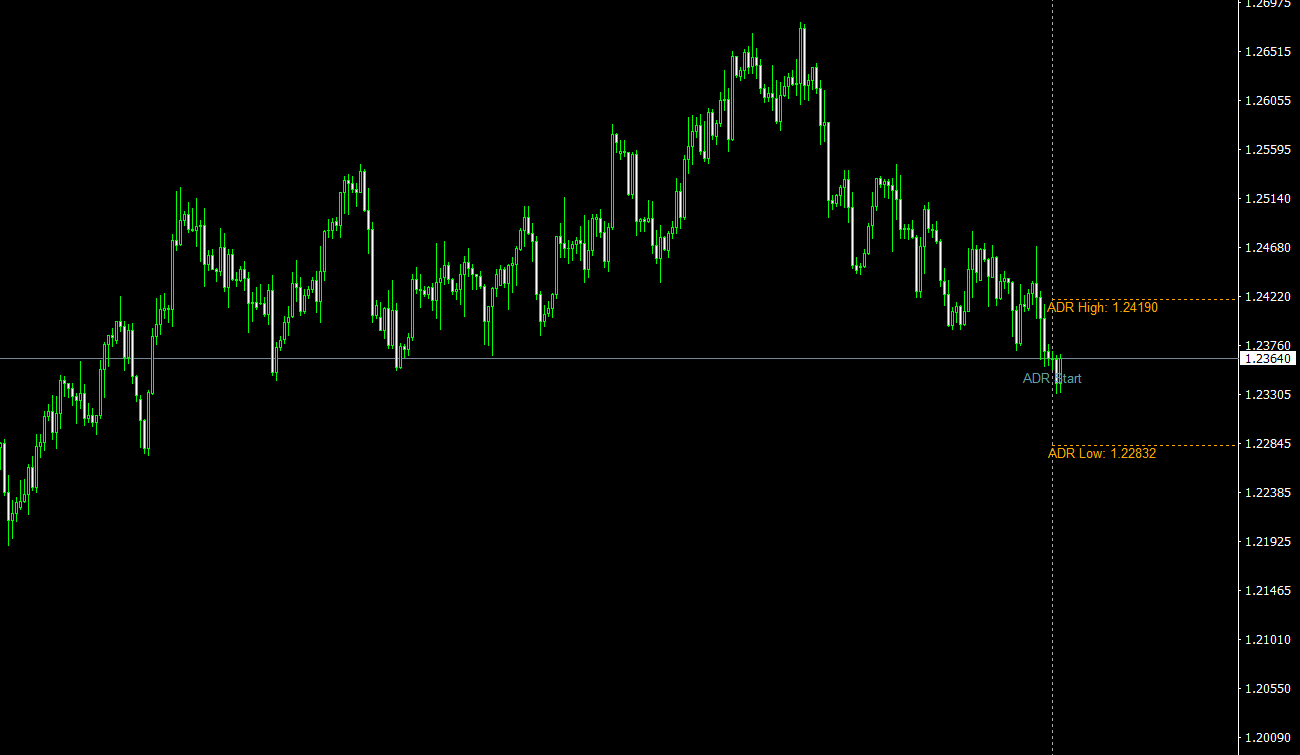

Forex trading is a game of predictions and volatility, requiring astute technical skills and keen market insights. One of the game-changing tools in a trader’s arsenal is the ADR (Average Daily Range) Indicator, specifically designed for the MetaTrader 4 (MT4) platform. This remarkable tool offers traders a wealth of information by plotting expected market range levels, which act as support and resistance on the trading chart. These indicators are integral to a trader’s decision-making process, playing a crucial role in defining their trading strategy and determining entry and exit points.

Understanding Average Daily Range (ADR) MT4 Indicator

The ADR Indicator, like many other technical tools in forex trading, works by deriving its values from another indicator, in this case, the ATR – Average True Range. The ATR is a standard MetaTrader indicator that measures market volatility by decomposing the complete range of an asset price for a specific period.

Choosing the appropriate ATR input in the ADR Indicator settings is vital for traders as it should align with their trading strategy. Yet, it’s essential to remember that each currency pair exhibits unique volatility patterns. Hence, traders are encouraged to experiment, test, and apply different ATR settings that correspond to the specific volatility and trading characteristics of each currency pair. A meticulous and customized approach ensures that the trader maximizes the benefits of the ADR Indicator.

Using ADR MT4 Indicator in Forex Trading

Two prominent trading strategies that traders can adopt with the ADR Indicator are the breakout and reversal trading strategies. As the name suggests, the breakout strategy involves entering a position when the price breaks through a defined resistance level and proceeds in that direction. The reversal strategy, on the other hand, involves entering a position when the price shifts direction after hitting a particular resistance or support level.

The ADR Indicator provides an expected market range, giving traders insights into potential price extremes. This knowledge proves useful when considering a buying position, for instance. A trader can BUY when the price reaches the lower ADR level, placing a stop loss below the previous swing low. This strategy provides a safety net for the trader, safeguarding against potential losses should the market move unfavorably. For this position, the most strategic take-profit point would be the upper ADR level, giving traders the best chance at capitalizing on the price movements.

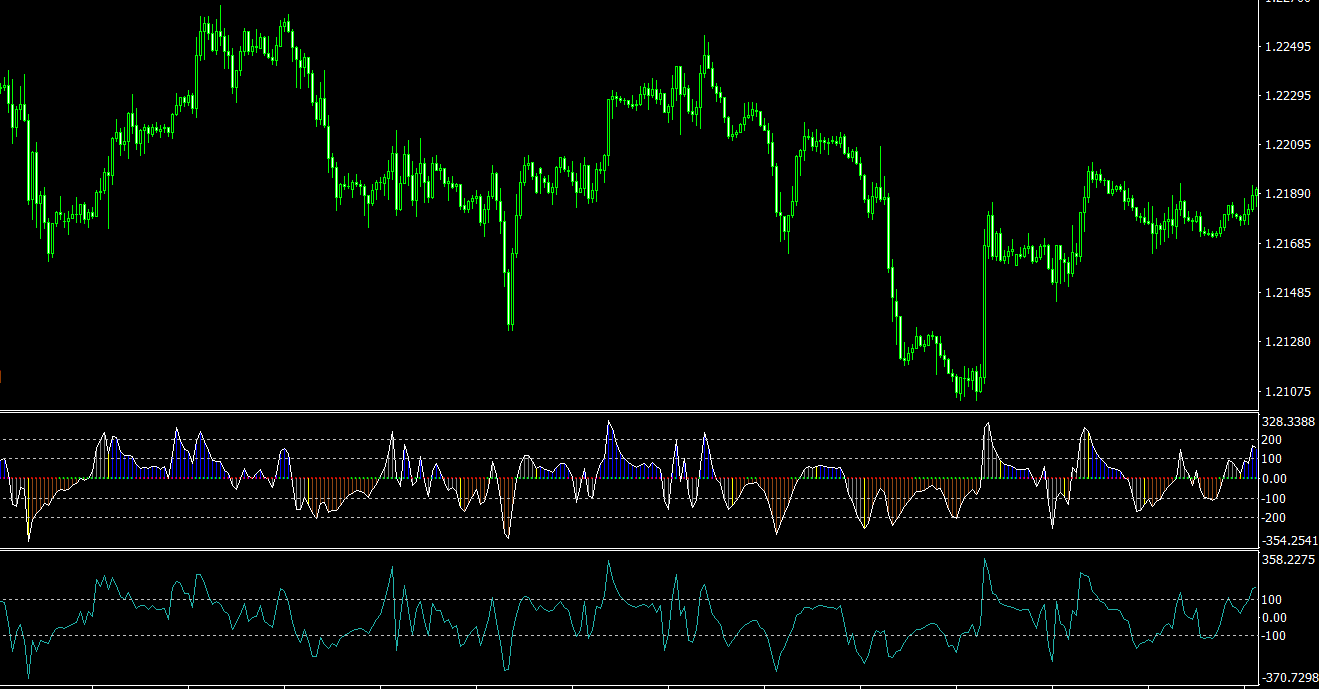

However, while the ADR Indicator is an invaluable tool, it’s important to remember that it should not be used in isolation. Forex trading requires a multi-dimensional approach, and the ADR Indicator should ideally be used in conjunction with price action analysis or other technical MT4 indicators. Combining these tools will provide a more holistic view of the market and help traders better understand overall price patterns and trends. It can also enhance the trader’s predictive capabilities and increase their chances of successful trades.

Conclusion

In conclusion, the ADR MT4 Indicator is an important addition to any forex trader’s toolkit, enabling them to plot support and resistance levels and predict market ranges more accurately. By combining the ADR Indicator with other technical tools and adopting tailored ATR settings, traders can devise effective trading strategies that cater to the volatility of different currency pairs. The key to successful forex trading lies in understanding and effectively using such tools, making informed decisions, and staying adaptable in the face of market volatility.

Features of Average Daily Range (ADR) MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In ADR.zip file you will find:

- ADR.ex4

Download Average Daily Range (ADR) MT4 indicator for free: