The world of Forex trading is replete with indicators, and moving averages have long been a staple among them. However, conventional moving averages suffer from inherent lag, which could be detrimental for timely trading decisions. This is where the SLMA MT4 Indicator comes in. Standing as a powerful alternative, SLMA eliminates the lag and stands as an efficient trend tool. In this article, we’ll delve into the intricacies of the SLMA MT4 Indicator, its construction, applications, and how it enhances trend trading strategies.

Understanding SLMA Indicator

Distinction from Classic Moving Averages

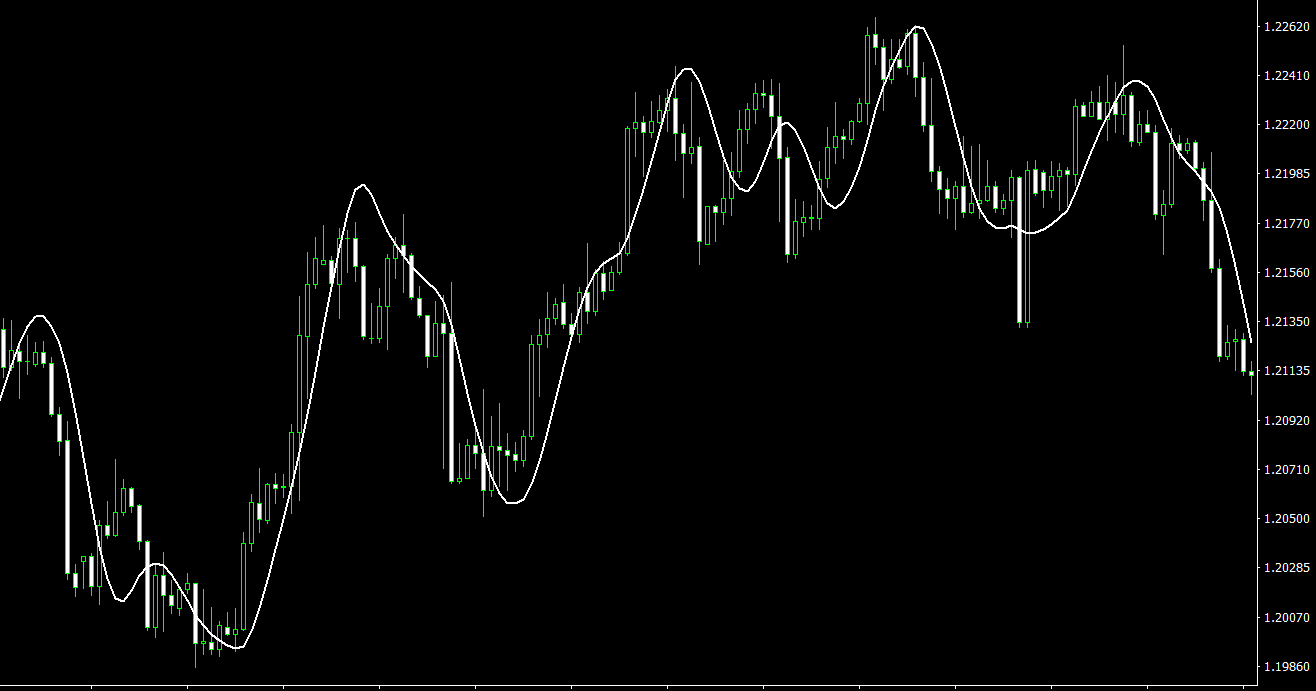

SLMA, which is visually akin to a classic moving average, is fundamentally different in its computation. While traditional moving averages lag behind, SLMA’s unique algorithm takes into account the trend direction across various segments of the price data. It involves calculating several average price values over different periods.

Lag Elimination and Trend Anticipation

SLMA’s different construction methodology results in the elimination of the lag which is usually associated with moving averages. The SLMA Indicator endeavors to catch up with the price and in some instances, it even gets ahead of it. This characteristic is particularly beneficial in identifying potential trend reversal points earlier than conventional moving averages.

Support and Resistance Levels

Similar to traditional moving averages, the SLMA Indicator can also serve as a support or resistance level for the price. This means that the SLMA line can act as a barrier that the price struggles to break through, or a level where the price tends to bounce back from.

Applying SLMA in Trend Trading Strategies

Replacing Classic Moving Averages

The SLMA Indicator can effectively replace classic moving averages in various trading strategies. Especially in trend following strategies, the lack of lag is a substantial advantage. This helps traders to enter and exit trades more timely and accurately.

Identifying Trend Reversals

Since SLMA tends to catch up or sometimes precede the price movements, it can be an invaluable tool for identifying trend reversals. For instance, when the SLMA line starts to flatten or change direction, it may indicate a possible reversal in trend.

Multiple SLMA Lines for Enhanced Accuracy

To achieve even greater precision in identifying trend reversals, traders can consider employing multiple SLMA lines with different periods. This enables them to analyze trends across different time frames and potentially identify significant turning points more effectively.

Integration with Other Indicators

While SLMA is powerful on its own, combining it with other MT4 indicators can create a more robust trading strategy. For instance, using SLMA in conjunction with indicators like RSI or MACD can help in confirming trends and filtering out false signals.

Conclusion

The SLMA MT4 Indicator is a remarkable innovation in trend indicators, addressing the inherent shortcomings of classic moving averages. Its ability to eliminate lag and anticipate price movements makes it an invaluable tool for trend traders. With its potential applications in identifying trend reversals, and acting as support or resistance levels, the SLMA Indicator is undoubtedly a worthy addition to any trader’s arsenal. As always, it is advisable for traders to test any new indicator in a demo environment before integrating it into their live trading strategy.

Features of SLMA MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In SLMA.zip file you will find:

- SLMA.ex4

Download SLMA MT4 indicator for free: