Forex trading is a popular investment method in which individuals and institutions trade currencies in a bid to profit from fluctuations in exchange rates. One essential aspect of forex trading is the development and implementation of effective strategies. A proven method for refining these strategies is backtesting, which involves simulating trades using historical data to evaluate the performance of a trading strategy.

In this comprehensive guide, we will delve into the process of backtesting a forex trading strategy, its benefits, limitations, and best practices.

Understanding Backtesting

Backtesting is a technique used to evaluate the efficacy of a trading strategy by applying it to historical data. This process helps traders to:

- Assess the potential profitability of a strategy

- Determine the optimal parameters for the strategy

- Identify and mitigate potential risks

- Increase confidence in the strategy

Steps for Backtesting a Forex Trading Strategy

a) Define the Trading Strategy

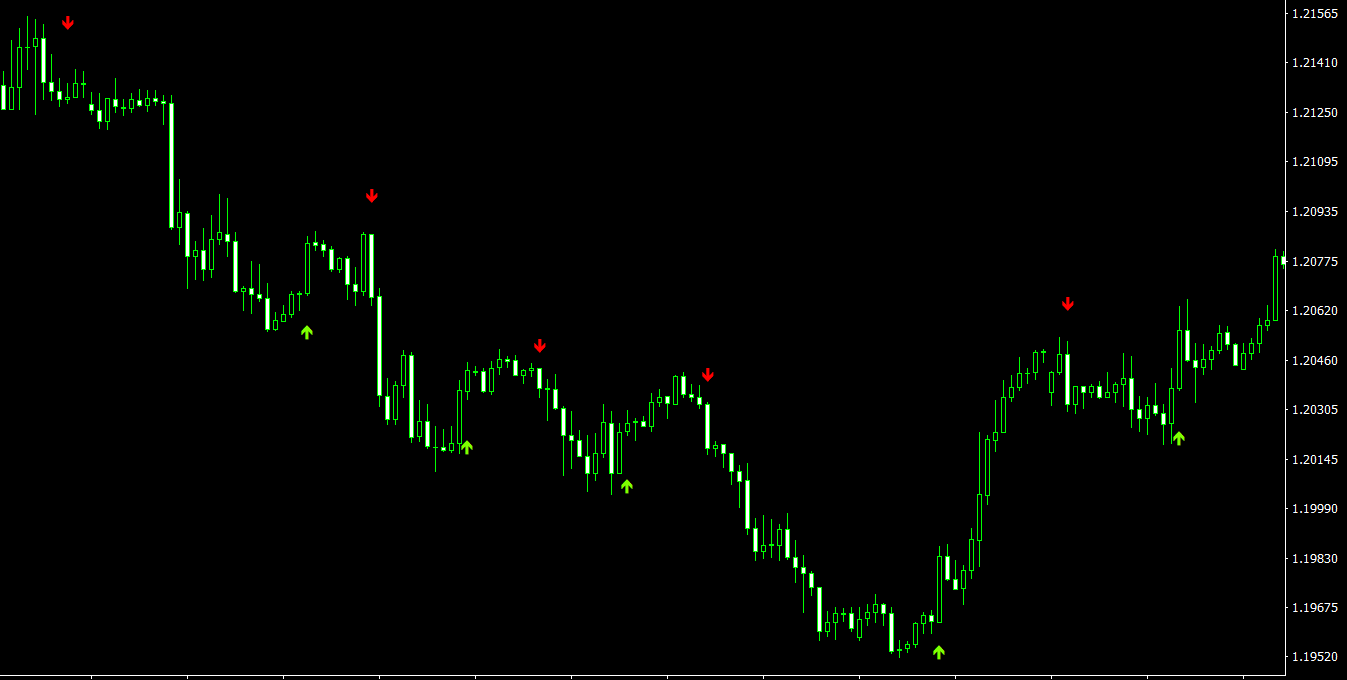

The first step in backtesting is to clearly define the trading strategy. This includes specifying the entry and exit rules, risk management parameters, and any other relevant variables. A well-defined trading strategy provides a clear framework for the backtest.

b) Acquire Historical Data

To backtest a strategy, traders require historical data, which includes the past prices of currency pairs. The data should be as accurate and complete as possible, including high, low, open, and close prices for the chosen timeframes. Several online sources, such as broker platforms and market data providers, offer historical forex data.

c) Determine the Timeframe

Traders must decide on the appropriate timeframe for the backtest. This should align with the trading strategy’s intended holding period and frequency of trading signals. For instance, a scalping strategy may require tick data, whereas a longer-term strategy may use daily or weekly data.

d) Choose the Right Backtesting Software

There are numerous backtesting software options available, including free and paid solutions. When selecting software, traders should consider factors such as ease of use, compatibility with their trading platform, and available features.

Some popular backtesting software options include:

- MetaTrader 4 and 5 Strategy Tester

- Forex Tester

- TradingView

- NinjaTrader

e) Implement the Trading Strategy

Once the software is chosen, traders must implement their trading strategy in the backtesting environment. This typically involves coding the entry and exit rules, risk management parameters, and any other relevant variables in a format compatible with the software.

f) Run the Backtest

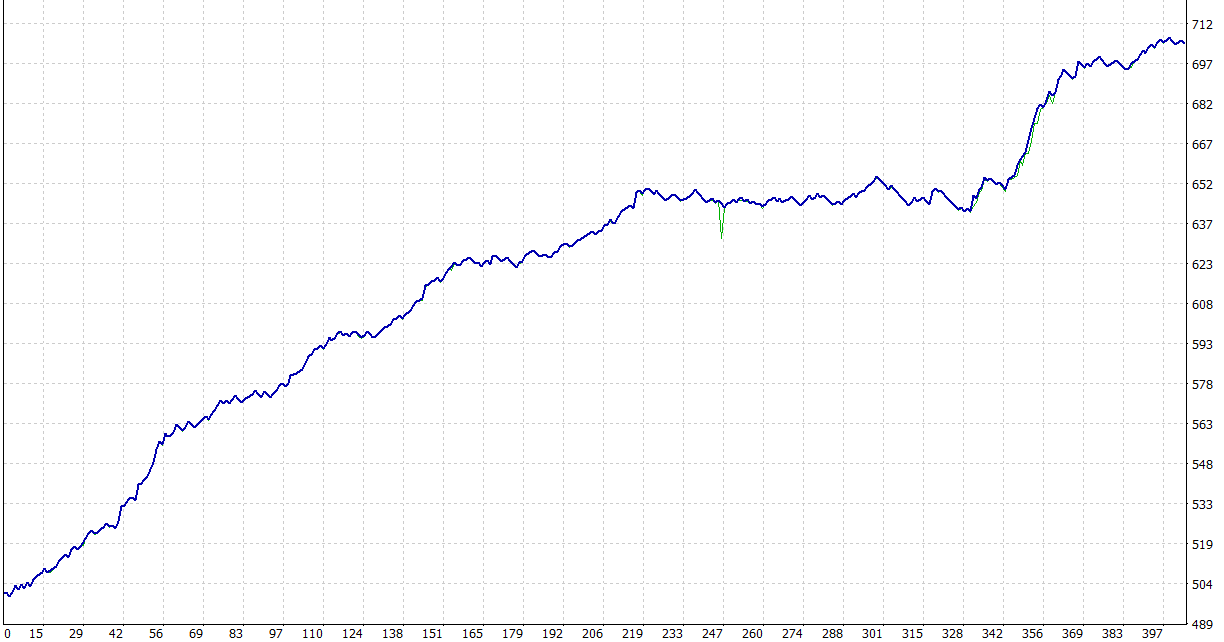

After implementing the trading strategy, traders can run the backtest using the historical data and chosen timeframe. The software will execute the trades according to the strategy’s rules and generate a performance report that includes key metrics such as profit/loss, win/loss ratio, drawdown, and trade frequency.

g) Analyze the Results

Traders should carefully analyze the backtest results to identify the strengths and weaknesses of their strategy. They should consider factors such as:

- Consistency of returns

- Risk-to-reward ratio

- Profitability during different market conditions

- The impact of transaction costs and slippage

- Any potential biases or errors in the backtesting process

h) Optimize the Trading Strategy

Based on the analysis, traders may need to optimize their strategy by adjusting parameters, such as entry and exit rules or risk management settings. This process often involves running multiple backtests with different parameter combinations to identify the best-performing settings.

i) Validate the Strategy

After optimizing the strategy, it’s essential to validate the results by conducting out-of-sample testing. This involves running the strategy on a separate set of historical data that wasn’t used during the initial backtesting process. A successful validation provides additional confidence in the strategy’s performance.

Limitations of Backtesting

While backtesting is a valuable tool for evaluating trading strategies, it has certain limitations:

- Historical performance may not accurately predict future results, as market conditions and dynamics can change.

- Data limitations, such as incomplete or inaccurate historical data, can affect the backtest results.

- Backtesting is susceptible to various biases, including lookahead bias, survivorship bias, and curve fitting, which can lead to over-optimization or overfitting of the strategy.

Best Practices for Backtesting Forex Strategies

To get the most value from backtesting, traders should follow these best practices:

- Use high-quality, accurate, and complete historical data to minimize data-related issues.

- Account for transaction costs and slippage in the backtesting process to obtain more realistic results.

- Choose an appropriate timeframe that aligns with the trading strategy’s intended holding period and frequency of trading signals.

- Be mindful of potential biases and avoid over-optimization or curve fitting by using out-of-sample testing and cross-validation techniques.

- Continuously update and retest the trading strategy as market conditions evolve to ensure its ongoing effectiveness.

- Consider using a combination of manual and automated backtesting to leverage the advantages of both approaches.

- Practice proper risk management throughout the backtesting process to ensure the strategy aligns with the trader’s risk tolerance and objectives.

Conclusion

Backtesting is a crucial step in the development and refinement of forex trading strategies. By simulating trades using historical data, traders can assess the potential profitability of a strategy, optimize its parameters, and increase their confidence in its performance. While backtesting has its limitations, adopting best practices can help traders mitigate these issues and maximize the value of their backtesting efforts. With a solid backtesting process in place, traders are better equipped to navigate the dynamic forex market and make more informed trading decisions.