The foreign exchange market, commonly known as Forex or FX, is a global decentralized market for the trading of currencies. It is considered the largest financial market in the world, with daily trading volumes exceeding $6 trillion. Forex trading involves the simultaneous buying of one currency and selling of another to take advantage of price fluctuations. While the potential for profit in this market is significant, there are numerous risks associated with Forex trading. This article explores the various risks involved in Forex trading and offers suggestions on how to mitigate them.

- Market Risk

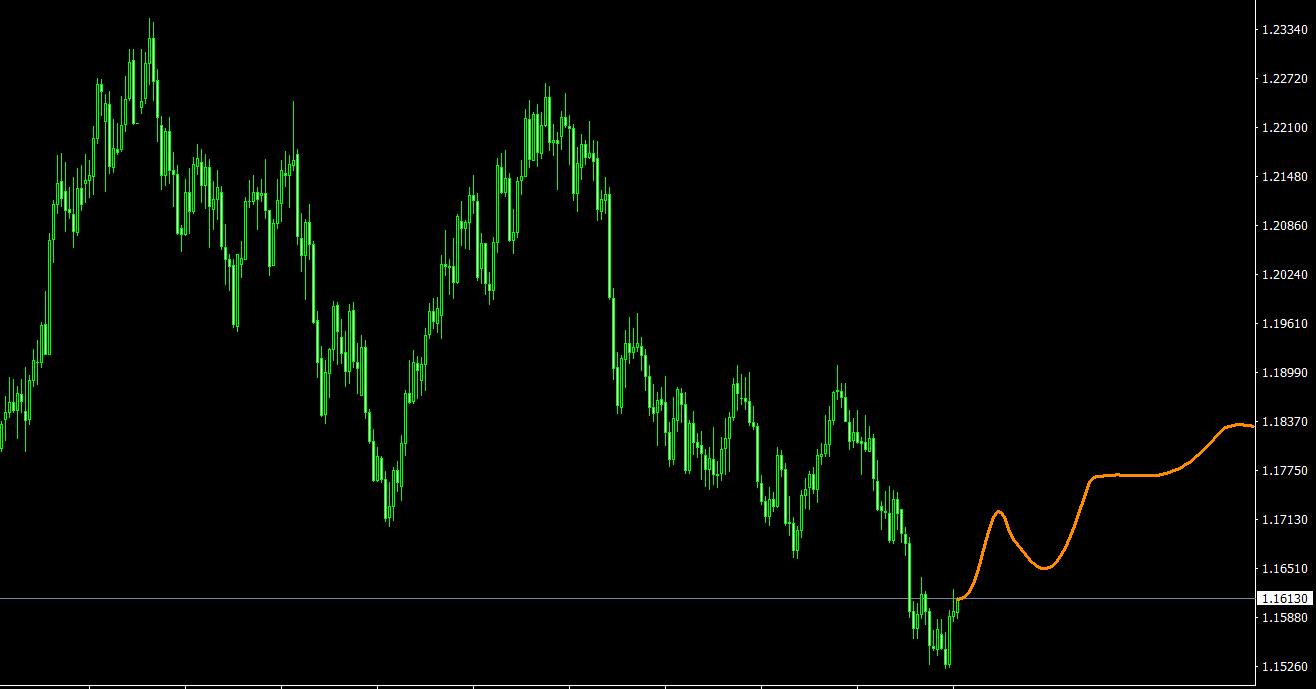

Market risk refers to the possibility that an investor will incur losses due to fluctuations in currency exchange rates. This risk is inherent to any trading activity, but it is particularly significant in the Forex market due to its high volatility. Factors such as geopolitical events, economic releases, and natural disasters can lead to sudden and unpredictable changes in currency values. Traders must be prepared for the possibility of substantial losses if the market moves against their positions.

- Leverage Risk

Leverage is a double-edged sword in Forex trading. It allows traders to control large positions with a relatively small amount of capital, magnifying potential profits as well as losses. High leverage can quickly lead to large losses if a trader’s position moves against them, potentially wiping out their entire account balance. To mitigate leverage risk, traders should use lower leverage ratios, employ stop-loss orders, and carefully manage their positions.

- Interest Rate Risk

Interest rates play a crucial role in determining currency values. Central banks set interest rates to control inflation and maintain economic stability, and changes in these rates can have a significant impact on currency exchange rates. Traders should pay close attention to interest rate differentials between the currencies they are trading, as these differences can create both opportunities and risks.

- Counterparty Risk

Counterparty risk refers to the possibility that the party on the other side of a trade (usually a broker or a financial institution) will not fulfill their obligation, potentially resulting in financial loss for the trader. To minimize this risk, traders should research and select reputable brokers and trading platforms with a solid track record and regulatory oversight.

- Liquidity Risk

Liquidity risk is the risk that a trader will be unable to exit a position at a desirable price due to a lack of market participants willing to buy or sell the currency pair. While the Forex market is generally considered highly liquid, liquidity can vary depending on the currency pair and time of day. To reduce liquidity risk, traders should focus on major currency pairs and avoid trading during periods of low market activity.

- Political Risk

Political events and decisions can have a significant impact on currency values, creating both opportunities and risks for Forex traders. Elections, policy changes, and geopolitical tensions can lead to uncertainty and volatility in the market. Traders should stay informed about global political developments and be prepared to adjust their strategies accordingly.

- Execution Risk

Execution risk is the possibility that a trade will not be executed at the desired price, potentially resulting in financial loss. Slippage, which occurs when a trade is executed at a worse price than expected due to market volatility or low liquidity, is a common example of execution risk. Traders can minimize execution risk by using limit orders instead of market orders, monitoring market conditions, and choosing a reliable broker with fast execution and low latency.

- Operational Risk

Operational risk encompasses the various non-market risks associated with the infrastructure, systems, and processes used in Forex trading. Examples include technological failures, human errors, and disruptions caused by natural disasters or cyberattacks. To mitigate operational risk, traders should develop contingency plans, use reliable trading software, and employ robust risk management strategies.

- Margin Call Risk

A margin call occurs when a trader’s account equity falls below the required margin level set by their broker. In such cases, the broker may close some or all of the trader’s open positions to protect against further losses. Traders can avoid margin calls by carefully monitoring their account equity and margin requirements, using stop-loss orders, and reducing position sizes when necessary.

- Emotional Risk

Forex trading can be emotionally taxing, with traders experiencing stress, fear, and greed, which can lead to poor decision-making and trading mistakes. Developing a disciplined trading plan, setting realistic goals, and employing sound risk management techniques can help traders manage emotional risk and stay focused on their long-term objectives.

Conclusion

While Forex trading offers significant profit potential, it also comes with various risks that traders must be aware of and manage effectively. By understanding and mitigating these risks, traders can improve their chances of success in the highly competitive and volatile world of Forex trading.