Selecting the right forex broker is an essential step for any aspiring trader. The broker you choose will significantly impact your trading experience, costs, and ultimately, your profitability. With countless brokers available in the market, finding the perfect match can be an overwhelming task.

This comprehensive guide aims to provide you with a detailed overview of the critical factors to consider when choosing a forex broker. By the end, you’ll have the knowledge and confidence to make an informed decision that suits your unique trading needs.

1. Regulatory Compliance and Security

The foremost consideration when selecting a forex broker should be the safety of your funds. To ensure a broker operates within the legal framework, look for those regulated by reputable authorities such as:

- The United States: Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA)

- United Kingdom: Financial Conduct Authority (FCA)

- European Union: European Securities and Markets Authority (ESMA) or individual country regulators such as Germany’s BaFin or France’s Autorité des Marchés Financiers (AMF)

- Australia: Australian Securities and Investments Commission (ASIC)

- Canada: Investment Industry Regulatory Organization of Canada (IIROC)

A regulated broker must adhere to stringent guidelines designed to protect the interests of their clients. This includes maintaining segregated client accounts, submitting regular financial reports, and participating in compensation schemes in case of bankruptcy.

2. Trading Platforms and Technology

Forex trading primarily takes place on electronic platforms provided by brokers. The trading platform should be user-friendly, reliable, and equipped with essential features and tools. Some popular trading platforms include MetaTrader 4, MetaTrader 5, and cTrader.

Key aspects to consider when evaluating trading platforms include:

- User Interface: The platform should be intuitive and easy to navigate, even for beginners.

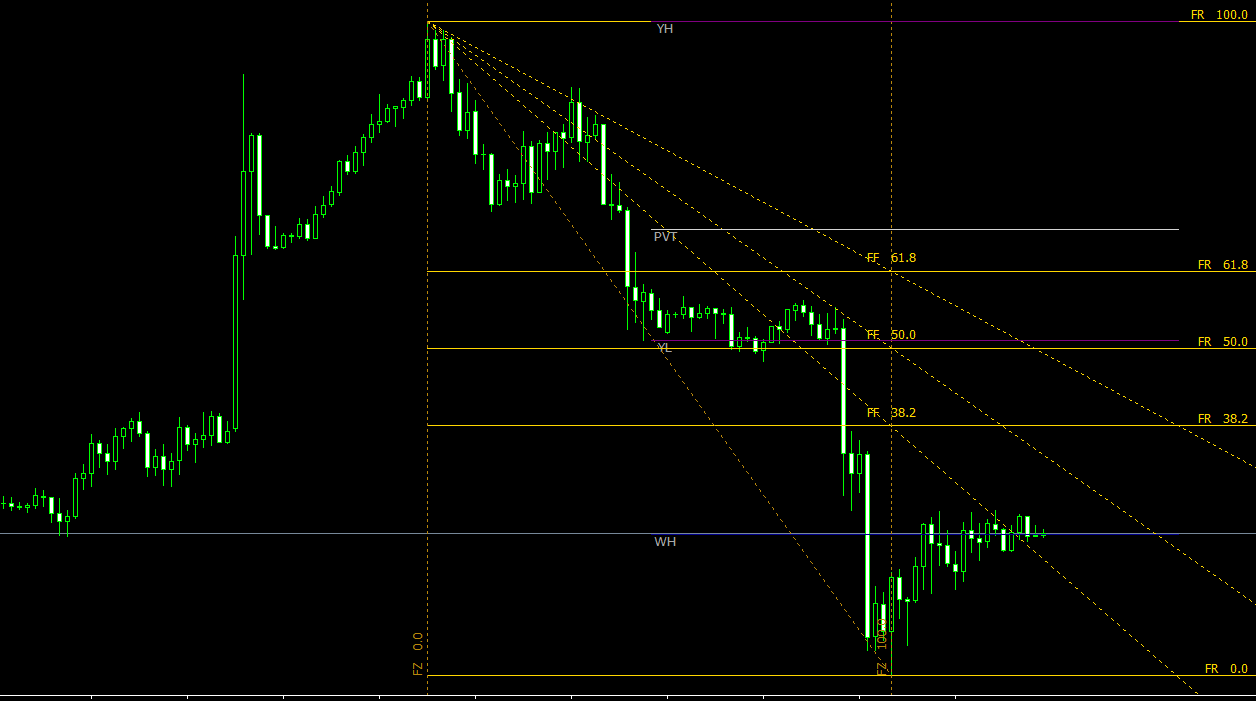

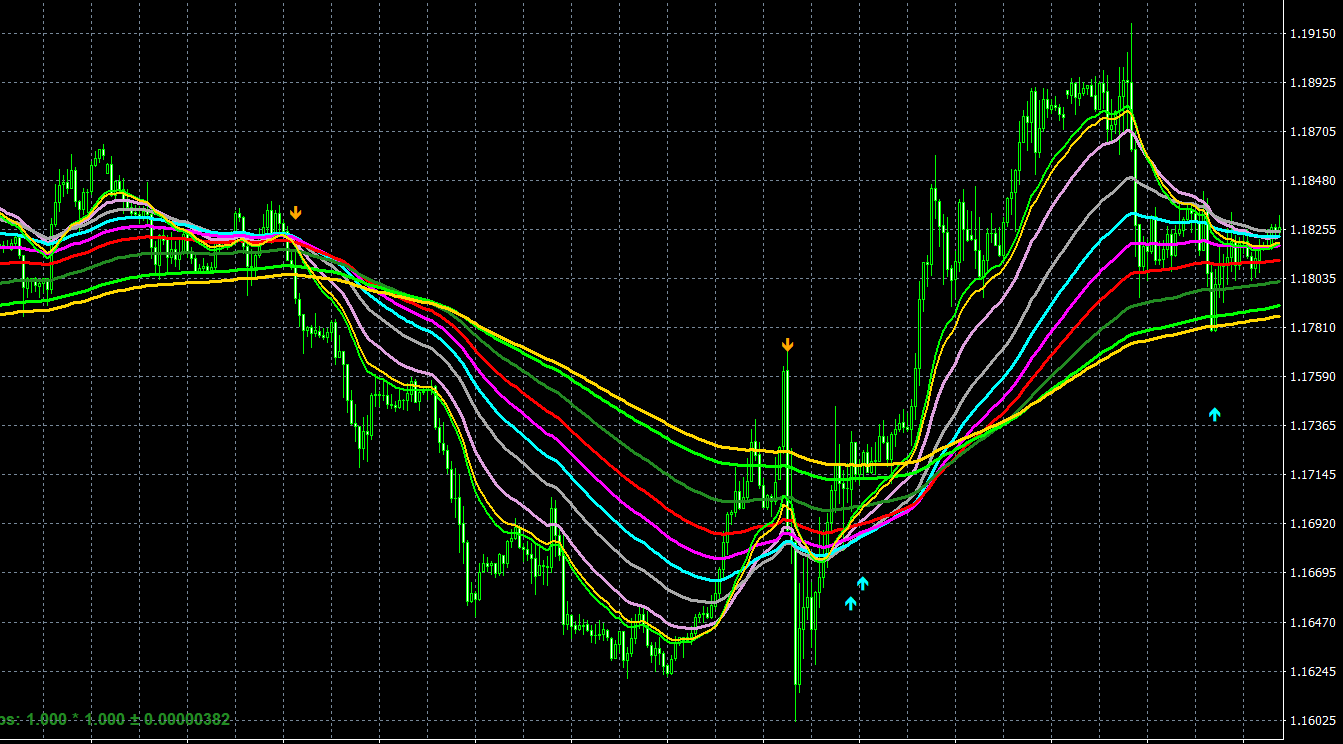

- Technical Indicators and Charting Tools: A variety of technical indicators and charting tools are necessary for conducting comprehensive market analysis.

- Order Types: The platform should support various order types, such as market orders, limit orders, and stop orders, allowing you to manage trades effectively.

- Customization: The ability to customize charts, indicators, and layouts according to your preferences can significantly enhance your trading experience.

- Automated Trading: Advanced traders may require access to Expert Advisors (EAs) or algorithmic trading solutions.

Ensure that the broker’s platform is compatible with your preferred device (desktop, mobile, or tablet) and operating system (Windows, macOS, or Linux).

3. Trading Costs

Trading costs can directly impact your profitability. Therefore, it’s crucial to understand and compare the cost structure of different brokers. Typical trading costs include:

- Spreads: The difference between the bid and ask price, which can be fixed or variable. Generally, lower spreads are preferred.

- Commissions: Some brokers charge a commission per trade, particularly those offering ECN (Electronic Communication Network) or STP (Straight Through Processing) services. Commissions can be based on trade size or charged as a flat fee.

- Rollover or Swap Fees: These are interest charges applied to positions held overnight, based on the interest rate differential between the two currencies in the pair.

- Account Maintenance Fees: Some brokers may charge monthly or annual fees for account maintenance or inactivity.

Evaluate these costs in the context of your trading strategy (scalping, day trading, or long-term investing) and account type (micro, mini, or standard).

4. Account Types and Leverage

Brokers often offer a range of account types, catering to different levels of expertise and trading capital. Common account types include:

- Demo Accounts: For beginners to practice and test trading strategies without risking real money.

- Micro or Mini Accounts: Suitable for traders with limited capital or those looking to start small.

- Standard Accounts: Targeted at experienced traders with larger capital.

- ECN or STP Accounts: Recommended for advanced traders seeking faster execution, lower spreads, and direct access to the interbank market.

Different account types may have varying minimum deposit requirements, spreads, commissions, and leverage options. Leverage allows you to control larger positions with a smaller initial investment, amplifying potential gains but also magnifying losses. Regulated brokers usually have leverage restrictions, depending on the jurisdiction.

Ensure the broker offers an account type that aligns with your trading goals, experience, and capital.

5. Deposit and Withdrawal Methods

A good broker should provide a seamless and hassle-free process for depositing and withdrawing funds. Verify the available funding methods, such as wire transfers, credit/debit cards, or e-wallets like PayPal, Skrill, and Neteller. Consider factors like fees, processing times, and minimum or maximum transaction amounts.

Additionally, look for brokers that maintain a transparent and straightforward withdrawal process, without unnecessary delays or restrictions.

6. Customer Support

Effective and responsive customer support can make a significant difference in your trading experience. Examine the broker’s customer support channels, including live chat, email, phone, and social media. Consider factors like availability, response times, and the quality of support provided.

Ideally, a broker should offer 24/5 customer support to accommodate the global nature of the forex market. Multilingual support is an added advantage, especially for non-English-speaking traders.

7. Educational Resources and Research Tools

A broker’s educational and research offerings can be particularly valuable for beginner traders or those looking to enhance their trading knowledge. Look for brokers that provide a comprehensive suite of educational resources, including webinars, video tutorials, articles, and e-books. These resources should cover a range of topics, from fundamental concepts to advanced trading strategies.

Additionally, research tools such as market news, economic calendars, and trading signals can help traders make informed decisions. Some brokers may also provide access to third-party research or analysis from industry experts.

8. Social Trading and Copy Trading Features

For traders who prefer a more hands-off approach, social trading and copy trading features can be highly beneficial. These features enable traders to follow, interact with, and copy the trades of experienced traders, allowing them to learn from others and potentially profit from their expertise.

Ensure the broker offers a robust social trading platform, with a diverse pool of successful traders to choose from and transparent performance metrics.

Conclusion

Choosing a forex broker is a crucial decision that should not be taken lightly. Carefully consider the factors discussed in this guide, and prioritize aspects that align with your unique trading goals and requirements. Conduct thorough research, read reviews from existing clients, and compare multiple brokers before making your final choice.

Remember that your initial broker selection is not set in stone. If you are unsatisfied with your experience or find a broker that better suits your needs, do not hesitate to make a change. With the right broker, you can set the foundation for a successful and fulfilling forex trading journey.