Forex trading, or foreign exchange trading, is the process of exchanging one currency for another in the global market. With an average daily trading volume of over $6 trillion, forex is the largest and most liquid market in the world. This vast market offers traders numerous opportunities to generate profits. However, success in forex trading requires a solid understanding of various strategies and the discipline to execute them consistently. In this article, we will explore some of the best forex trading strategies that can help traders achieve their financial goals.

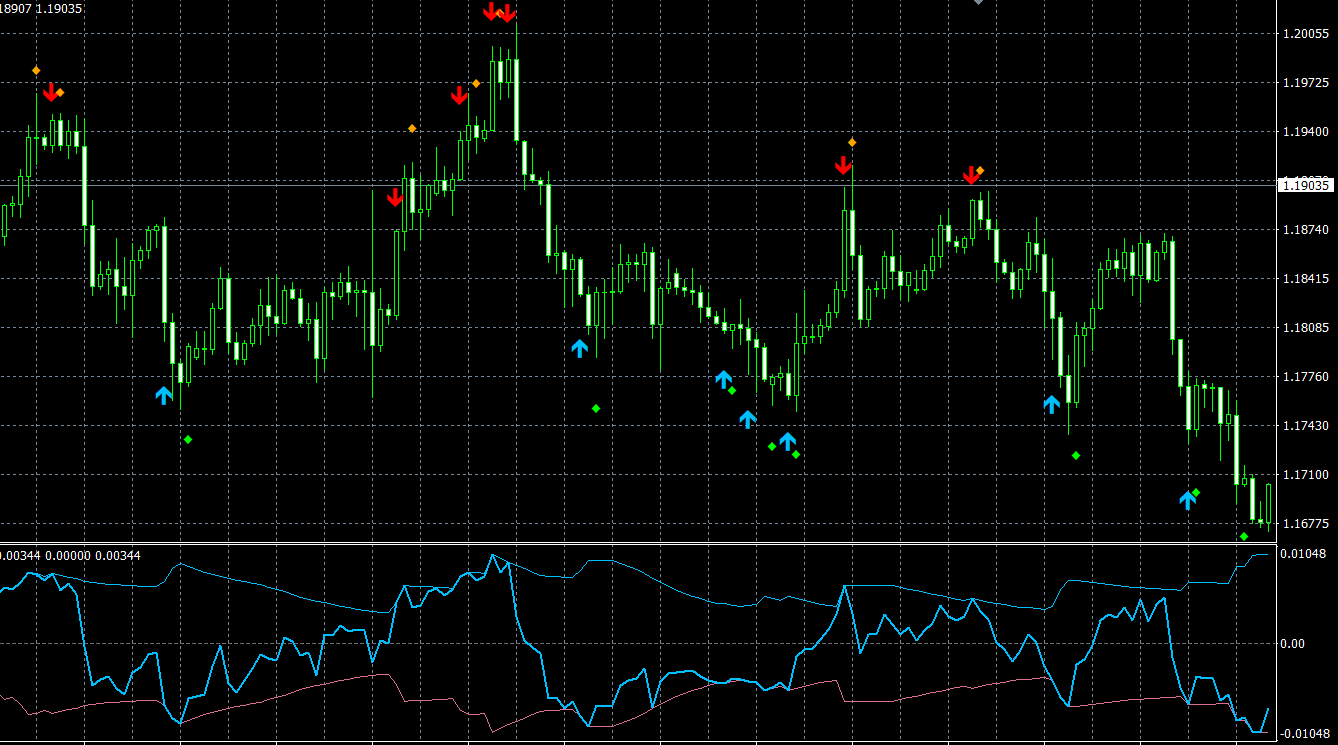

Scalping is a short-term trading strategy that focuses on capturing small price movements with a high frequency of trades. Scalpers typically hold positions for a few seconds to a few minutes and aim to achieve multiple small profits throughout the day. This strategy requires a high level of discipline, quick decision-making, and effective risk management. Popular technical tools used by scalpers include candlestick patterns, Bollinger Bands, and the Relative Strength Index (RSI).

Day trading is another popular Forex trading strategy that involves opening and closing positions within a single trading day. Day traders aim to take advantage of market volatility and typically hold positions for several hours. Day trading requires careful analysis of the market and the ability to make quick decisions based on technical and fundamental analysis.

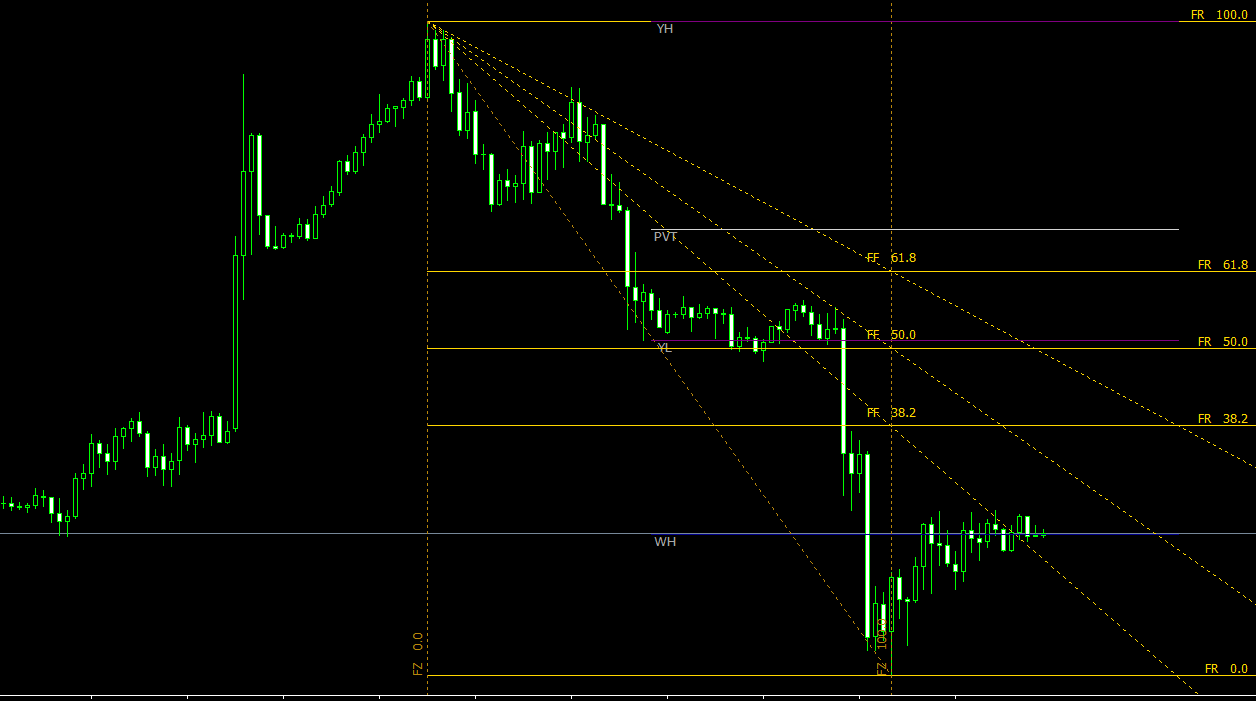

Swing trading is a medium-term strategy that aims to capitalize on price swings that occur over several days or weeks. Swing traders typically identify trends and trade in the direction of the trend, entering positions at retracement points and exiting when the price reaches a predetermined target or reverses direction. Common technical tools used by swing traders include Fibonacci retracements, moving averages, and stochastic oscillators.

Position trading is a long-term strategy that involves holding trades for weeks, months, or even years. Position traders primarily focus on fundamental analysis to identify and invest in currency pairs with strong long-term potential. They may also use technical analysis to time their entries and exits, aiming to maximize profit and minimize risk. Position trading requires patience and a thorough understanding of macroeconomic factors that influence currency values.

Trend following is a popular and straightforward forex trading strategy. It involves identifying and trading in the direction of the prevailing market trend. Traders who follow this strategy rely on technical indicators such as moving averages, trendlines, and support and resistance levels to determine the direction and strength of the trend. Some key advantages of trend following are its simplicity and its potential for capturing significant profits during strong market trends.

Breakout trading is a strategy that capitalizes on price movements that break through established support or resistance levels. This typically occurs when the market consolidates within a range and eventually breaks out, signaling a potential trend or a continuation of the existing trend. Traders using this strategy often employ chart patterns, such as triangles, wedges, and flags, to identify potential breakouts. They also use technical indicators, like the Average True Range (ATR), to measure volatility and set stop-loss and take-profit levels.

- Carry Trade Strategy

The carry trade strategy involves borrowing a currency with a low-interest rate and using the proceeds to purchase a currency with a higher interest rate. Traders profit from the interest rate differential between the two currencies, known as the carry. This strategy works best in stable market conditions and requires a strong understanding of interest rates and central bank policies. However, carry trades can be subject to sudden reversals due to shifts in market sentiment or changes in interest rate expectations.

News trading involves capitalizing on market volatility that results from major economic news releases and events. Traders who employ this strategy closely monitor the economic calendar and develop trade plans based on expected market reactions to specific news events. While news trading can offer significant profit potential, it also carries a high level of risk due to the unpredictable nature of market reactions and the potential for rapid price movements.

Conclusion

These are some of the most common Forex trading strategies used by traders. While each strategy has its advantages and disadvantages, traders should choose a strategy that suits their personality, risk tolerance, and trading style. To be successful in Forex trading, traders need to have a solid understanding of the market, a well-defined trading plan, and the discipline to stick to their plan. By using one or more of these trading strategies and implementing a sound risk management plan, traders can increase their chances of success in the Forex market.