Foreign exchange (forex) trading is the act of buying and selling currencies in the global market, and it is the largest financial market in the world. Among the many trading strategies employed by forex traders, trend following is one that has proven to be successful over the years. This article delves into the world of forex trend following, exploring what it is, its principles, and the main strategies used by trend-following traders. By understanding and utilizing these strategies, traders can increase their chances of success in the forex market.

What is Forex Trend Following?

Forex trend following is a trading strategy that seeks to capitalize on the direction of the prevailing market trend. The underlying premise is that financial markets, including the forex market, have a tendency to move in discernable, persistent trends. Trend-following traders attempt to ride these trends, buying when the market is going up and selling when the market is going down.

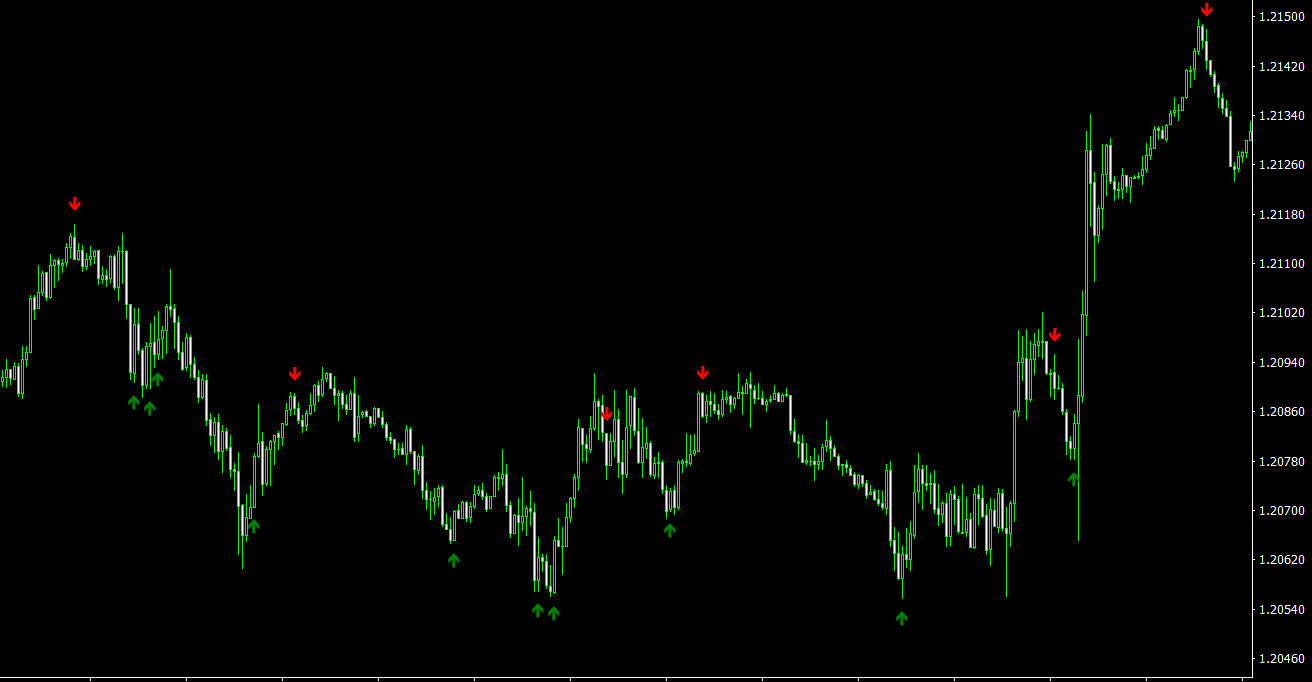

The concept of trend following is grounded in the belief that it is impossible to accurately predict where the market will go next, and that it is more beneficial to react to what the market is doing rather than trying to anticipate its next move. This approach eliminates the need to forecast or predict market movements, allowing traders to focus on analyzing price action and identifying potential entry and exit points based on the existing trend.

Forex Trend Following Principles

There are several key principles underlying the trend following approach in forex trading:

- Markets are driven by trends: Market prices tend to move in sustained directions, which trend-following traders attempt to capitalize on. They look for trends at different time frames, from intraday to long-term.

- Trade with the trend: Trend followers believe that it is more profitable to trade in the direction of the prevailing trend, rather than against it. This increases the probability of successful trades.

- Focus on price action: Rather than relying on fundamental analysis or news events, trend-following traders focus on analyzing price action to determine the existence and direction of a trend.

- Use stop losses: Utilizing stop-loss orders is a key aspect of risk management in trend following. These orders are set to minimize losses if the market moves against the trader’s position.

- Let profits run: Trend followers aim to capture large price movements by allowing profitable trades to run as long as the trend remains intact.

- Cut losses short: As soon as a trade begins to go against the trader’s position, a trend follower will quickly exit the trade to minimize losses.

Main Trend Following Strategies

There are numerous trend-following strategies employed by forex traders. The following are some of the most popular and effective methods:

- Moving Average Crossover

One of the simplest trend-following strategies is the moving average crossover. In this method, traders use two moving averages, one short-term and one long-term, to generate buy and sell signals. When the short-term moving average crosses above the long-term moving average, it indicates that the trend is shifting upwards, and a buy signal is generated. Conversely, when the short-term moving average crosses below the long-term moving average, the trend is shifting downwards, generating a sell signal.

- Channel Breakouts

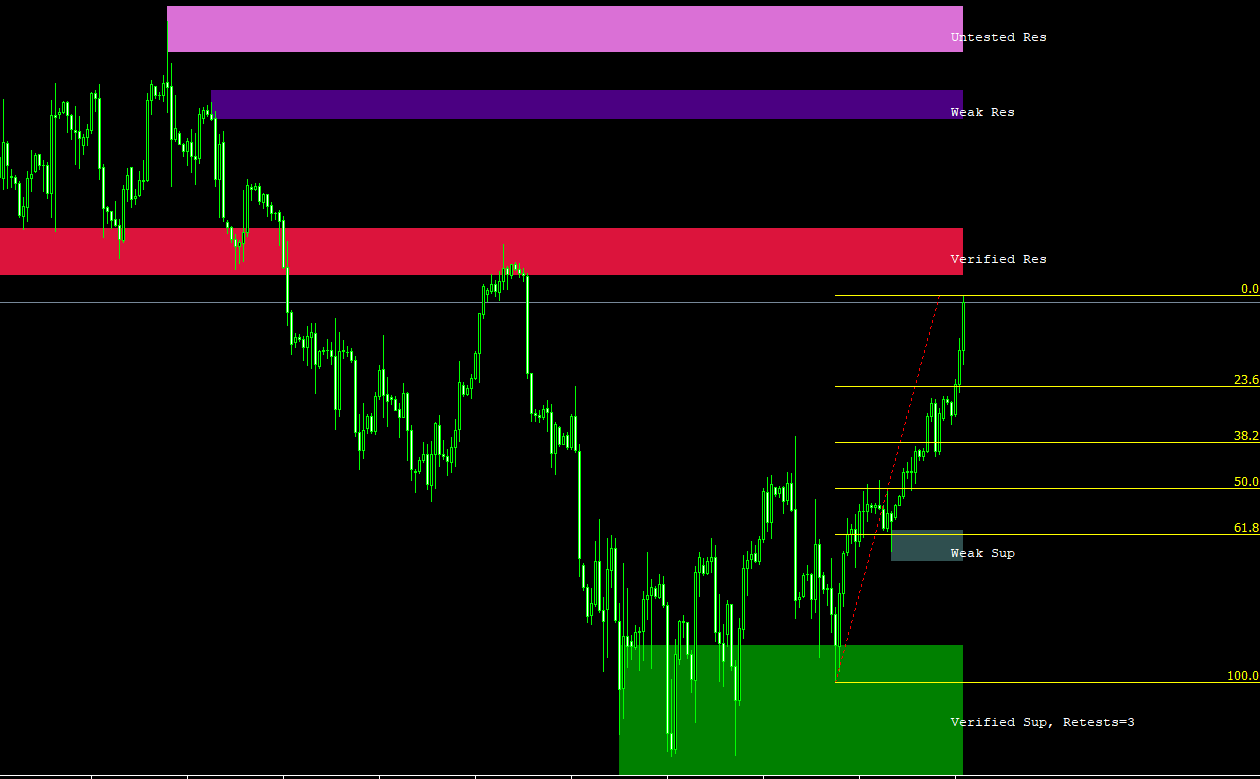

Channel breakouts involve identifying price channels in which the market has been trading for a certain period. Traders plot support and resistance levels on their charts and wait for a breakout, either above the resistance level or below the support level, to signal the beginning of a new trend. Once the price breaks through the channel, traders enter the trade in the direction of the breakout, with a stop loss set on the opposite side of the channel.

- Trend Line Breaks

This strategy involves drawing trend lines on a chart, connecting the peaks and troughs of price movements. A trend line break occurs when the price moves through the trend line, indicating a potential trend reversal or a continuation of an existing trend. Traders enter a trade in the direction of the break and set a stop loss on the opposite side of the trend line. This strategy can be used in conjunction with other trend-following techniques to confirm the validity of the break.

- Parabolic SAR

The Parabolic Stop and Reverse (SAR) is a technical indicator developed by J. Welles Wilder Jr. It is designed to identify potential trend reversals and provide entry and exit points in the market. The Parabolic SAR is represented as a series of dots plotted either above or below the price bars on a chart. When the dots are below the price bars, it signals a bullish trend, and traders should consider entering a long position. Conversely, when the dots are above the price bars, it signals a bearish trend, and traders should consider entering a short position. Traders can also use the Parabolic SAR to set trailing stop losses, helping them lock in profits as the trend progresses.

- Average Directional Index (ADX)

The Average Directional Index (ADX) is a technical indicator developed by J. Welles Wilder Jr. to help traders determine the strength of a trend. The ADX fluctuates between 0 and 100, with higher values indicating a stronger trend. Generally, a reading above 25 is considered a strong trend, while a reading below 20 suggests a weak or non-existent trend. Traders can use the ADX in conjunction with other trend-following indicators to confirm the strength of a trend before entering a trade.

- MACD Divergence

The Moving Average Convergence Divergence (MACD) is another popular trend-following indicator used by forex traders. The MACD is a momentum oscillator that measures the relationship between two moving averages, usually the 12-day and 26-day exponential moving averages (EMAs). MACD divergence occurs when the price movement of a currency pair and the MACD indicator diverge in direction. This can signal a potential trend reversal. When the MACD is rising and the price is falling, it is known as bullish divergence, indicating a potential uptrend. Conversely, when the MACD is falling and the price is rising, it is known as bearish divergence, signaling a potential downtrend.

Conclusion

Forex trend following is a popular and proven trading strategy that has helped countless traders succeed in the world’s largest financial market. By understanding and utilizing the principles and strategies of trend following, traders can increase their chances of making profitable trades and minimize losses. Whether employing moving average crossovers, channel breakouts, trend line breaks, or any of the other main trend-following strategies, the key to success lies in diligent risk management and the willingness to let profits run while cutting losses short. As with any trading strategy, practice and experience are essential for mastering the art of forex trend following.