In the world of forex trading, technical analysis plays a critical role in helping traders make informed decisions and develop effective trading strategies. Among the various technical analysis tools, moving average indicators are particularly popular due to their simplicity and versatility. This article will explore the concept of moving averages, their different types, and how to use them effectively in forex trading.

What are Moving Average Indicators?

A moving average (MA) is a widely-used technical analysis tool that calculates the average price of a currency pair over a specified period. By smoothing out price fluctuations and filtering out market noise, moving averages provide a clearer view of the overall trend, making it easier for traders to identify potential trading opportunities.

There are several types of moving averages, each with its unique characteristics and advantages. The three main types of moving averages are Simple Moving Averages (SMA), Exponential Moving Averages (EMA), and Weighted Moving Averages (WMA).

- Simple Moving Average (SMA)

The Simple Moving Average (SMA) is the most basic form of moving average. It calculates the average price of a currency pair over a specified period by giving equal weight to all price data points in the period. The SMA is calculated by summing the closing prices of a currency pair for a certain number of periods and dividing the result by the number of periods. The formula for the SMA is as follows:

SMA = (P1 + P2 + … + Pn) / n

Where P1, P2, …, Pn are the closing prices for each period, and n is the number of periods.

- Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is a more sophisticated moving average that assigns more weight to recent price data, making it more responsive to current market conditions. The EMA calculation involves using a smoothing factor to exponentially weight the price data points. The formula for the EMA is:

EMA = (Close – Previous EMA) * (2 / (n + 1)) + Previous EMA

Where Close is the closing price of the current period, Previous EMA is the EMA of the previous period, and n is the number of periods.

- Weighted Moving Average (WMA)

The Weighted Moving Average (WMA) also assigns more weight to recent price data but uses a different weighting method than the EMA. In the WMA calculation, the weight of each price data point is directly proportional to its age, with more recent data receiving higher weights. The formula for the WMA is:

WMA = (P1 * 1 + P2 * 2 + … + Pn * n) / (1 + 2 + … + n)

Where P1, P2, …, Pn are the closing prices for each period, and n is the number of periods.

Using Moving Average Indicators in Forex Trading

Moving average indicators can be invaluable tools for forex traders seeking to identify market trends and potential trading opportunities. To effectively use moving averages in forex trading, consider the following tips:

- Choose the appropriate moving average type: Depending on your trading strategy and the market conditions, select the moving average type that best suits your needs. While the SMA is more straightforward and easier to calculate, the EMA and WMA are more responsive to recent price changes and may be more suitable for short-term trading.

- Select the right period: The period you choose for your moving average will impact its responsiveness to price changes. A shorter period will make the moving average more sensitive to price fluctuations, while a longer period will make it smoother and less reactive. Consider your trading time horizon and style when selecting the appropriate period for your moving average.

- Combine moving averages with other technical analysis tools: To enhance the effectiveness of your analysis and reduce the likelihood of false signals, use moving averages in conjunction with other technical analysis tools, such as support and resistance levels, chart patterns, and oscillators. Combining multiple indicators can provide additional confirmation for your trading decisions.

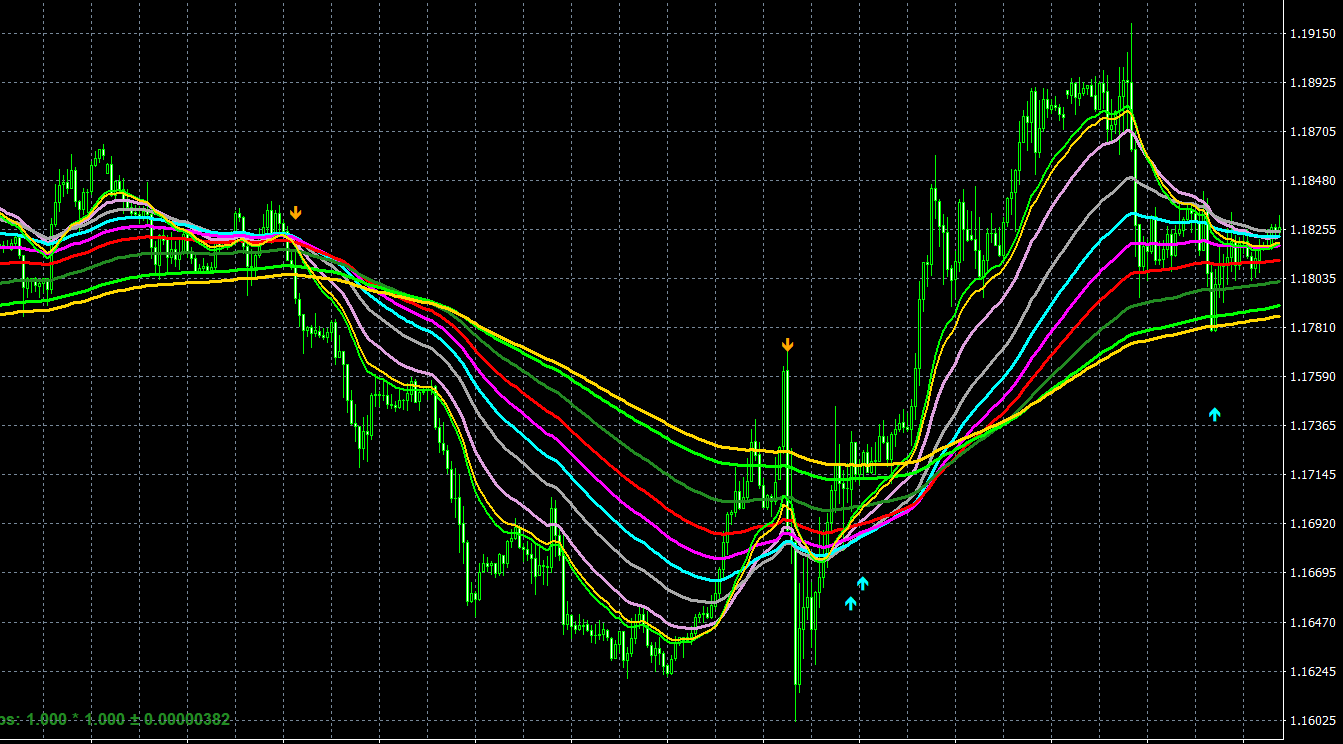

- Utilize multiple moving averages: Applying multiple moving averages with different periods can help identify potential trading opportunities and trend reversals. For example, when a shorter period moving average (e.g., 10-day MA) crosses above a longer period moving average (e.g., 50-day MA), it may signal the beginning of an uptrend, generating a buy signal. Conversely, when the shorter period moving average crosses below the longer period moving average, it may indicate the start of a downtrend, generating a sell signal.

- Monitor for crossovers: Crossovers are points where the price intersects with the moving average, and they can provide potential trading signals. A price crossover above the moving average may indicate bullish momentum, while a price crossover below the moving average may suggest bearish momentum.

- Implement sound risk management strategies: Despite the usefulness of moving average indicators, forex trading always involves a degree of uncertainty. It’s essential to practice sound risk management strategies, such as setting stop-loss orders, managing your position sizes, and maintaining a diversified portfolio, to protect your capital and ensure long-term trading success.

- Test and optimize your trading strategy: Before incorporating moving averages into your live trading, test your trading strategy using historical data or a demo account. This process allows you to assess the effectiveness of moving averages and other technical analysis tools in your strategy, and make any necessary adjustments to optimize performance.

Conclusion

Moving average indicators are versatile and powerful tools that can help forex traders identify market trends and potential trading opportunities. By understanding the different types of moving averages, their calculations, and how to effectively use them in conjunction with other technical analysis tools, traders can maximize their potential for success in the forex market.