Arrow indicators are a popular group of technical analysis tools used by forex traders to identify potential trading signals in a visually intuitive manner. These indicators employ arrows or similar graphical elements to pinpoint potential entry and exit points, helping traders make more informed decisions. This article will explore the concept of arrow indicators, various types of arrow indicators, and how to effectively use them in forex trading.

What are Arrow Indicators?

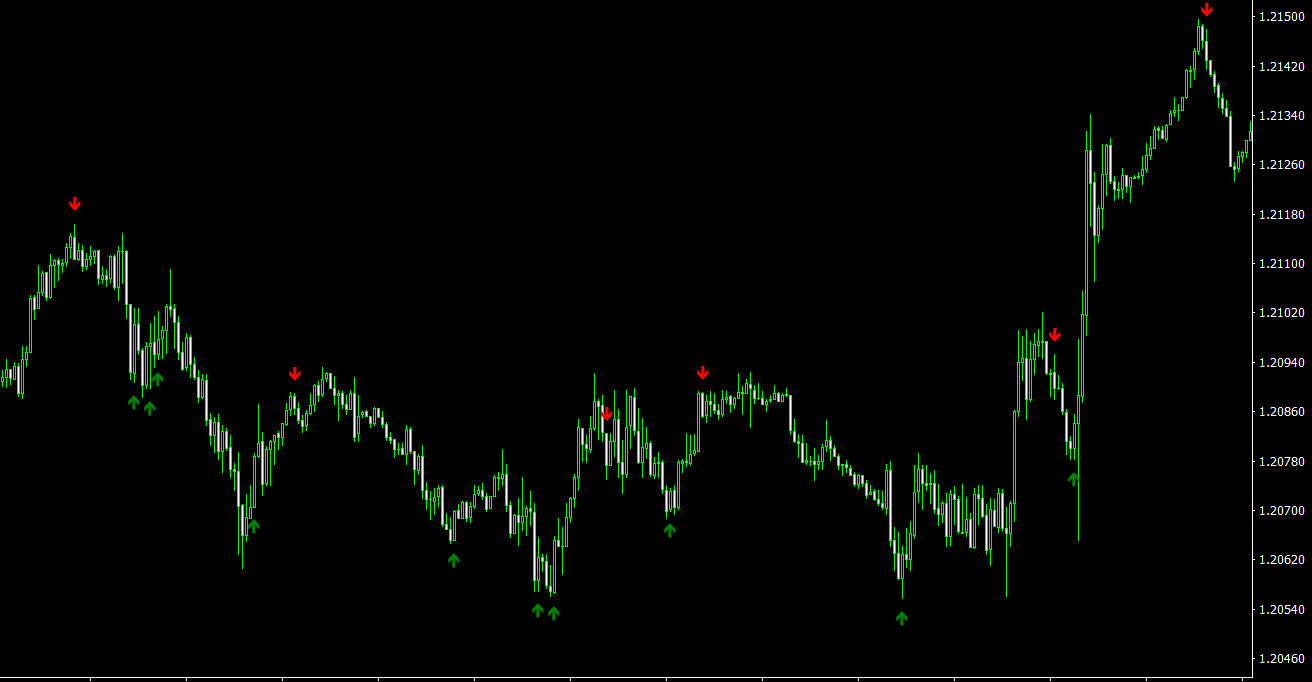

Arrow indicators are a family of technical analysis tools designed to provide clear, visual signals to traders by using arrows or other graphical markers on the price chart. These indicators typically analyze the underlying asset’s price data, incorporating various technical analysis methods to generate signals indicating potential buying or selling opportunities. The main objective of arrow indicators is to simplify the trading decision-making process by presenting clear and easy-to-interpret signals.

Types of Arrow Indicators

There are several types of arrow indicators, each employing different techniques and calculations to generate trading signals. Some of the most popular arrow indicators include:

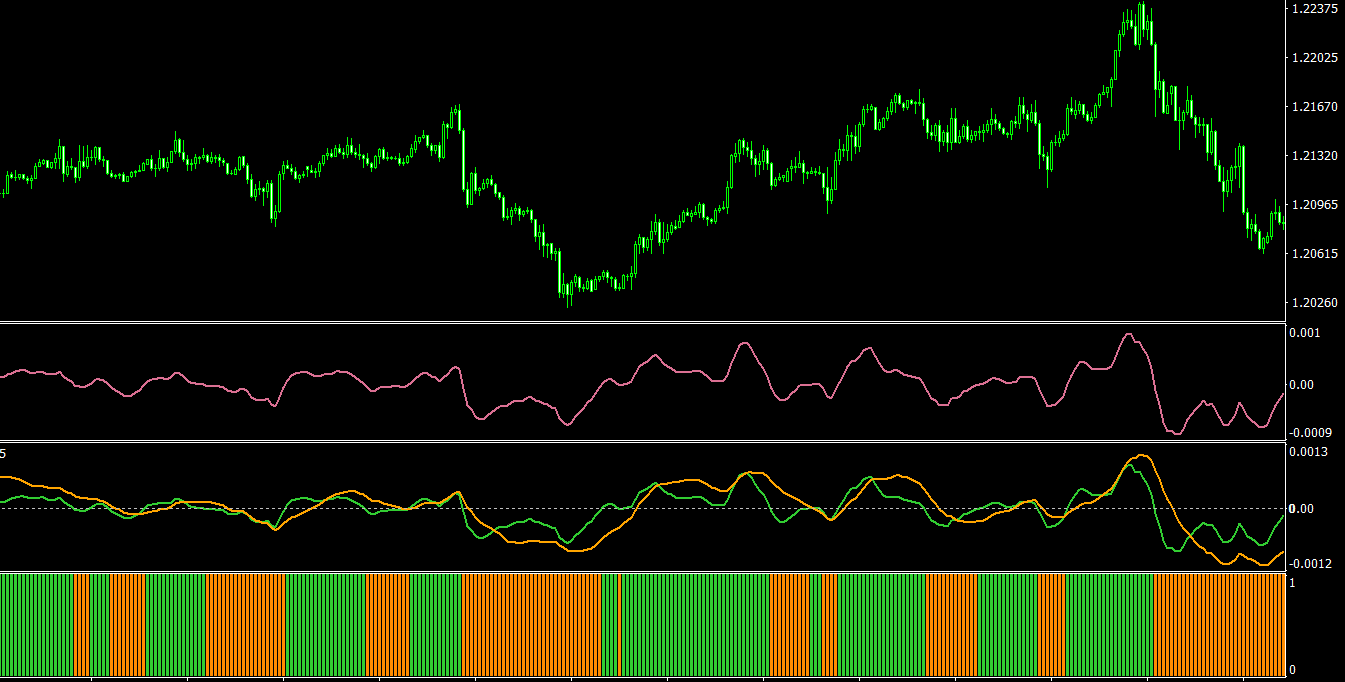

- Moving Average Crossover Arrows: This type of arrow indicator uses moving averages to generate signals. When a shorter moving average (e.g., 5-period) crosses above a longer moving average (e.g., 20-period), a bullish arrow appears on the chart, suggesting a potential long position. Conversely, when the shorter moving average crosses below the longer moving average, a bearish arrow is displayed, indicating a potential short position.

- RSI Divergence Arrows: RSI Divergence Arrows employ the Relative Strength Index (RSI) to identify potential divergences between price action and the RSI. When the price forms a higher high, but the RSI forms a lower high, a bearish arrow appears, suggesting a potential reversal to the downside. Conversely, if the price forms a lower low while the RSI forms a higher low, a bullish arrow is displayed, indicating a potential reversal to the upside.

- MACD Crossover Arrows: This arrow indicator uses the Moving Average Convergence Divergence (MACD) to generate trading signals. When the MACD line crosses above the signal line, a bullish arrow is displayed, suggesting a potential long position. When the MACD line crosses below the signal line, a bearish arrow appears, indicating a potential short position.

- Stochastic Oscillator Crossover Arrows: The Stochastic Oscillator Crossover Arrows indicator identifies potential buying and selling opportunities based on the Stochastic Oscillator’s crossovers. When the %K line crosses above the %D line in oversold territory, a bullish arrow appears, suggesting a potential long position. Conversely, when the %K line crosses below the %D line in overbought territory, a bearish arrow is displayed, indicating a potential short position.

Using Arrow Indicators in Forex Trading

To effectively use arrow indicators in forex trading, consider the following tips:

- Select the appropriate arrow indicator: Different arrow indicators provide unique insights into market conditions and price action. Choose the arrow indicator that best aligns with your trading strategy, objectives, and preferences.

- Combine arrow indicators with other technical analysis tools: Arrow indicators can provide valuable information about potential trading opportunities, but they should not be used in isolation. Combine arrow indicators with other technical analysis tools, such as support and resistance levels, trend lines, and additional indicators, to make more informed trading decisions.

- Filter false signals: Arrow indicators can sometimes generate false signals, leading to losses. To minimize the risk of false signals, use additional confirmation tools, such as price action analysis, to validate the signals generated by the arrow indicator.

- Adjust indicator settings to suit your trading style: Most arrow indicators come with customizable settings that allow you to adjust their calculations to better align with your trading preferences and objectives. Experiment with different settings and timeframes to find the ones that work best for you.

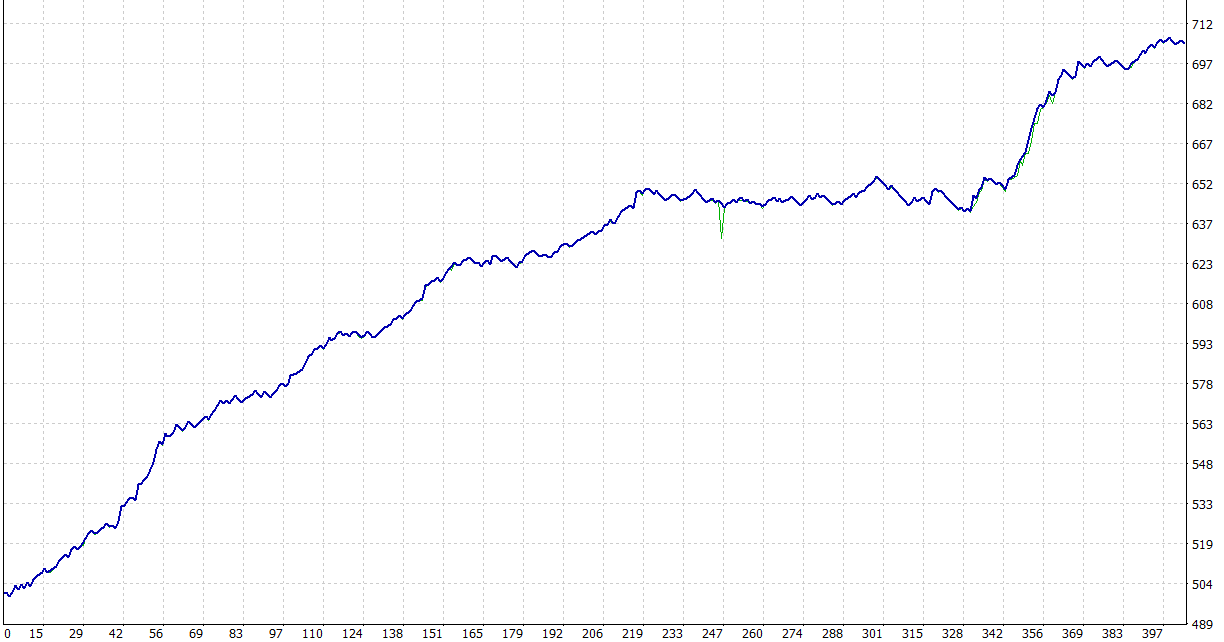

- Backtest and refine your trading strategy: Before incorporating arrow indicators into your live forex trading, test your trading strategy using historical data or a demo account. This process allows you to assess the effectiveness of the arrow indicators and make any necessary adjustments to optimize your strategy’s performance.

- Manage your risk: Forex trading carries inherent risks, and employing sound risk management strategies is essential for long-term success. Use stop-loss orders, maintain appropriate position sizes, and diversify your investment portfolio to protect your capital and minimize potential losses.

Forex Trading Strategies Using Arrow Indicators

Several forex trading strategies incorporate arrow indicators to generate signals and identify trading opportunities. Some popular strategies include:

- Moving Average Crossover Arrows Strategy: This strategy involves entering the market when the moving average crossover arrow indicator generates a signal. A long position is opened when a bullish arrow appears, with a stop-loss order placed below the recent low. Conversely, a short position is opened when a bearish arrow appears, with a stop-loss order placed above the recent high.

- RSI Divergence Arrows Strategy: This strategy focuses on identifying potential reversals using the RSI Divergence Arrows indicator. When a bullish arrow appears, a long position is opened, with a stop-loss order placed below the recent low. When a bearish arrow is displayed, a short position is opened, with a stop-loss order placed above the recent high.

- MACD Crossover Arrows Strategy: This strategy involves entering the market when the MACD Crossover Arrows indicator generates a signal. A long position is opened when a bullish arrow appears, with a stop-loss order placed below the recent low. Conversely, a short position is opened when a bearish arrow appears, with a stop-loss order placed above the recent high.

- Stochastic Oscillator Crossover Arrows Strategy: This strategy focuses on opening positions based on the Stochastic Oscillator Crossover Arrows indicator’s signals. A long position is opened when a bullish arrow appears, with a stop-loss order placed below the recent low. Conversely, a short position is opened when a bearish arrow is displayed, with a stop-loss order placed above the recent high.

Conclusion

Arrow indicators offer forex traders an effective and visually appealing way to identify potential trading opportunities. By understanding the different types of arrow indicators and how to effectively use them, you can enhance your forex trading performance and make more informed decisions.

Incorporating arrow indicators into your trading strategy can provide valuable insights into price action and market dynamics. By combining arrow indicators with other technical analysis tools, adjusting their settings to suit your trading preferences, and implementing sound risk management strategies, you can increase your chances of success in the highly competitive forex market.