Price action is a critical aspect of forex trading, as it reveals the underlying market dynamics and provides valuable insights into potential trading opportunities. Price action indicators are technical analysis tools designed to help traders interpret and capitalize on these price movements. This article will discuss what price action indicators are, their importance in forex trading, and how traders can effectively use them to enhance their trading strategies.

What are Price Action Indicators?

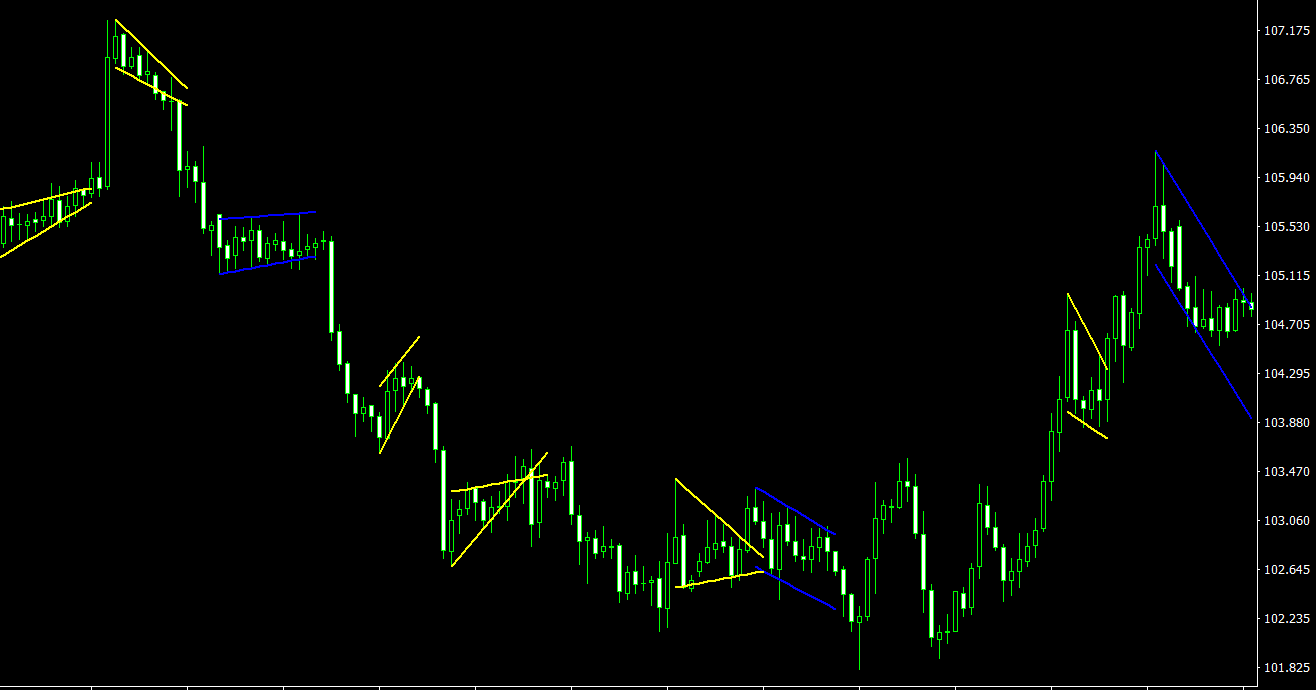

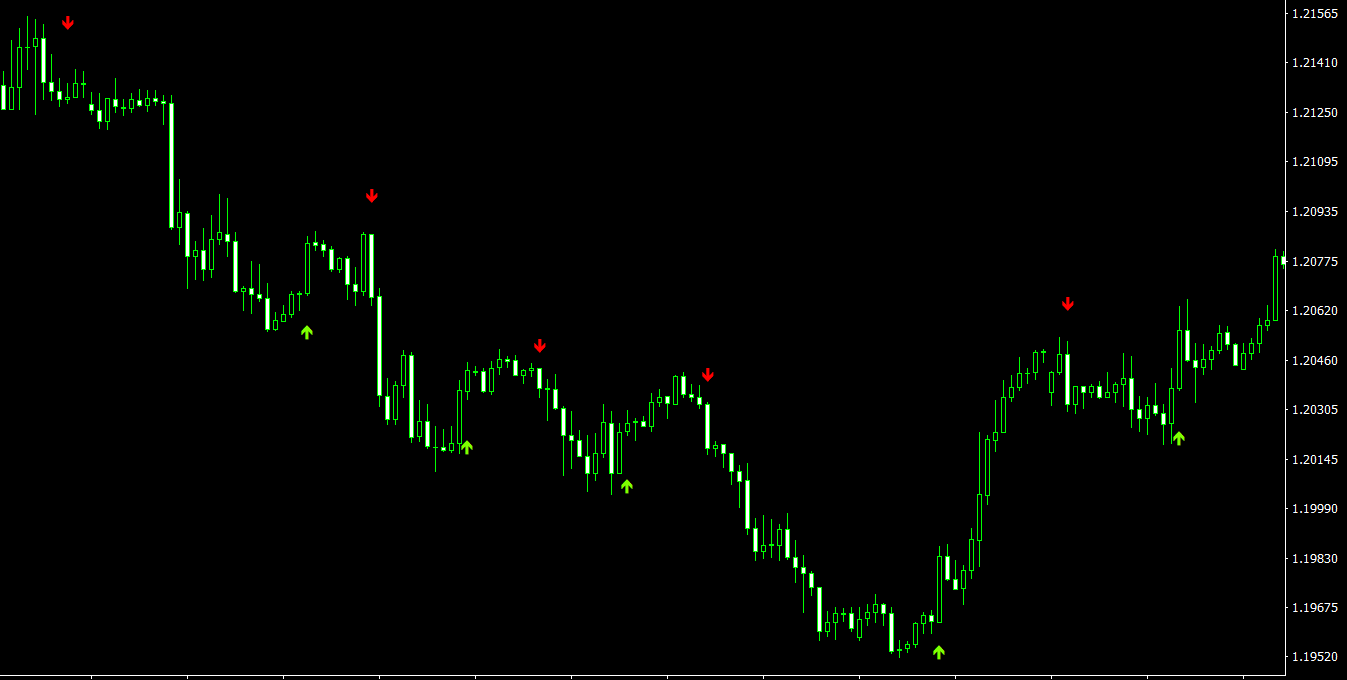

Price action indicators are technical analysis tools that help traders analyze and interpret market price movements, such as trends, reversals, and consolidations. Unlike traditional technical indicators, which rely on mathematical calculations and formulas, price action indicators focus on the raw price data itself. Some popular price action indicators include candlestick patterns, chart patterns, and support and resistance levels.

The Importance of Price Action Indicators in Forex Trading

Price action indicators play a crucial role in forex trading, offering valuable insights into market dynamics and potential trading opportunities. Some of the benefits of using price action indicators include:

- Identifying Market Trends: Price action indicators can help traders identify prevailing market trends, enabling them to make more informed trading decisions and capitalize on potential opportunities.

- Revealing Potential Reversals: Price action indicators can signal potential trend reversals, providing early warnings of market shifts and allowing traders to adjust their strategies accordingly.

- Enhancing Trading Strategies: Incorporating price action indicators into a trading strategy can improve its effectiveness, allowing traders to better identify potential trading opportunities and manage risk.

- Facilitating Quick Decision-Making: Price action indicators provide real-time information about market dynamics, enabling traders to make rapid decisions and capitalize on fleeting opportunities.

How to Use Price Action Indicators in Forex Trading

Effectively utilizing price action indicators in forex trading can help traders identify potential entry and exit points, as well as assess market conditions and manage risk. Here are some tips for using price action indicators in your trading strategy:

- Study Different Price Action Indicators: Familiarize yourself with various price action indicators, such as candlestick patterns, chart patterns, and support and resistance levels. Each indicator offers unique insights into market dynamics and can be used in different trading scenarios.

- Combine Price Action Indicators with Other Technical Tools: To create a well-rounded trading strategy, combine price action indicators with other technical analysis tools, such as trend lines, moving averages, and oscillators.

- Analyze Multiple Timeframes: Examine price action indicators across multiple timeframes to gain a more comprehensive understanding of market dynamics and identify potential trading opportunities.

- Practice Patience and Discipline: Wait for high-probability trade setups based on your price action analysis, rather than trying to anticipate price movements or chase every potential opportunity.

- Employ Risk Management Techniques: Utilize risk management strategies, such as setting stop loss orders and using appropriate position sizing, to protect your capital and minimize potential losses.

Using Price Action Indicators in Forex Trading

When using price action indicators in forex trading, it’s essential to incorporate them into a comprehensive trading strategy that includes risk management techniques and other technical analysis tools. Here are some steps to effectively utilize price action indicators in your trading approach:

- Choose the Right Price Action Indicators: Select price action indicators that best suit your trading style, objectives, and risk tolerance. Consider using a combination of indicators to gain a more comprehensive understanding of market conditions.

- Develop a Trading Plan: Create a trading plan that outlines your objectives, risk tolerance, and preferred price action indicators. This plan should also include specific entry and exit criteria, as well as risk management techniques.

- Monitor the Market: Regularly analyze the forex market, paying close attention to price action indicators and other technical tools to identify potential trading opportunities.

- Execute Your Trades: Once you have identified a high-probability trade setup based on your price action analysis, execute your trade according to your trading plan. Be sure to set stop loss orders and take profit levels as dictated by your risk management strategy.

- Evaluate and Adjust Your Strategy: Regularly review your trading performance and make any necessary adjustments to your price action-based trading strategy based on your results and changing market conditions. Continuously refine your approach to ensure it remains effective and aligned with your objectives.

Conclusion

Price action indicators are invaluable tools for forex traders looking to better understand and capitalize on market dynamics. By understanding and effectively utilizing price action indicators, traders can make more informed decisions, optimize their trading strategies, and better manage risk. Combining price action indicators with other technical analysis tools can further enhance a trader’s ability to navigate the complexities of the forex market, ultimately contributing to improved trading performance and profitability. As with any trading tool, practice and ongoing education are key to mastering the use of price action indicators and reaping the benefits they offer in forex trading. With the right combination of price action indicators and a disciplined approach, traders can successfully navigate the ever-changing world of forex trading.