A well-structured trading plan is crucial for success in the highly competitive and dynamic world of forex trading. It serves as a roadmap, providing a clear set of rules and guidelines that help you navigate the market and make informed decisions. This comprehensive guide will walk you through the steps to create a robust trading plan for forex trading, ensuring consistency and discipline in your approach.

Establish Your Trading Goals

The first step in creating a trading plan is to define your goals. These should be specific, measurable, achievable, relevant, and time-bound (SMART). Your trading goals should reflect your financial objectives, risk tolerance, and time horizon. Some examples of trading goals include:

- Achieving a specific annual return on investment (ROI)

- Building a diversified trading portfolio

- Developing and mastering specific trading strategies

Choose Your Trading Style

Your trading style should align with your goals, personality, and available time. There are four primary trading styles in forex:

1. Scalping: Involves frequent, short-term trades with small profit targets. Scalpers may hold positions for seconds to minutes, making multiple trades per day.

2. Day Trading: Day traders open and close positions within the same trading day, avoiding overnight risks. They typically hold positions for minutes to hours.

3. Swing Trading: Swing traders hold positions for several days to weeks, aiming to capitalize on short- to medium-term market trends.

4. Position Trading: Position traders take a long-term approach, holding positions for weeks to months or even years, seeking to profit from major market trends.

Develop Your Trading Strategy

Your trading strategy should be based on a clear set of rules and criteria for entering, managing, and exiting trades. A well-defined strategy reduces emotional decision-making and promotes consistency. Some key components of a trading strategy include:

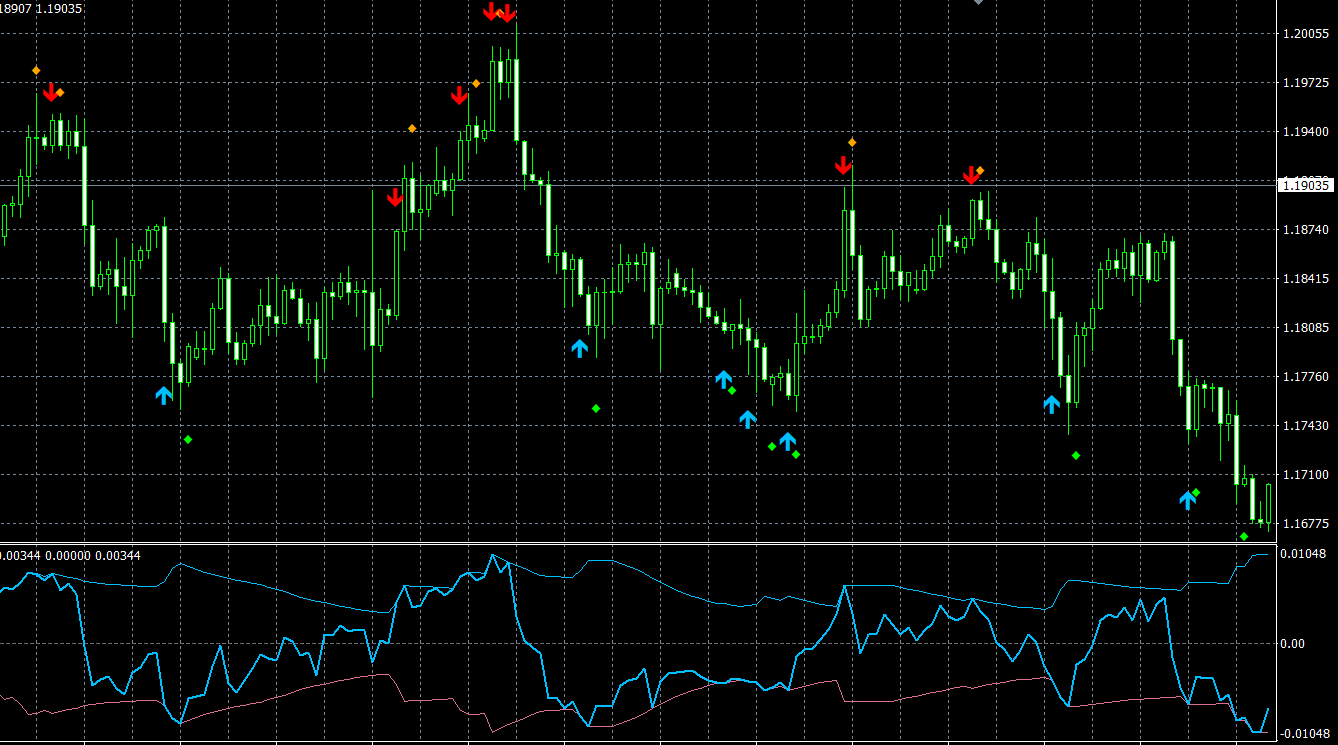

1. Trade Setups: Identify specific market conditions or patterns that signal a potential trading opportunity.

2. Entry Rules: Define clear rules for entering a trade, such as a specific technical indicator signal or a break of support or resistance levels.

3. Risk Management: Determine the maximum amount of risk per trade, expressed as a percentage of your trading capital. Establish rules for setting stop-loss and take-profit orders.

4. Trade Management: Outline how to manage open positions, such as adjusting stop-loss orders or scaling in/out of positions.

5. Exit Rules: Establish criteria for closing a trade, either to secure profits or cut losses.

Select Your Trading Tools and Platforms

Choose the tools and platforms that best suit your trading style and strategy. This includes:

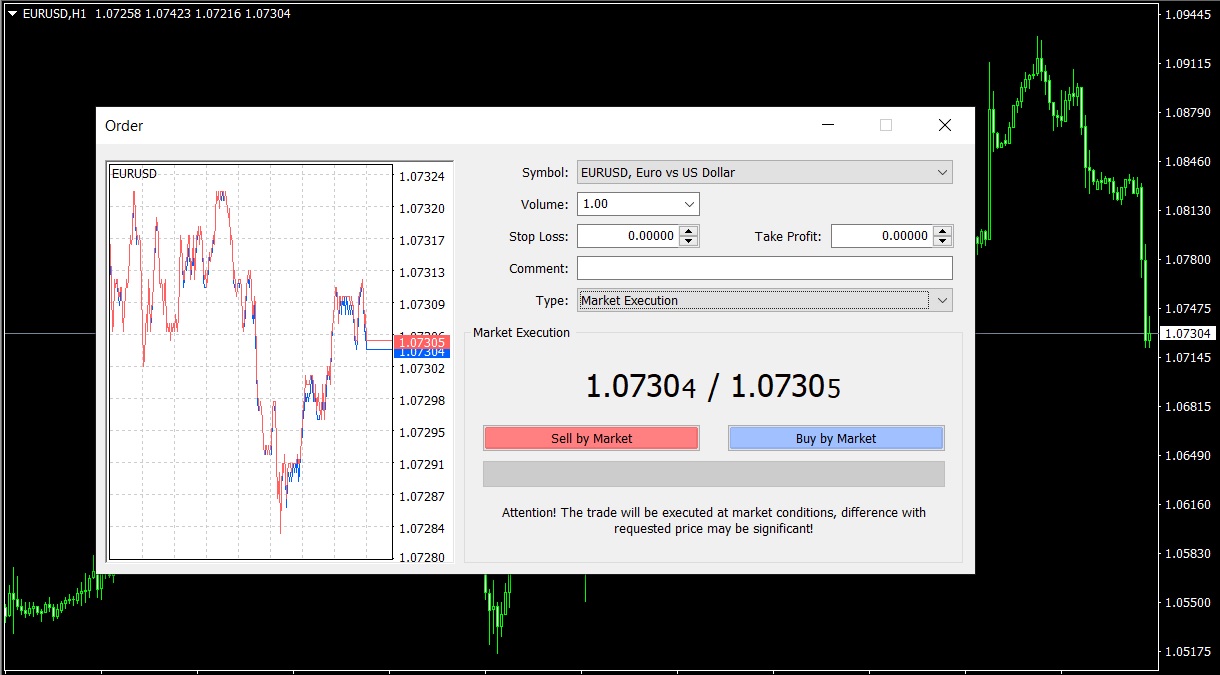

1. Trading Platform: Select a reliable and user-friendly trading platform that offers the features, charting tools, and technical indicators you require.

2. Charting Software: Use charting software that supports your preferred chart types, time frames, and technical indicators.

3. Economic Calendar: Monitor an economic calendar to stay informed about upcoming news events and data releases that may impact the forex market.

4. Trading Journal: Maintain a detailed trading journal to record your trades, track your performance, and refine your trading plan over time.

Establish a Routine

Create a routine that outlines your daily, weekly, and monthly trading activities. This helps you maintain discipline and consistency in your approach. Your routine should include:

1. Market Analysis: Set aside time for daily market analysis, focusing on the currency pairs and time frames relevant to your trading style and strategy.

2. Trade Execution: Allocate specific times for executing trades, based on your trading style and the market conditions you aim to exploit.

3. Performance Review: Regularly review your trading performance to identify areas for improvement and make necessary adjustments to your trading plan.

4. Ongoing Education: Dedicate time to learning about new trading strategies, techniques, and market developments to continually enhance your trading skills.

Test and Refine Your Trading Plan

Before committing real capital, test your trading plan using a demo account or backtesting software. This allows you to identify potential weaknesses, gauge the effectiveness of your strategy, and make necessary adjustments. Key metrics to track during testing include:

- Win rate: The percentage of winning trades out of the total number of trades executed

- Risk-reward ratio: The comparison of potential profit to potential loss per trade

- Expectancy: The average amount you can expect to win or lose per trade

- Drawdown: The largest peak-to-trough decline in your trading account balance

Implement Your Trading Plan

Once you have tested and refined your trading plan, it’s time to put it into action. Begin trading with real capital, strictly adhering to your plan’s rules and guidelines. Remember, discipline is key to success in forex trading. Avoid deviating from your plan based on emotions or sudden market fluctuations.

Continuously Review and Improve Your Trading Plan

A trading plan should be dynamic, evolving as you gain experience and knowledge. Regularly review your plan and trading performance, identifying areas for improvement, and making necessary adjustments. As market conditions change, you may need to adapt your strategy, risk management rules, or trading tools to maintain a profitable edge.

Conclusion

Creating a well-structured trading plan is essential for success in forex trading. By establishing clear goals, selecting a suitable trading style, developing a robust trading strategy, and implementing effective risk management, you can navigate the forex market with confidence and discipline. Remember that ongoing education, routine, and continuous improvement are crucial to achieving and maintaining success in forex trading.