The forex market presents numerous opportunities for traders to profit from currency fluctuations. Among the many trading styles, swing trading has emerged as a popular approach due to its unique combination of short- and medium-term trading elements. In this article, we will explore the concept of forex swing trading, its benefits and drawbacks, and the main strategies employed by successful swing traders.

What is Forex Swing Trading?

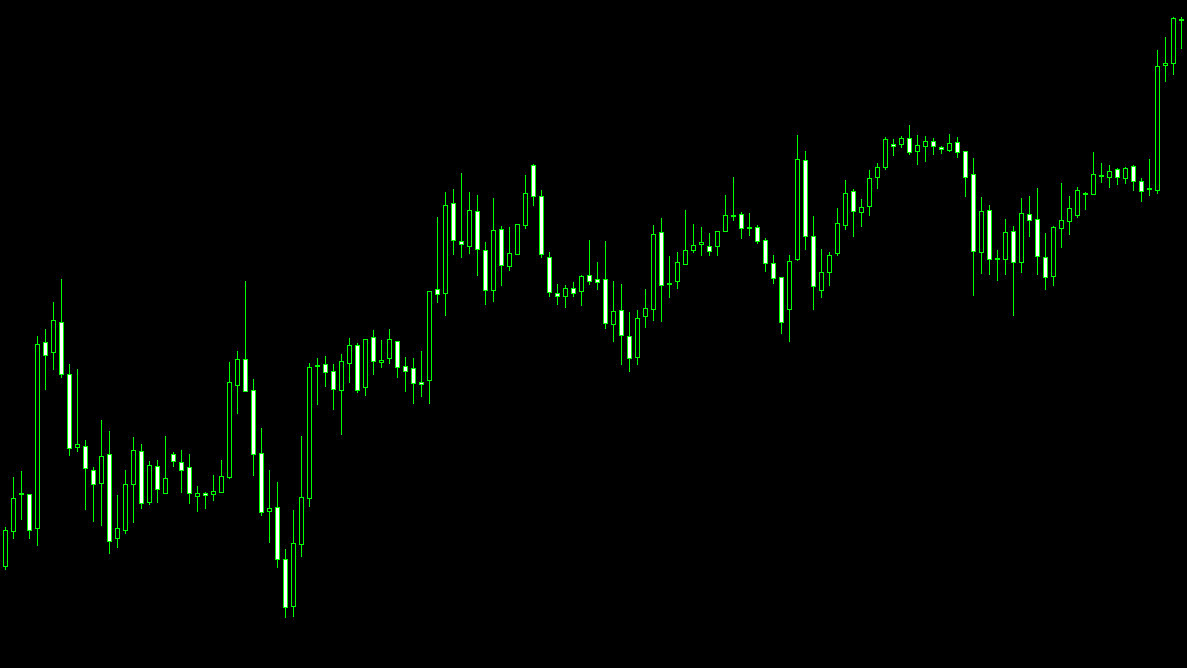

Forex swing trading is a trading style that aims to capitalize on short- to medium-term price movements in the currency market. Swing traders typically hold their positions for a few days to several weeks, looking to capture gains from market swings caused by changing market sentiment, economic data releases, or geopolitical events. By utilizing a combination of technical and fundamental analysis, swing traders can identify trends, support and resistance levels, and potential entry and exit points for their trades.

Benefits of Forex Swing Trading

- Balance of time and potential returns: Swing trading strikes a balance between the fast-paced nature of day trading and the longer time horizon of position trading, offering traders the opportunity to profit from price swings without having to monitor the market constantly.

- Lower transaction costs: Compared to day trading, swing traders make fewer trades, resulting in lower overall transaction costs, including spreads and commissions.

- Flexibility: Swing trading allows traders to profit from both trending and range-bound markets, providing a versatile approach that can adapt to changing market conditions.

- Manageable risk: Swing traders use various risk management techniques, such as stop-loss orders and position sizing, to manage potential losses, making it a relatively manageable trading style in terms of risk.

Drawbacks of Forex Swing Trading

- Overnight risk: Swing traders are exposed to overnight risk, as their positions remain open for several days or weeks, potentially leading to significant price gaps caused by unexpected news events or market movements.

- Time commitment: While swing trading is less time-consuming than day trading, it still requires a substantial time commitment for market analysis, trade management, and ongoing education.

- Emotional challenges: Swing trading can be emotionally challenging for some traders, as it requires patience and discipline to wait for the right trading opportunities and manage open positions for an extended period.

Main Swing Trading Strategies

Swing traders employ various strategies to identify and capitalize on short- to medium-term price movements in the forex market. Some of the main swing trading strategies include:

- Trend Following

Trend following is a popular swing trading strategy in which traders aim to capitalize on the continuation of existing trends. By using technical analysis tools, such as moving averages, trend lines, and the ADX (Average Directional Index), swing traders can identify the direction of the prevailing trend and enter trades accordingly. They typically look for retracements or pullbacks within the trend to enter trades, aiming to capture a portion of the trend’s subsequent price movement.

- Range Trading

Range trading is a strategy that focuses on trading within well-defined support and resistance levels, which are often established by price consolidating after a significant move. Swing traders can use technical analysis tools, such as horizontal trend lines or Fibonacci retracements, to identify these levels and enter trades when the price approaches or bounces off them. They will usually place a stop loss beyond the support or resistance level and set a profit target near the opposite boundary of the range.

- Moving Average Crossover

The moving average crossover strategy involves using two moving averages, one short-term and one long-term, to generate buy and sell signals. When the short-term moving average crosses above the long-term moving average, it indicates that the trend is shifting upwards, generating a buy signal. Conversely, when the short-term moving average crosses below the long-term moving average, the trend is shifting downwards, generating a sell signal. Swing traders can use this strategy to enter trades in the direction of the crossover and capture potential price swings.

- Breakout Trading

Breakout trading is a strategy where swing traders enter the market when the price breaks through a predetermined support or resistance level. This often signals that a significant price movement is about to occur, and the trader aims to capture the ensuing price swing. Stop-loss orders are usually placed just beyond the broken support or resistance level to manage risk.

- Momentum Trading

Momentum trading is a strategy that focuses on trading currencies with strong price momentum. Swing traders can use technical indicators, such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD), to identify currencies with strong momentum and potential trading opportunities. By entering trades in the direction of the momentum, traders aim to capture the continuation of the price movement for a short- to medium-term period.

- Fibonacci Retracement

The Fibonacci retracement strategy involves using Fibonacci levels to identify potential retracement levels within a trend. Swing traders can use these levels to enter trades on pullbacks within the trend, aiming to capture the continuation of the trend once the retracement is complete. Traders typically set stop-loss orders below the Fibonacci retracement level and profit targets near the previous high or low, depending on the direction of the trend.

- Candlestick Patterns

Candlestick patterns can be a valuable tool for swing traders, as they provide insight into market sentiment and potential reversals or continuations of price movements. By analyzing candlestick patterns, such as engulfing patterns, hammers, and shooting stars, swing traders can identify potential entry and exit points for their trades. Combining candlestick analysis with other technical indicators can further increase the effectiveness of this strategy.

Conclusion

Forex swing trading is a versatile and popular trading style that offers traders the opportunity to profit from short- to medium-term price movements in the currency market. By utilizing a combination of technical and fundamental analysis, swing traders can identify trends, support and resistance levels, and potential entry and exit points for their trades.

The main swing trading strategies, such as trend following, range trading, moving average crossover, and breakout trading, provide traders with various approaches to capitalize on price swings in the forex market. However, swing trading also comes with its share of challenges, such as overnight risk, time commitment, and emotional hurdles.

By implementing effective risk management techniques and continuously improving their trading skills, swing traders can overcome these challenges and increase their chances of success. As with any trading style, mastering the art of swing trading takes time, practice, and patience. By understanding the principles of swing trading and utilizing the main strategies, traders can improve their chances of achieving consistent success in the forex market.