In the world of forex trading, the ability to accurately analyze market trends and price movements is crucial for making informed decisions and minimizing risk. One of the fundamental concepts in technical analysis is the identification of support and resistance levels, which can provide valuable insights into potential entry and exit points for trades, as well as the overall market sentiment. This article will discuss what support and resistance indicators are, their importance in forex trading, and how traders can effectively use them to enhance their trading strategies.

What are Support and Resistance Indicators?

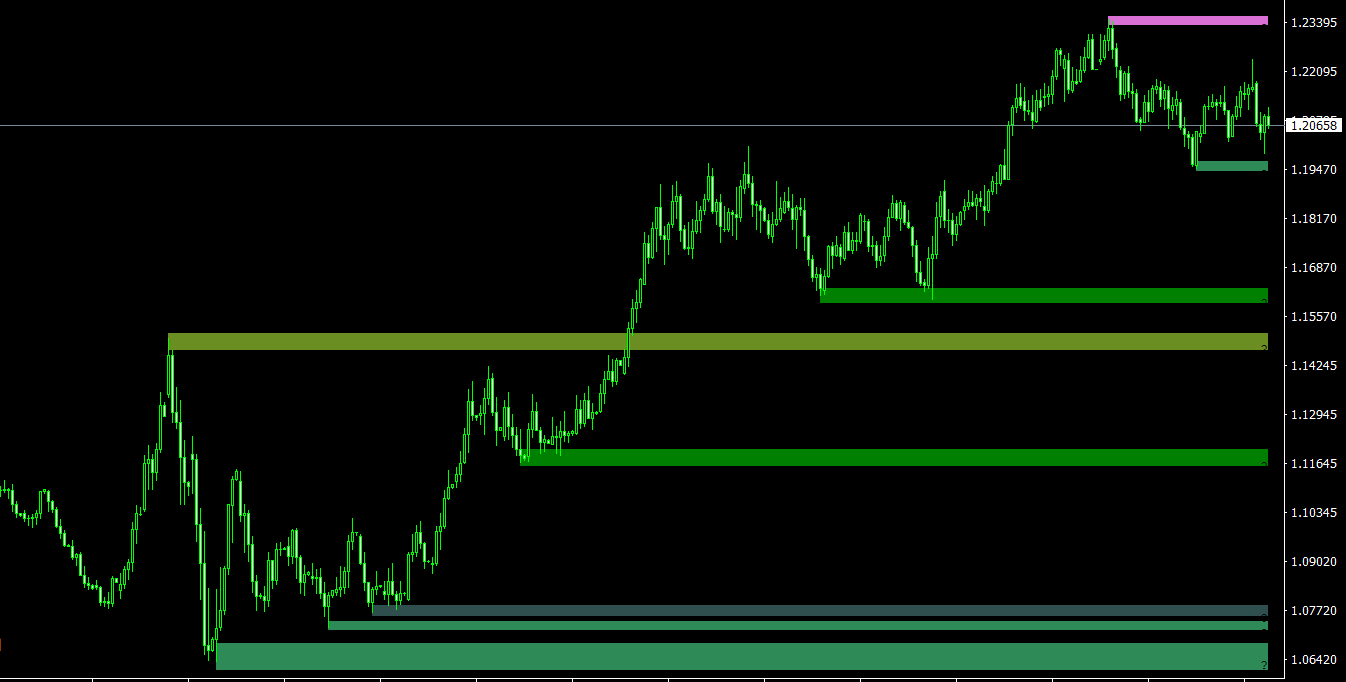

Support and resistance indicators are technical analysis tools that help traders identify significant price levels at which the market may experience a reversal or a consolidation. These price levels act as psychological barriers, where buying or selling pressure may increase, causing the price to change direction or pause before continuing its trend.

- Support: A support level is a price point at which the demand for a currency pair is strong enough to prevent the price from falling further. At support levels, buyers tend to enter the market, increasing demand and potentially driving the price upward.

- Resistance: A resistance level is a price point at which the supply of a currency pair is strong enough to prevent the price from rising further. At resistance levels, sellers tend to enter the market, increasing supply and potentially driving the price downward.

Various technical tools and techniques can help traders identify support and resistance levels, such as trend lines, chart patterns, moving averages, and Fibonacci retracements.

The Importance of Support and Resistance Indicators in Forex Trading

Support and resistance indicators play a critical role in forex trading, offering valuable insights into market dynamics and potential trading opportunities. Some of the benefits of using support and resistance indicators include:

- Identifying Potential Reversal Points: By analyzing support and resistance levels, traders can gain insights into potential price reversals, allowing them to enter or exit trades at opportune moments.

- Determining Stop Loss and Take Profit Levels: Support and resistance levels can be used to set stop loss and take profit orders, helping traders manage risk and optimize their returns.

- Assessing Market Sentiment: Support and resistance indicators can provide information about the overall market sentiment, helping traders make more informed trading decisions.

- Enhancing Trading Strategies: Incorporating support and resistance indicators into a trading strategy can improve its effectiveness, allowing traders to better identify potential trading opportunities and manage risk.

How to Use Support and Resistance Indicators in Forex Trading

Effectively utilizing support and resistance indicators in forex trading can help traders identify potential entry and exit points, as well as assess market sentiment and manage risk. Here are some tips for using support and resistance indicators in your trading strategy:

- Identify Key Support and Resistance Levels: Analyze historical price data to identify significant support and resistance levels, taking note of areas where the price has repeatedly reversed or consolidated.

- Incorporate Multiple Timeframes: Analyze support and resistance levels across multiple timeframes to gain a more comprehensive understanding of the market and identify potential trading opportunities.

- Combine with Other Technical Analysis Tools: Support and resistance indicators can be effectively combined with other technical analysis tools, such as chart patterns, trend lines, and oscillators, to create a well-rounded trading strategy.

- Monitor Price Action: Keep an eye on price action near support and resistance levels, as this can provide insights into potential reversals or breakouts.

- Use Support and Resistance Levels for Stop Loss and Take Profit Orders: Set stop loss orders below support levels or above resistance levels to protect your capital from potential losses. Similarly, set take profit orders near resistance levels in a long position or near support levels in a short position to lock in profits.

- Watch for Breakouts and False Breakouts: Be aware of breakouts, where the price moves beyond a support or resistance level, indicating a potential continuation of the trend or the start of a new trend. However, be cautious of false breakouts, where the price initially moves beyond a support or resistance level but quickly reverses, trapping traders who entered the trade based on the breakout. Employing additional confirmation tools, such as trend lines or moving averages, can help validate a breakout before entering a trade.

- Adapt to Changing Market Conditions: Support and resistance levels are not static and may change as market conditions evolve. Regularly review and update your support and resistance levels to ensure they remain relevant and accurate.

- Practice Patience and Discipline: Wait for the price to reach key support or resistance levels before entering a trade, rather than trying to anticipate price movements. This approach can help you avoid entering trades too early or late, increasing the potential for profitable trades.

Conclusion

Support and resistance indicators are essential technical analysis tools in forex trading, providing valuable insights into market dynamics and potential trading opportunities. By understanding and effectively utilizing support and resistance indicators, traders can make more informed decisions, optimize their trading strategies, and better manage risk. Combining support and resistance indicators with other technical analysis tools can further enhance a trader’s ability to navigate the complexities of the forex market, ultimately contributing to improved trading performance and profitability. As with any trading tool, practice and ongoing education are key to mastering the use of support and resistance indicators and reaping the benefits they offer in forex trading.