In the world of forex trading, where the buying and selling of currencies take place around the clock, having access to the right tools and information can make all the difference in a trader’s success. Technical analysis is an essential aspect of forex trading, and one of the key components that traders often overlook is trading volume. Volume indicators are tools that help traders analyze the volume of trades in the market, providing valuable insights into market sentiment, momentum, and potential trend reversals. This article will discuss what volume indicators are and how traders can use them to enhance their forex trading strategies.

What are Volume Indicators?

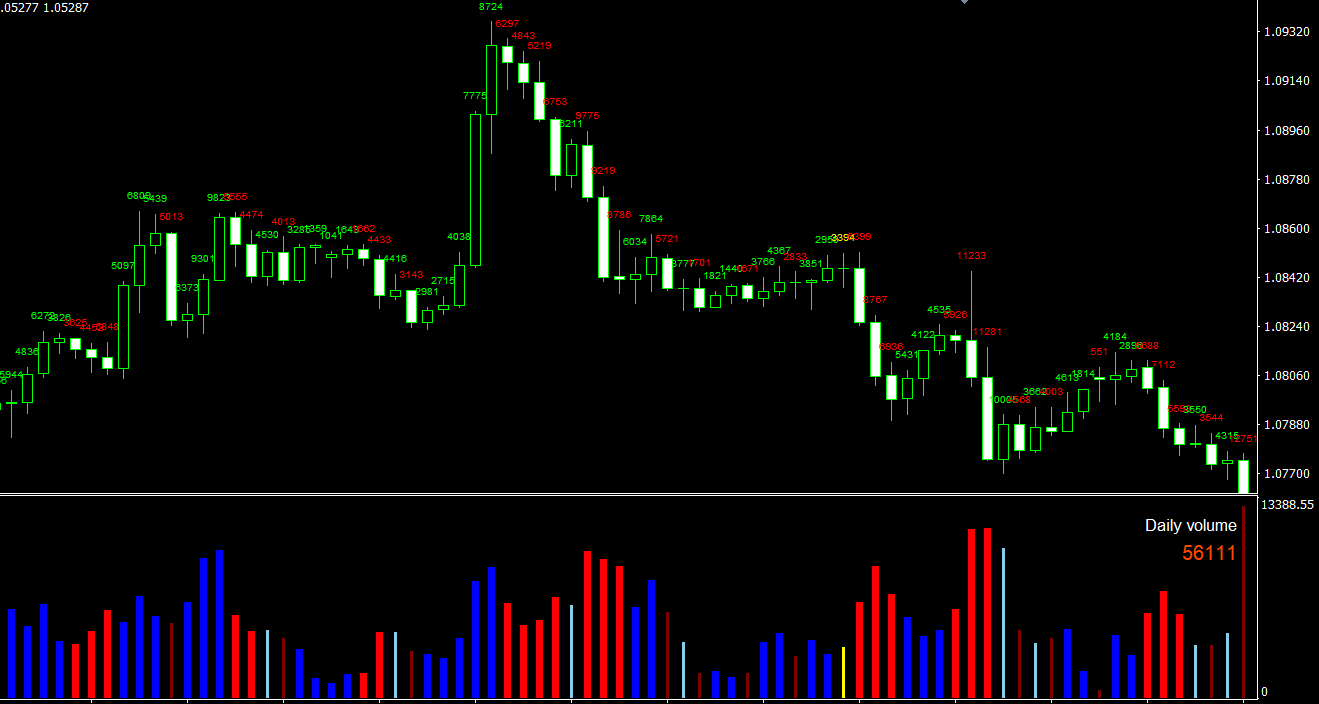

Volume indicators are a type of technical analysis tool that helps traders evaluate the strength of a market trend based on the trading volume. Trading volume refers to the number of contracts or shares that are traded within a specific period. In the context of forex trading, volume represents the number of currency units that are exchanged during a given time frame.

In general, a high trading volume indicates strong market interest, while low trading volume suggests a lack of interest or conviction. By analyzing the relationship between price movements and trading volume, traders can gain valuable insights into market dynamics, such as supply and demand, liquidity, and market sentiment.

There are various types of volume indicators, each with its unique method of representing and interpreting trading volume data. Some of the most popular volume indicators include:

- On-Balance Volume (OBV): OBV is a cumulative indicator that adds volume on up days and subtracts volume on down days, providing a running total of volume flow.

- Chaikin Money Flow (CMF): CMF is an oscillator that measures buying and selling pressure by comparing the close price to the high-low range and multiplying it by the volume.

- Money Flow Index (MFI): MFI is a momentum indicator that combines price and volume data to measure buying and selling pressure in the market.

- Volume Rate of Change (VROC): VROC is an oscillator that measures the rate at which volume is changing over time, helping traders identify potential trend reversals and breakouts.

Using Volume Indicators in Forex Trading

Incorporating volume indicators into your forex trading strategy can provide valuable insights and improve your decision-making process. Here are some ways to use volume indicators in forex trading:

- Confirming Trends: A rising trading volume during a price uptrend can indicate strong buying interest, suggesting that the trend is likely to continue. Conversely, decreasing volume during a downtrend may signify weakening selling pressure and a potential trend reversal.

- Identifying Breakouts and Reversals: Volume indicators can help traders spot breakouts and reversals by highlighting sudden increases in trading volume. For example, a significant surge in volume accompanied by a price breakout from a consolidation pattern could signal the start of a new trend.

- Detecting Market Sentiment: Analyzing trading volume can provide insights into market sentiment and the conviction of market participants. High trading volume during a price rally suggests strong bullish sentiment, while low volume during a decline could indicate weak bearish sentiment.

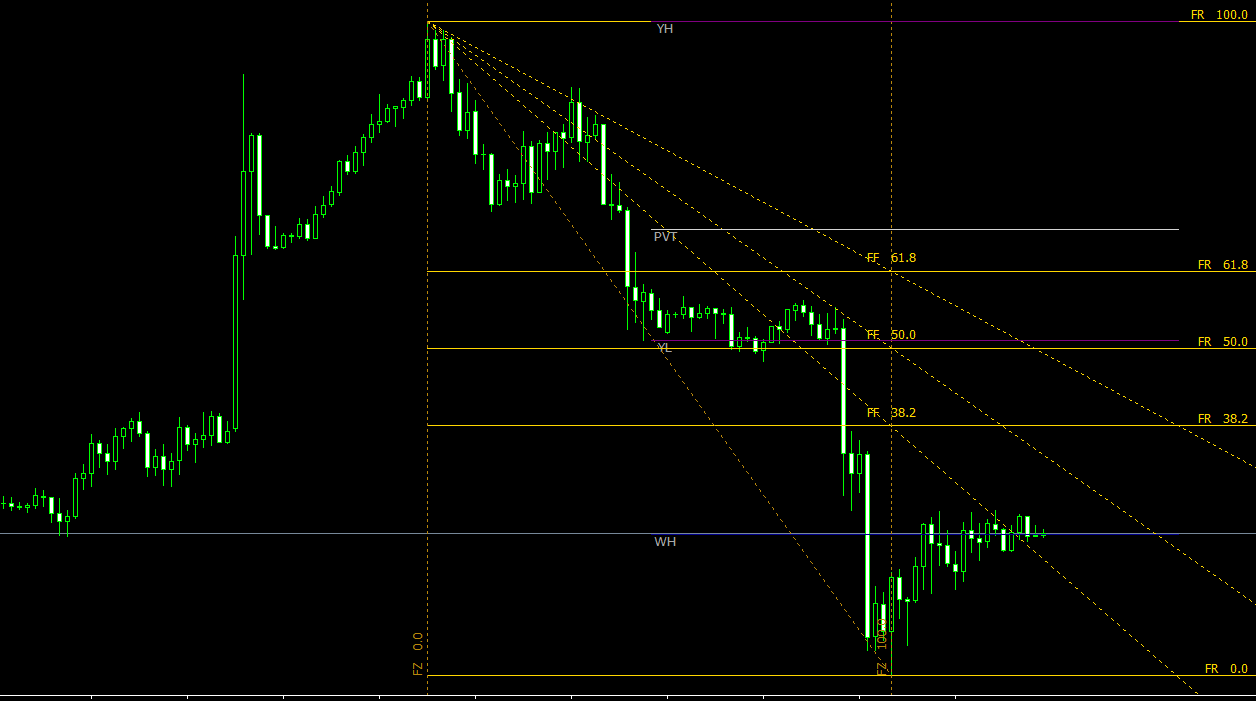

- Enhancing Other Technical Analysis Tools: Volume indicators can be combined with other technical analysis tools, such as moving averages, support and resistance levels, and chart patterns, to develop a comprehensive trading strategy.

Conclusion

Volume indicators are an essential aspect of technical analysis in forex trading, offering valuable insights into market dynamics, trend strength, and potential reversals. By understanding and utilizing volume indicators in their trading strategies, forex traders can gain a deeper understanding of market sentiment, confirm the validity of trends, and identify potential breakouts and reversals. Integrating volume indicators with other technical analysis tools can create a more robust and effective trading strategy, ultimately helping traders make more informed decisions and potentially increase their profitability in the forex market. As trading volume is a reflection of market interest and conviction, incorporating volume indicators can provide a more comprehensive understanding of market behavior and price movements. By incorporating volume indicators into their trading toolkit, forex traders can better navigate the complexities of the market, make more informed decisions, and improve their overall trading performance in the ever-changing world of forex trading.