The foreign exchange (forex) market is characterized by its dynamic nature and constant fluctuations in currency values. To successfully navigate this complex financial environment, traders must be able to identify and assess market volatility accurately. Volatility indicators are technical analysis tools that help traders measure and analyze the degree of price fluctuations in currency pairs. By understanding and incorporating volatility indicators into their trading strategies, forex traders can make more informed decisions and enhance their overall trading performance. This article will discuss what volatility indicators are and how traders can use them effectively in forex trading.

What are Volatility Indicators?

Volatility indicators are a type of technical analysis tool that helps traders gauge the level of price fluctuations or volatility in the forex market. Volatility is a crucial aspect of trading, as it can impact the potential profit and risk associated with a particular trade. High volatility signifies larger price swings, which can lead to more significant profits or losses, while low volatility indicates smaller price movements and potentially lower returns.

There are various types of volatility indicators, each with its unique method of measuring and interpreting market volatility. Some of the most popular volatility indicators include:

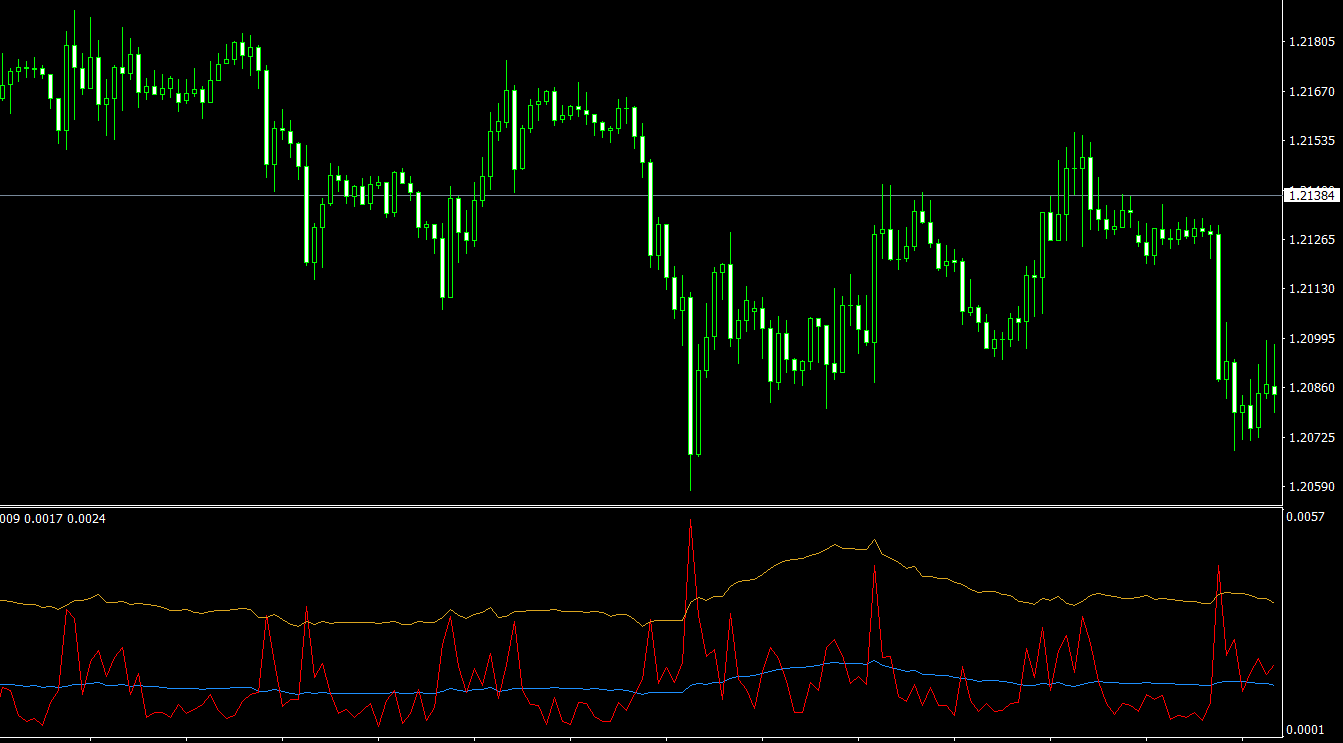

- Average True Range (ATR): ATR is an indicator that measures the average range of price movement over a specific period, providing an estimation of market volatility.

- Bollinger Bands: Bollinger Bands are a set of three lines, consisting of a simple moving average (SMA) and two standard deviation lines above and below the SMA. The bands expand and contract based on market volatility.

- Standard Deviation: Standard Deviation is a statistical measure that calculates the dispersion of price data from its mean, providing an estimate of market volatility.

- Historical Volatility: Historical Volatility is a measure of the standard deviation of price returns over a specific period, reflecting the degree of price fluctuations in the past.

Using Volatility Indicators in Forex Trading

Incorporating volatility indicators into your forex trading strategy can provide valuable insights into market conditions and help you make more informed decisions. Here are some ways to use volatility indicators in forex trading:

- Assessing Market Conditions: Volatility indicators can help traders determine whether the market is experiencing high or low volatility, allowing them to adjust their trading strategies accordingly. For example, during periods of high volatility, traders may choose to trade breakout or trend-following strategies, while low volatility may favor range-bound or mean reversion strategies.

- Setting Stop Loss and Take Profit Levels: By understanding market volatility, traders can more effectively set stop loss and take profit levels to manage risk and optimize returns. For example, using the ATR indicator, traders can place stop losses at a multiple of the ATR value to account for market volatility.

- Identifying Entry and Exit Points: Volatility indicators such as Bollinger Bands can help traders identify potential entry and exit points based on price action. For instance, when the price touches the upper or lower Bollinger Band, it may indicate an overbought or oversold condition, signaling a potential reversal.

- Enhancing Other Technical Analysis Tools: Volatility indicators can be combined with other technical analysis tools, such as support and resistance levels, chart patterns, and trend indicators, to develop a comprehensive trading strategy.

Conclusion

Volatility indicators are an essential component of technical analysis in forex trading, offering valuable insights into market conditions and price fluctuations. By understanding and utilizing volatility indicators in their trading strategies, forex traders can make more informed decisions, manage risk more effectively, and potentially increase their profitability. Integrating volatility indicators with other technical analysis tools can create a more robust and effective trading strategy, allowing traders to navigate the complexities of the forex market and capitalize on opportunities presented by varying market conditions. Ultimately, the use of volatility indicators can help traders better understand the inherent risks and potential rewards associated with their trades, enabling them to make more confident decisions and improve their overall trading performance in the ever-changing world of forex trading. By incorporating volatility indicators into their trading toolkit, forex traders can better adapt to different market conditions and enhance their ability to identify and capitalize on trading opportunities.