In the world of forex trading, technical analysis plays a crucial role in helping traders make informed decisions and develop successful trading strategies. Among the plethora of technical analysis tools available, divergence indicators are particularly valuable for their ability to detect potential trend reversals and market turning points. This article will explore the concept of divergence indicators, their characteristics, and how to use them effectively in forex trading.

What are Divergence Indicators?

Divergence indicators are a set of technical analysis tools that compare the price action of a currency pair to the behavior of a related oscillator or momentum indicator, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator. Divergence occurs when the price and the oscillator move in opposite directions, signaling a potential trend reversal or weakening momentum.

There are two types of divergences: regular and hidden. Regular divergences signal a potential trend reversal, while hidden divergences indicate trend continuation.

- Regular Divergence: Regular divergence occurs when the price forms a higher high or a lower low, while the oscillator forms a lower high or a higher low, respectively. Regular bullish divergence takes place when the price forms a lower low, and the oscillator forms a higher low, suggesting a potential upward trend reversal. Regular bearish divergence occurs when the price forms a higher high, and the oscillator forms a lower high, indicating a possible downward trend reversal.

- Hidden Divergence: Hidden divergence occurs when the price forms a lower high or a higher low, while the oscillator forms a higher high or a lower low, respectively. Hidden bullish divergence takes place when the price forms a higher low, and the oscillator forms a lower low, suggesting trend continuation in an upward direction. Hidden bearish divergence occurs when the price forms a lower high, and the oscillator forms a higher high, indicating trend continuation in a downward direction.

Using Divergence Indicators in Forex Trading

To effectively use divergence indicators in forex trading, consider the following tips:

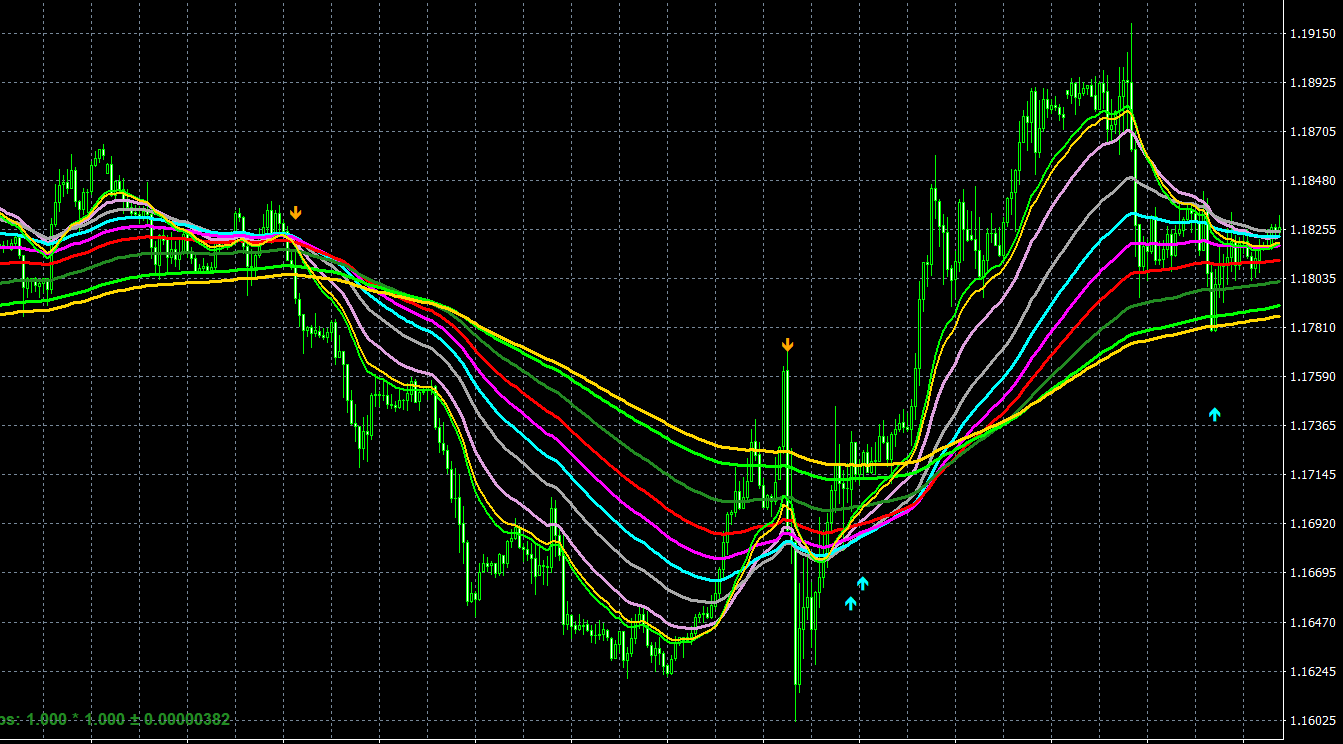

- Combine divergence indicators with other technical analysis tools: Divergence indicators, like any other technical analysis tool, should not be used in isolation. Combining them with other tools, such as support and resistance levels, trend lines, moving averages, and chart patterns, can provide additional confirmation and enhance the effectiveness of your analysis.

- Analyze multiple timeframes: Examining currency pairs on multiple timeframes can provide a more comprehensive view of the market and help you identify potential trading opportunities more effectively. For example, you can use a longer timeframe to determine the overall trend and a shorter timeframe to identify optimal entry and exit points.

- Focus on significant divergences: Not all divergences result in successful trades, and some may be considered “false signals.” To increase the probability of a successful trade, focus on significant divergences that occur over an extended period and involve major price swings. Additionally, pay attention to divergences that are confirmed by multiple oscillators or that align with significant support and resistance levels.

- Implement sound risk management strategies: Despite the usefulness of divergence indicators, forex trading always involves a degree of uncertainty. It’s essential to practice sound risk management strategies, such as setting stop-loss orders, managing your position sizes, and maintaining a diversified portfolio, to protect your capital and ensure long-term trading success.

- Test and optimize your trading strategy: Before incorporating divergence indicators into your live trading, test your trading strategy using historical data or a demo account. This process allows you to assess the effectiveness of divergence indicators and other technical analysis tools in your strategy, and make any necessary adjustments to optimize performance.

Divergence Trading Strategies

There are several ways to use divergence indicators in forex trading. Some of the most popular strategies include:

- Regular Divergence Trading: This strategy involves identifying potential trend reversals based on regular divergences. When a regular bullish divergence occurs, traders can enter a long position, anticipating an upward trend reversal. Conversely, when a regular bearish divergence is observed, traders can enter a short position, expecting a downward trend reversal. Stop-loss orders can be placed below or above the recent swing low or high, depending on the trade direction.

- Hidden Divergence Trading: This strategy involves using hidden divergences to identify trend continuation opportunities. When a hidden bullish divergence occurs, traders can enter a long position, expecting the upward trend to continue. When a hidden bearish divergence is observed, traders can enter a short position, anticipating the downward trend to persist. Stop-loss orders can be placed below or above the recent swing low or high, depending on the trade direction.

- Divergence-Confluence Trading: This strategy involves combining divergence signals with other technical analysis tools to identify high-probability trading opportunities. For example, a trader may identify a regular divergence that aligns with a significant support or resistance level or a chart pattern, such as a double top or double bottom. These confluence areas may provide stronger trading signals, as they represent agreement between various market factors.

- Divergence Breakout Trading: This strategy involves using divergences to confirm potential breakout opportunities. When a divergence occurs near a significant support or resistance level, trendline, or chart pattern, it may indicate a higher likelihood of a successful breakout. Traders can enter a position in the direction of the breakout and place stop-loss orders below or above the breakout level, depending on the trade direction.

Conclusion

Divergence indicators are a valuable and powerful set of technical analysis tools that can help forex traders identify potential trend reversals and market turning points. By understanding the concept of divergences, their characteristics, and how to use them effectively in conjunction with other technical analysis tools, traders can maximize their potential for success in the forex market.

Incorporating divergence indicators into your forex trading strategy can provide valuable insights into the market’s underlying momentum and trend strength. By combining divergence indicators with other technical analysis tools, analyzing multiple timeframes, and implementing sound risk management strategies, you can increase your chances of success in the highly competitive and ever-changing forex market.