We have all heard about the huge opportunities to become rich by trading in Forex market, but for most of people this topic remains unclear like walking in the dark forest.

Today I will try to cast the first ray of light and answer the “difficult” questions: what is Forex, how it works and how to make money on it. At the end of the article, I will give you my opinion about whether Forex is simply a scam for inexperienced Internet users.

How do Forex traders make money?

What does your imagination draw when you hear the word “market”? Likely this is a large crowd of people, counters, all kinds of shouting and the like. In order not to get confused in all this, economists have divided the financial market into several components.

The first component (which is also the oldest) is the raw materials market. It is common to call it “commodity market”. Here, in addition to oil, coal, and gas other things like cotton, sugar, grain crops, timber, coffee and many other things are traded.

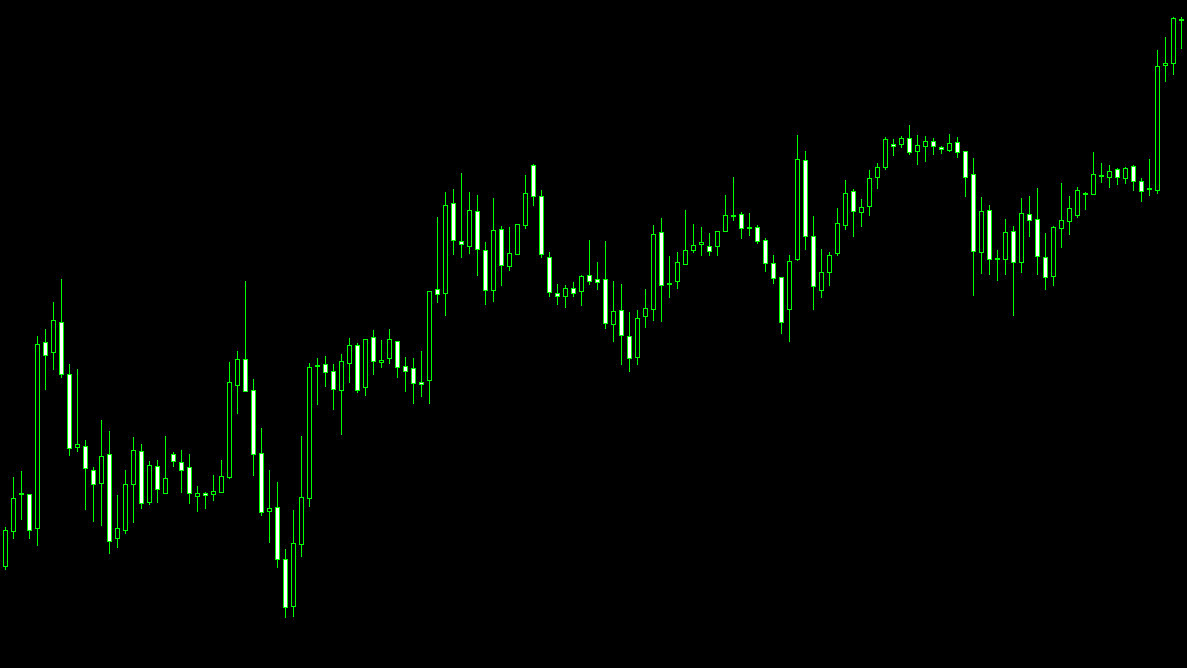

As these goods are bought and sold, supply and demand act on them, therefore, the price is constantly changing, and its rate is displayed on the charts. For example, below is a graph of changes in oil prices.

The second component of financial market, which appeared much later, is securities. You may know this market segment as the “stock market”.

The functioning of any financial market is not possible without the presence of one very important connecting substance, the means of making payment – money. Money, like raw materials and securities, has its own value, so it either grows in price or falls. The financial market part responsible for money was named as foreign exchange market or Forex.

We have figured out what Forex is, but not quite fully yet.

The currency, stock and commodity markets combined make the whole financial market, but they function a little differently. Moreover, Forex stands apart from the rest. Let’s dig deeper on how it works and discuss a number of its features, because without knowing them, it is impossible to move on to real trading.

Features of the Forex market

As a historical reference, I should note that the first exchanges appeared about 700 years ago, since then they have been constantly developing and improving until they reached the current level.

The main difference between Forex and other components of the financial market has already been discussed by us: it is trading in currencies, not in securities or raw materials. But if the value of a company share, a barrel of oil, a kilogram of coffee can be expressed in the currency of a particular country, then in what way can the currency itself be expressed?

Making money on growing and dropping market

Trying to put value on money in terms of the goods it can buy could be too problematic. However, the term “purchasing power of money” still exists, and we will talk about it in articles devoted to fundamental analysis. The simplest option, which brilliant economists have came up, is to express the value of one currency to another.

Add a new word to your mental vocabulary:

The exchange rate – is the value of the one currency, expressed in the currency of another country.

For example, one dollar against the euro is (at the time of this writing) 0.85, one euro against the UK pound is 0.90.

If the value of one currency is expressed through the value of another, then with the growth of one currency, the other will fall and vice versa. This seemingly simple statement leads us to the key difference between Forex and other market segments:

In Forex, you can make money both on a rise in price and on its fall, because a fall in one currency always means an increase in another.

If we bought oil at a price of 50 dollars per barrel, then we can make money only if we sell it at a higher price and nothing else. In Forex, to make money on the fall of the currency, we simply buy another currency with which the original is paired.

Leverage

The extraordinary popularity of Forex among people is partly due to the fact that it is possible to trade here using leverage. I will talk in more detail about this remarkable feature in a separate article, where I will try to explain everything in detail.

For now, you need to understand that leverage allows you to open a trade for an amount several times larger than you have on your account. For example, if you have 2 000 dollars, and one Euro costs 1,18 dollars, then without leverage, you can purchase only 1 695 units of European currency. If you use leverage, for example 1:100, you have the opportunity to open a deal with an amount of 100 times larger compared to the initial one, so instead of buying 1 695 EUR, you can buy 169 500 EUR.

But keep in mind that leverage will not lead you into any debt to a broker; no one will give you “credit”. Why this is so and how trading with leverage is possible will be discussed in a separate article about leverage.

Spreads

In the stock and commodity markets, when opening and closing each transaction, a certain commission is charged, for example, 0.03% of its amount. Commission is the broker’s earnings, without which trading would be impossible.

Broker is a company that executes trade orders (buys and sells stocks, raw materials, currencies at set prices).

There are brokers for Forex market as well, but most of them make profit not from commissions, but from spreads. A spread is a certain amount of money that needs to be paid only once at the time of opening a trade.

For example, here is the spread for the TRY / JPY (Turkish Lira / Japanese Yen) currency pair.

Let’s calculate: 13.357 – 13.317 = 0.04 Yen. We will have to pay 0.04 Japanese Yen to the broker to get the right to open a deal.

Spreads have their advantages, but there are also disadvantages: when they are too large, it is not possible to trade short-term or scalp (but more on that later). Of course, mostly “exotic” currency pairs usually have such huge spreads. Most traders open deals with “major” currency pairs, where the spreads are tiny. An example is the EUR / USD pair (Euro / Dollar).

Let’s calculate: 1.17893 – 1.17881 = 0.00012 dollars will be the broker’s earnings from one dollar deal opened by us.

Since the spread is charged immediately upon opening a trade, we will always see a negative value in the “Trade” tab of our terminal. For clarity, let’s open a deal on the AUD / USD pair (Australian dollar / US dollar) on a demo account and look at the control menu.

We are in the loss because the spread has been paid from the account.

Some brokers offer raw trading accounts, which mean they are not adding additional spread to the interbank quotes, but instead of spread they make money by charging commission on each transaction. Raw trading account sometimes could be a better option, as tighter spreads mean that probability to hit your stop loss is somewhat lower compared to probability on standard spread account. However, you will still have to deduct trading commissions from your trading profit.

Interbank trading

Do you listen to economic news broadcasted on radio or TV? Then you probably heard such expressions as: “New York Exchange”, “London Exchange”, “Tokyo Exchange” and so on.

These exchanges are the buildings in which traders gather to trade – either the stock or commodity markets. The Forex exchange is not located neither in Great Britain, nor in the USA, nor anywhere else, trading is conducted exclusively on the Internet or, as traders say, on the Interbank market.

24-hour trading

Trading on stock and commodity exchanges is conducted only at certain times, for example, the London Stock Exchange is open from 8:00 to 4:30 PM (GMT Time zone), the New York Stock Exchange – from 2:30pm – 9:00pm (GMT), and so on.

Of course, nowadays traders conduct their trades mainly via the Internet, but during non-working hours it is impossible to make transactions even online on stock and commodity exchanges.

Forex works around the clock. It is closed only on weekends (Saturday and Sunday), as well as on some international holidays (New Years Day – January 1st and Christmas – December 25th).

Swaps

If we open a deal on currency market and close it the next day, that is, we maintain an open position overnight; some numbers appear in the “Swap” column of the trading terminal, which can be either positive or negative. What is it?

Opening a position in the market means the following: we give our broker one currency, and he gives us another in return. Let’s say we buy Euros for dollars.

In order for a broker to give us Euros, he turns to liquidity providers, usually large banks. Banks give the broker Euros, which we need, as if ”on credit”.

If we close our deal within one day, the broker will return the “loan” to the bank and will not pay any interest, but if the position is held overnight, the broker will have to pay interest. The broker does not want to do this and moves the costs on the trader. So you will see it in the “Swap” column.

So far, I hope everything is clear. But you may ask, if you have to pay interest for something, how come you may see a positive value in “Swap” column. Where does it come from?

Let me explain. The broker takes the currency that we need on credit from the bank, but what about the money that we give the broker in return? Will the dollars we have exchanged for Euros just lie there? The answer is simple, no.

The broker gives the money received from the trader to the same liquidity provider so that they can deposit it and then pay it with interest. If we close the position during the day and get our dollars back, the broker will not receive interest on them. But if we hold the trade and exit the market the next day, the suppliers (banks) will refund our deposit and pay interest to us.

The swap will turn out to be positive if the interest received from the dollars invested by the broker is greater than the interest on Euro loan taken by him. This value depends on the interest rate. At the moment, the interest rate in the United States is higher than in Europe, so the swap for the Euro / dollar pair is.

Now you have a more detailed idea of what Forex is, right?

Forex – scam or not?

You may have already searched for the answer on the Internet, right? If yes, then you must have come across information about fraudulent brokers, fictitious quotes displayed on terminals, instantly disappearing investments in PAMM accounts, and so on.

Another common thing that I have read in many reviews: “I just opened a deal, but the price immediately went back, hit the stop loss, and then the priced moved in my direction again!”. So the impression is created that brokers are really doing nothing but stealing from newbie traders.

In fact: according to statistics, 80% of all new traders drain all their money in the first year of trading. And this is why there is a massive amount of negative reviews on brokerage houses. But the question arises: is the market to blame for this? Professionals, oddly enough, earn stable income. Forex is a huge market and provides amazing opportunities to earn big money; therefore it attracts all kinds of people and companies. Most of them are honest and decent, but you will also come across scam brokers or scam investors that provide fake services and are looking to steal your money. So you have to do your own research before sending your hard earned money anywhere. But Forex market itself is definitely NOT a scam and you can make huge income if you know what you are doing.