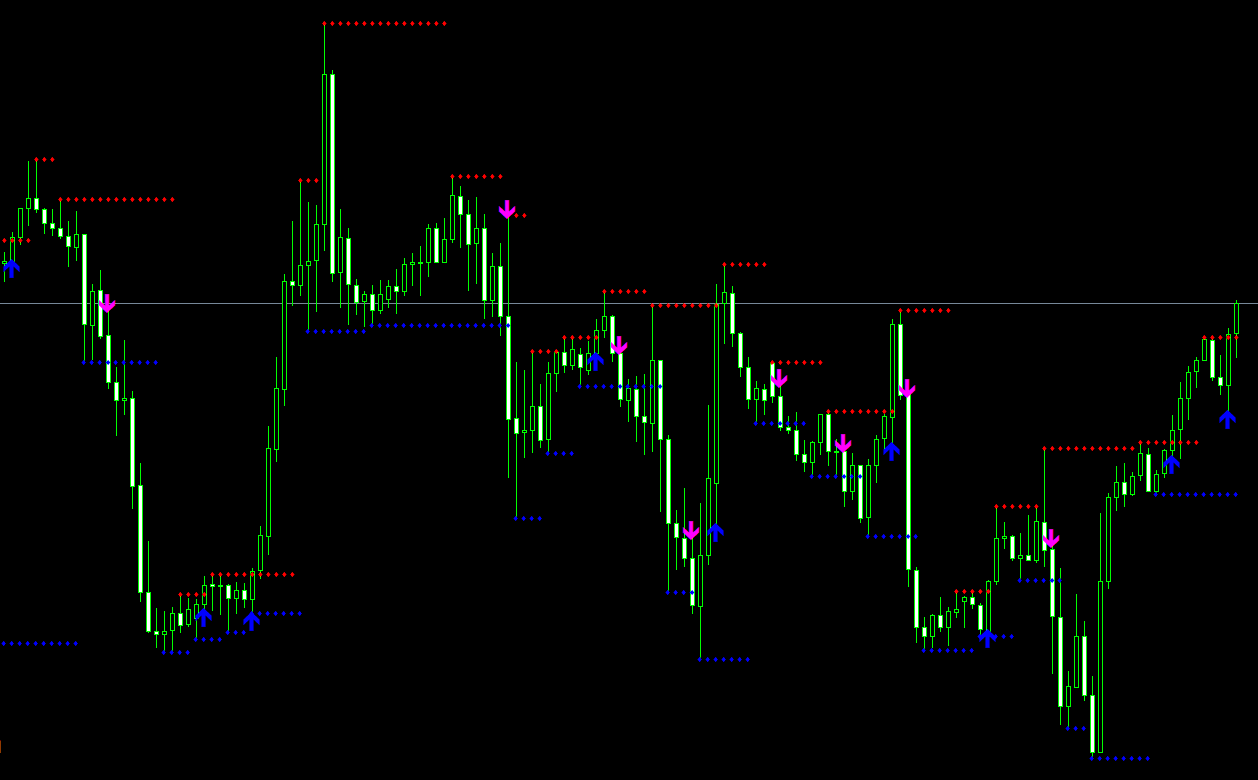

The Fibonacci level indicators DayFibo and WeekFibo are powerful tools that automatically plot Fibonacci levels on charts based on the extremes of the past day and past week. These simple but effective indicators have been a staple in the foreign exchange market for years and remain highly relevant today. In this article, we will discuss the key features and benefits of DayFibo and WeekFibo indicators and explore how to use Fibonacci levels effectively in your trading strategy.

Overview of DayFibo and WeekFibo MT4 Indicators

The DayFibo and WeekFibo indicators are designed to independently build Fibonacci levels on the charts. As the name suggests, the DayFibo indicator plots Fibonacci levels based on the extremes of the past day, while the WeekFibo indicator does so based on the extremes of the previous week. These classic Fibonacci tools have long been popular with traders and are unlikely to lose their relevance.

Key Features of DayFibo and WeekFibo Indicators

- Automatic Fibonacci Level Plotting: The DayFibo and WeekFibo indicators automatically plot Fibonacci levels on the chart, saving traders time and effort in manually calculating and drawing these levels.

- Based on Extremes: The DayFibo indicator is based on the extremes of the past day, while the WeekFibo indicator is based on the extremes of the past week. This allows traders to analyze price movements over different timeframes and make informed decisions.

- Simple and Effective: The DayFibo and WeekFibo trading indicators are simple yet highly effective tools that can be useful to any trader, regardless of their experience level.

Using Fibonacci Levels in Your Trading Strategy

Fibonacci levels are widely used in trading due to their ability to identify potential support and resistance levels in the market. By incorporating the DayFibo and WeekFibo indicators into your trading strategy, you can effectively use Fibonacci levels to improve your decision-making process and enhance your overall trading performance.

- Identify Potential Support and Resistance Levels: Use the DayFibo and WeekFibo indicators to identify potential support and resistance levels on the charts. These levels can provide valuable insights into price movements and help you determine when to enter or exit a trade.

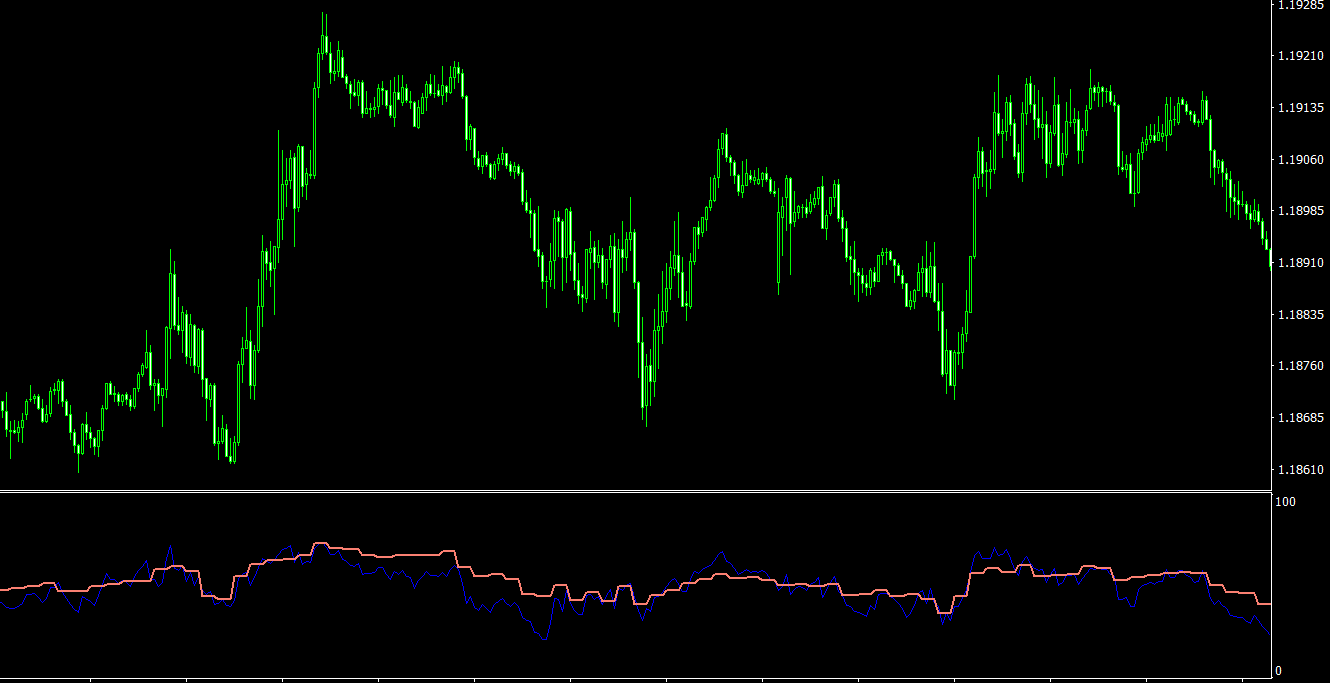

- Combine with Other Technical MT4 Indicators: To increase the accuracy and effectiveness of your trading strategy, combine the DayFibo and WeekFibo indicators with other technical analysis tools, such as moving averages, trendlines, and oscillators.

- Monitor Multiple Timeframes: By using both the DayFibo and WeekFibo indicators, you can monitor and analyze price movements on different timeframes. This can provide a more comprehensive understanding of market trends and help you make more informed trading decisions.

- Set Stop Loss and Take Profit Levels: Use the Fibonacci levels plotted by the DayFibo and WeekFibo indicators to set appropriate stop loss and take profit levels. This can help you effectively manage your risk and protect your trading capital.

Conclusion

The DayFibo and WeekFibo MT4 indicators are powerful tools that can greatly enhance your trading strategy by automatically plotting Fibonacci levels on the charts. By incorporating these simple yet effective indicators into your trading strategy, you can leverage the power of Fibonacci levels to identify potential support and resistance levels, manage risk, and make more informed trading decisions. With their timeless relevance and proven effectiveness, the DayFibo and WeekFibo indicators are indispensable tools for any trader looking to succeed in the Forex market.

Features of DayFibo and WeekFibo MT4 indicators

- Platform: Metatrader 4

- Ability to change settings: No

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In DayFibo-WeekFibo.zip file you will find:

- DayFibo.ex4

- WeekFibo.ex4

Download DayFibo and WeekFibo MT4 indicators for free: