Foreign exchange (Forex) trading has gained massive popularity in recent years, primarily due to its potential for high returns and the ease of access to trading platforms. Forex trading involves the buying and selling of currencies, with the ultimate goal of profiting from fluctuations in exchange rates. Whether you’re looking to diversify your investment portfolio, learn new skills, or simply seek an exciting way to generate income, this comprehensive guide will walk you through the process of starting Forex trading.

Understanding the Basics of Forex Trading

Before diving into the world of Forex trading, it’s crucial to grasp its fundamentals. The Forex market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. Unlike stock markets, the Forex market operates 24 hours a day, five days a week, which provides ample opportunities for traders to take advantage of global economic events and market movements.

Currency Pairs: Forex trading is conducted in pairs. When you buy one currency, you are simultaneously selling another. Currency pairs are classified into three categories: major pairs (e.g., EUR/USD, USD/JPY), minor pairs (e.g., EUR/GBP, NZD/JPY), and exotic pairs (e.g., USD/TRY, EUR/ZAR).

Bid and Ask Prices: When trading Forex, you will notice two prices for each currency pair: the bid price (the price at which you can sell the base currency) and the ask price (the price at which you can buy the base currency). The difference between the bid and ask prices is known as the spread, which is a transaction cost you’ll incur when trading.

Leverage: Forex trading is typically conducted on margin, meaning that you can control larger positions with a smaller amount of capital. This is called leverage, and it allows traders to potentially make more significant profits or losses with relatively small investments. Leverage is expressed as a ratio, such as 50:1 or 100:1, which means that you can control a position worth 50 or 100 times your invested capital, respectively. While leverage can amplify returns, it also increases the risk of losses, making it essential to employ proper risk management strategies.

Choose the Right Broker

Selecting a reliable and trustworthy Forex broker is a critical step in starting your trading journey. A good broker will provide a user-friendly trading platform, competitive fees, diverse currency pairs, and excellent customer support. Keep the following factors in mind when choosing a Forex broker:

- Regulation: Ensure that the broker is regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia.

- Trading platform: The broker’s trading platform should be intuitive, easy to navigate, and feature-rich, allowing you to execute trades efficiently and manage your positions effectively.

- Fees and spreads: Compare the fees and spreads offered by different brokers, as these can significantly impact your trading profitability.

- Demo account: A demo account allows you to practice trading in a risk-free environment using virtual funds, helping you familiarize yourself with the trading platform and develop your trading skills before investing real money.

Develop a Trading Strategy

Successful Forex trading requires a well-thought-out strategy that takes into account your financial goals, risk tolerance, and trading style. Some popular Forex trading strategies include:

- Fundamental analysis: Traders who use fundamental analysis base their decisions on economic indicators, central bank policies, and geopolitical events, which can impact currency valuations. By understanding how these factors influence currency movements, traders aim to make informed decisions and anticipate future market trends.

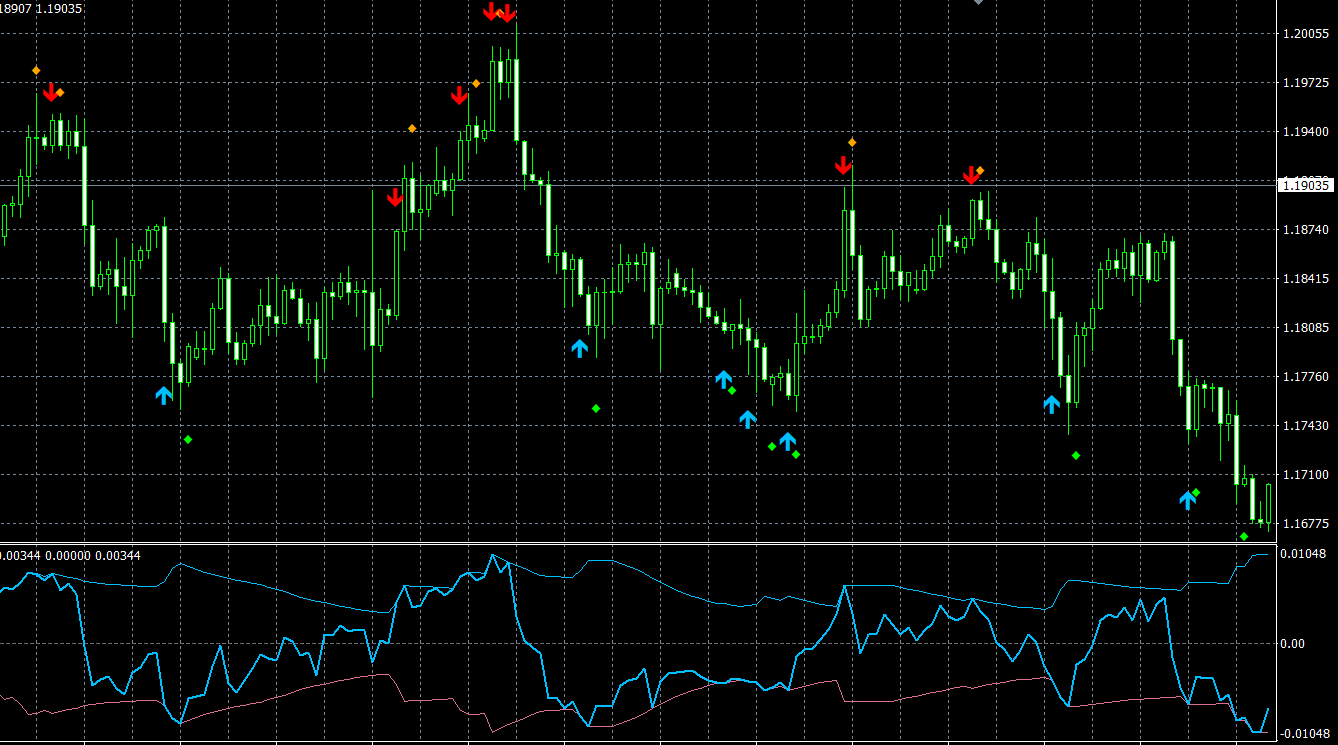

- Technical analysis: This approach focuses on historical price data and patterns to predict future market movements. Technical traders use various tools and indicators, such as moving averages, trend lines, and support and resistance levels, to identify potential trading opportunities.

- Sentiment analysis: Sentiment analysis involves gauging market sentiment by analyzing the collective behavior of market participants. Traders who use sentiment analysis believe that understanding the emotions and psychology of other traders can provide valuable insights into market trends.

- Scalping: This short-term trading strategy involves entering and exiting multiple trades within minutes or even seconds, aiming to profit from small price movements. Scalping requires quick decision-making and can be time-consuming, but it can also generate frequent, albeit small, profits.

Implement Risk Management Techniques

Effective risk management is crucial for long-term success in Forex trading. It involves identifying potential risks, assessing their impact on your trading capital, and taking appropriate measures to mitigate them. Some essential risk management techniques include:

- Setting stop-loss orders: A stop-loss order is an instruction to close your position at a predetermined price, should the market move against you. This helps limit your losses and protect your trading capital.

- Managing leverage: While leverage can amplify profits, it can also magnify losses. Be cautious when using high leverage and ensure that you have a clear understanding of its implications on your trading account.

- Position sizing: Determine the appropriate size of your trade, considering your account balance and the level of risk you are willing to take. Avoid risking more than 1-2% of your trading capital on a single trade.

- Diversification: Diversify your trading portfolio by investing in different currency pairs or using multiple trading strategies. This can help spread the risk and minimize the impact of a single losing trade on your account.

Continuously Improve Your Trading Skills

Forex trading is a learning process that requires constant improvement and adaptation to changing market conditions. To enhance your trading skills:

- Stay informed: Keep yourself updated on global economic events, central bank policies, and market news that could impact currency valuations.

- Analyze your trades: Regularly review your trading performance to identify patterns, mistakes, and areas for improvement. Learn from both your winning and losing trades to become a more proficient trader.

- Seek education: Continuously invest in your trading education by reading books, attending webinars, and participating in online trading communities. Learning from experienced traders and experts can provide valuable insights and help you develop new strategies.

Conclusion

Starting Forex trading can be an exciting and potentially profitable endeavor. By understanding the basics of Forex trading, choosing a reputable broker, developing a solid trading strategy, implementing risk management techniques, and continuously improving your trading skills, traders can increase their chances of success. It’s important to remember that Forex trading is a continuous learning process, and even experienced traders face challenges. Therefore, embracing patience, discipline, and adaptability is vital for long-term success. With determination and the right approach, beginners can confidently step into the world of Forex trading and unlock a world of opportunities.