Forex trading involves analyzing currency pair price movements to identify profitable trading opportunities. Technical analysis plays a significant role in this process, with various tools and techniques available to traders. Among these, breakout indicators are highly valued for their ability to spot potential market moves and trend development. This article will delve into the concept of breakout indicators, their different types, and how to effectively use them in forex trading.

What are Breakout Indicators?

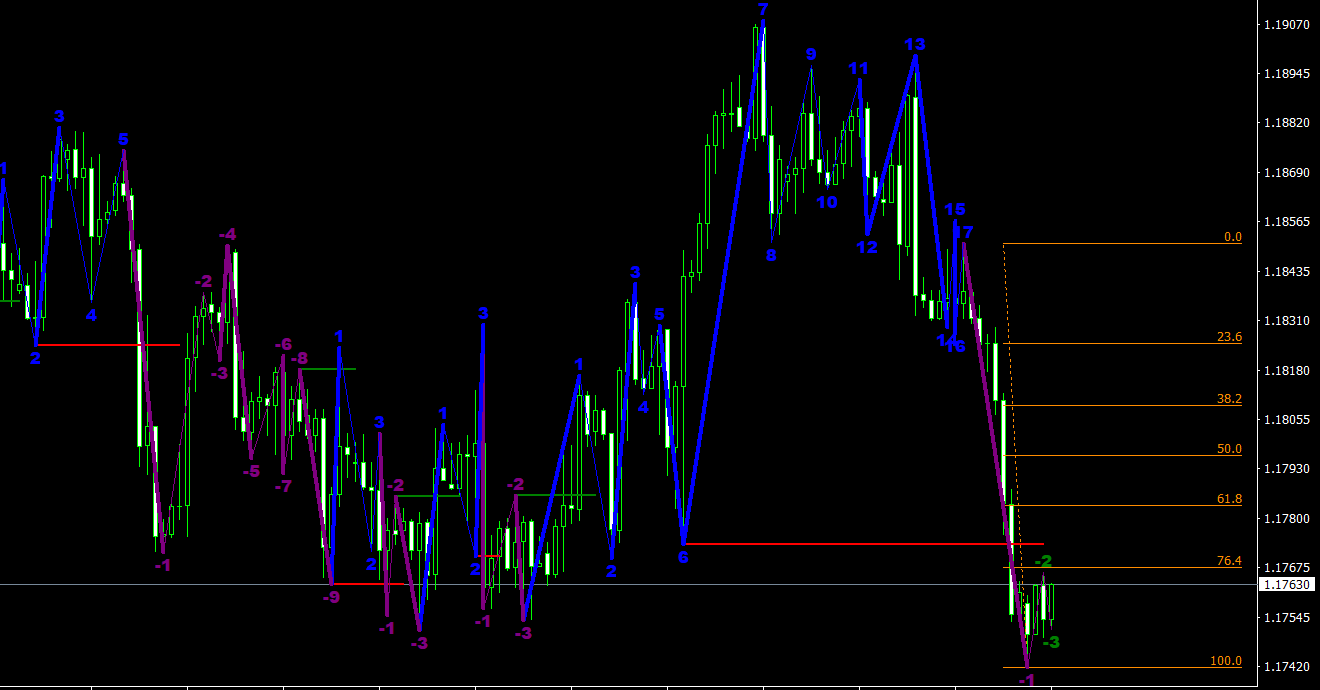

Breakout indicators are a set of technical analysis tools designed to identify potential price breakouts from defined support and resistance levels, trendlines, or chart patterns. Breakouts often signal the start of a new trend or a significant market move, providing traders with opportunities for profitable trades. Breakout indicators can help traders determine when the market is likely to experience a significant price movement and provide entry points for trades that capitalize on these moves.

Types of Breakout Indicators

There are several types of breakout indicators, each with its unique characteristics and applications. Some of the most popular breakout indicators include:

- Donchian Channels: Donchian Channels, created by Richard Donchian, are a trend-following channel indicator that consists of an upper and lower band based on the highest high and lowest low over a specified number of periods (usually 20 periods). Donchian Channels help traders identify potential breakouts and trend reversals and establish stop-loss and profit target levels based on historical price extremes.

- Average True Range (ATR): Developed by J. Welles Wilder Jr., the Average True Range (ATR) is a volatility indicator that measures the degree of price movement within a specified period. The ATR can be used as a breakout indicator by establishing a threshold above or below which a breakout is considered to have occurred. A price move exceeding the threshold may signal the start of a new trend or a continuation of the existing trend.

- Moving Average Crossovers: Moving average crossovers involve using two different moving averages, typically a shorter and a longer period, to identify potential breakouts. When the shorter moving average crosses above the longer moving average, it may indicate a potential upward breakout, whereas a cross below the longer moving average suggests a potential downward breakout.

- Volume-based Indicators: Volume-based indicators, such as the On Balance Volume (OBV) or the Volume Rate of Change (VROC), help traders assess the strength of price moves by analyzing changes in trading volume. A sudden increase in volume may suggest the presence of a breakout, as it indicates strong market interest and participation.

Using Breakout Indicators in Forex Trading

To effectively use breakout indicators in forex trading, consider the following tips:

- Combine breakout indicators with other technical analysis tools: Breakout indicators, like any other technical analysis tool, should not be used in isolation. Combining them with other tools, such as support and resistance levels, chart patterns, and other trend indicators, can provide additional confirmation and enhance the effectiveness of your analysis.

- Analyze multiple timeframes: Examining currency pairs on multiple timeframes can provide a more comprehensive view of the market and help you identify potential trading opportunities more effectively. For example, you can use a longer timeframe to determine the overall trend and a shorter timeframe to identify optimal entry and exit points.

- Be aware of false breakouts: Breakouts can occasionally be false, where the price momentarily moves outside the defined level but quickly reverses back within its previous range. To mitigate the risk of false breakouts, look for additional confirmation from other technical analysis tools or wait for the price to close outside the breakout level before entering a trade.

- Implement sound risk management strategies: Despite the usefulness of breakout indicators, forex trading always involves a degree of uncertainty. It’s essential to practice sound risk management strategies, such as setting stop-loss orders, managing your position sizes, and maintaining a diversified portfolio, to protect your capital and ensure long-term trading success.

- Test and optimize your trading strategy: Before incorporating breakout indicators into your live trading, test your trading strategy using historical data or a demo account. This process allows you to assess the effectiveness of breakout indicators and other technical analysis tools in your strategy and make any necessary adjustments to optimize performance.

Breakout Trading Strategies

There are several ways to use breakout indicators in forex trading. Some of the most popular breakout strategies include:

- Donchian Channel Breakout Trading: This strategy involves trading breakouts from Donchian Channels, with the expectation that the price will continue in the direction of the breakout. When the price breaks above the upper Donchian Channel, traders can enter a long position, while a break below the lower Donchian Channel warrants a short position. Stop-loss orders can be placed below or above the Donchian Channel, depending on the trade direction.

- ATR Breakout Trading: This strategy involves using the Average True Range (ATR) to identify potential breakouts by establishing a threshold above or below which a breakout is considered to have occurred. Traders can enter a position in the direction of the breakout once the price move exceeds the threshold, and set stop-loss orders based on a multiple of the ATR value.

- Moving Average Crossover Trading: This strategy involves entering a position in the direction of the moving average crossover, anticipating a potential breakout. For example, when the shorter moving average crosses above the longer moving average, traders can enter a long position, whereas a cross below the longer moving average suggests entering a short position. Stop-loss orders can be placed below or above the longer moving average, depending on the trade direction.

- Volume-based Breakout Trading: This strategy involves using volume-based indicators to confirm the strength of a breakout. Traders can enter a position in the direction of the price move when a breakout coincides with a sudden increase in volume, as it indicates strong market interest and participation. Stop-loss orders can be placed below or above the breakout level, depending on the trade direction.

Conclusion

In conclusion, breakout indicators are a valuable set of technical analysis tools that can help forex traders identify potential market moves and trend development. By understanding the concept of breakout indicators, their various types, and how to use them effectively in conjunction with other technical analysis tools, traders can maximize their potential for success in the forex market.

Incorporating breakout indicators into your forex trading strategy can provide valuable insights into price movements and market dynamics. By combining breakout indicators with other technical analysis tools, analyzing multiple timeframes, and implementing sound risk management strategies, you can increase your chances of success in the highly competitive and ever-changing forex market.