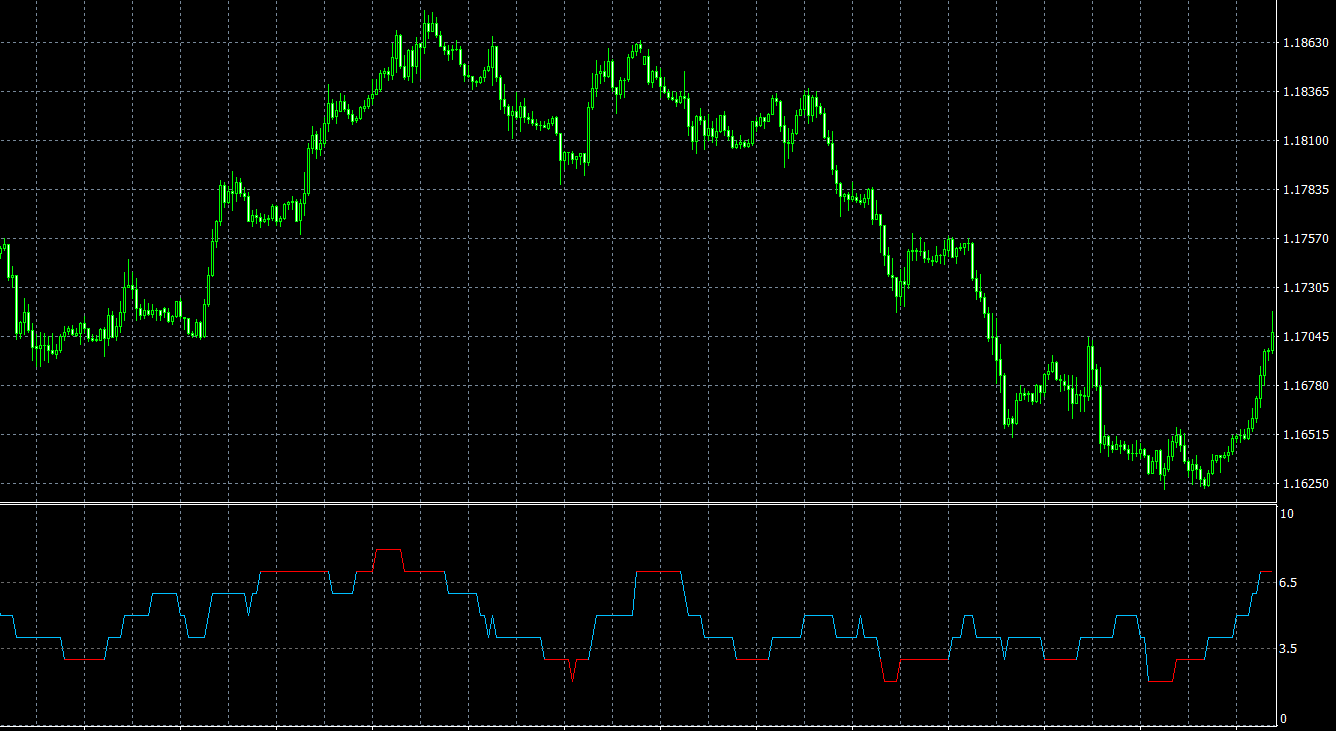

The Overbought Oversold Level MT4 Indicator is a powerful and innovative tool that uses two Donchian channels to determine the beginning of price corrections and reversals. By leveraging this indicator, traders can identify overbought and oversold market conditions with precision, making it easier to generate profitable trading signals. In this article, we will explore the key features of the Overbought Oversold Level MT4 Indicator and provide guidance on how to interpret and apply its signals for optimal trading results.

Key Features of the Overbought Oversold Level MT4 Indicator

- Dual Donchian Channels: The indicator utilizes two Donchian channels with different periods, which allows for a comprehensive analysis of market conditions and enhances the accuracy of overbought and oversold signals.

- Non-Repainting: The Overbought Oversold Level trading indicator does not repaint, ensuring that historical signals remain consistent for accurate backtesting and analysis. The indicator only redraws on the current, unclosed bar.

- Advanced Calculation Method: The indicator calculates the total distance between the Highest High lines of the larger period and the Lowest Low of the smaller period, and vice versa. These values are then compared as a percentage to reduce noise and minimize false level crossings.

- Color-Coded Signals: When the line of the Overbought Oversold Level indicator reaches its highest or lowest levels, the line changes color for easy visualization of signals and prompt identification of trading opportunities.

How to Use the Overbought Oversold Level MT4 Indicator

To effectively utilize the Overbought Oversold Level MT4 Indicator, follow these guidelines:

- Identify Overbought and Oversold Conditions: When the line of the indicator reaches its highest level (overbought condition) or lowest level (oversold condition), the line will change color, signaling a potential trading opportunity.

- Watch for Reversals and Corrections: Overbought and oversold signals often indicate the beginning of price corrections and reversals. Monitor the indicator’s line for color changes and assess the market conditions for potential trade entry or exit points.

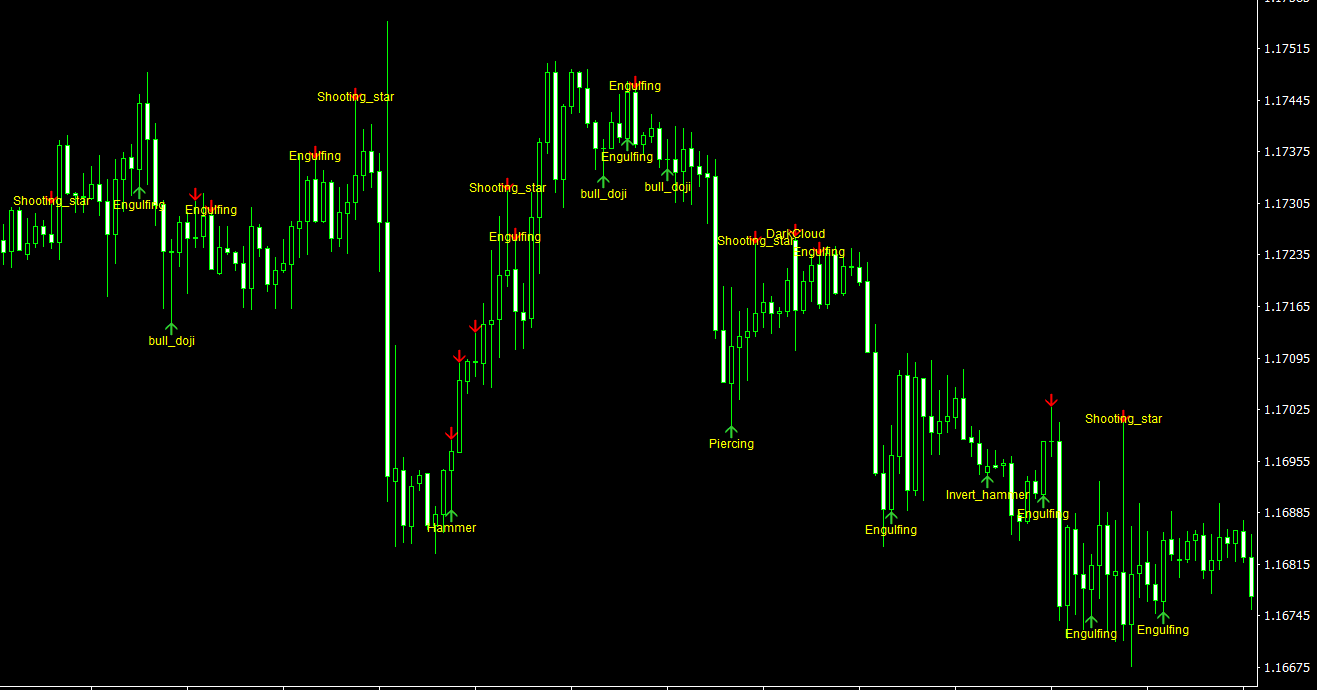

- Incorporate Other Technical Analysis Tools: Combining the Overbought Oversold Level indicator with other technical analysis tools, such as moving averages or support and resistance levels, can provide a more comprehensive understanding of market conditions and potential trading opportunities.

- Test and Optimize: Adjust the indicator’s settings and parameters to suit your trading preferences, currency pair, and timeframe. Regularly review and fine-tune the settings to maintain their effectiveness and relevance as market conditions evolve.

Conclusion

The Overbought Oversold Level MT4 Indicator is an advanced, non-repainting tool that can significantly enhance your trading performance by providing accurate overbought and oversold signals. Its dual Donchian channels and advanced calculation method enable traders to identify potential market reversals and corrections with precision. By incorporating the Overbought Oversold Level MT4 Indicator into your trading strategy and following the guidelines provided in this article, you can improve your market analysis capabilities and make more informed trading decisions.

Features of Overbought Oversold Level MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Overbought-Oversold-Level.zip file you will find:

- Overbought Oversold Level.ex4

Download Overbought Oversold Level MT4 indicator for free: