Forex trading has become a popular topic in recent years, with many people looking for alternative ways to earn an income. The foreign exchange market (Forex or FX) is a decentralized global market where currencies are traded. It is the largest and most liquid financial market in the world, with daily trading volume exceeding $6.6 trillion. With such high volumes and the promise of potentially substantial profits, the question on everyone’s mind is: can you make money from forex trading?

This article delves into the intricacies of forex trading, the factors that influence profitability, the strategies employed by successful traders, and whether or not it is possible to make money consistently.

Understanding Forex Trading

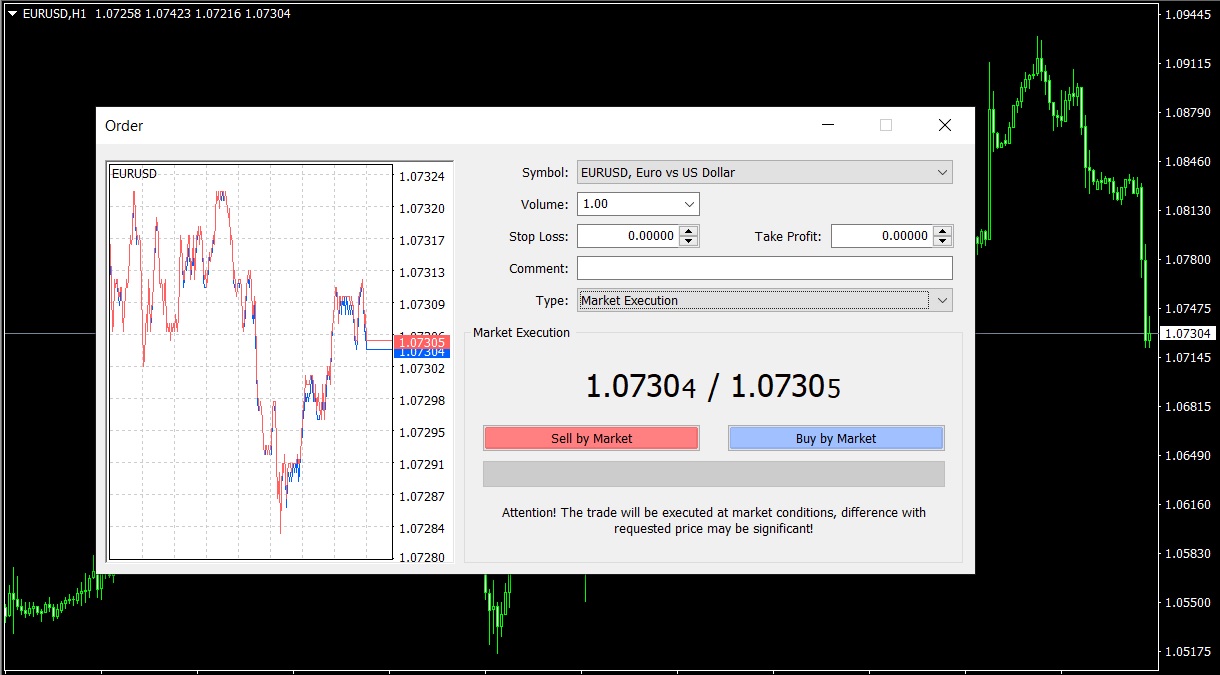

Forex trading involves buying one currency and selling another, typically in currency pairs such as EUR/USD, USD/JPY, and GBP/USD. Participants include banks, corporations, institutional investors, and individual traders. The market operates 24 hours a day, five days a week, which means there is always activity, providing opportunities for traders.

A key concept in forex trading is leverage, which allows traders to control a large position with a relatively small investment. Brokers offer varying degrees of leverage, and while this can amplify profits, it can also result in significant losses if the market moves against the trader’s position.

Factors Influencing Profitability

Numerous factors influence the potential profitability of forex trading. Some of the primary factors include:

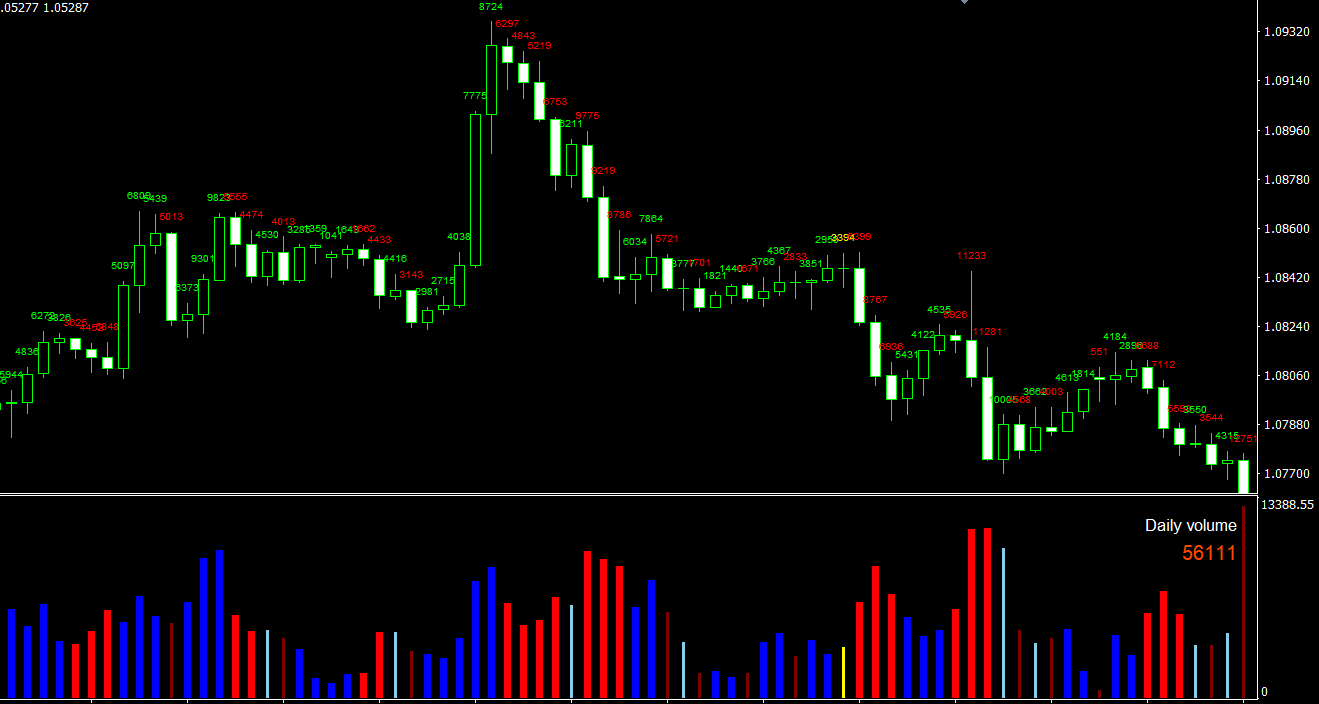

- Market volatility: Higher volatility offers increased opportunities for profit, but also presents greater risks. Traders must learn to navigate market conditions and anticipate price movements.

- Trading strategy: A well-defined and consistently applied trading strategy is crucial for long-term success. Strategies include fundamental analysis, technical analysis, and sentiment analysis.

- Risk management: Effective risk management strategies minimize losses and protect a trader’s account balance. This includes proper position sizing, setting stop-loss orders, and utilizing a favorable risk-reward ratio.

- Psychological factors: Discipline, patience, and emotional control are critical components of successful forex trading. A trader must learn to avoid common psychological pitfalls, such as overtrading, revenge trading, and fear of missing out.

- Trading costs: Brokerage fees, commissions, and spreads can eat into profits, particularly for high-frequency traders. Traders should consider these costs when evaluating their potential profitability.

The Reality of Forex Trading: The Good, the Bad, and the Ugly

The reality of forex trading is a mix of success stories and cautionary tales. Here is a breakdown of some key points:

- The Good: Successful traders do exist, and they make a living by trading forex. They typically have extensive experience, a solid understanding of market dynamics, and effective risk management strategies. They also employ a disciplined approach to trading and constantly adapt their strategies based on market conditions.

- The Bad: A majority of retail forex traders fail to make consistent profits. Studies suggest that between 70% and 90% of retail traders lose money in the long run. This can be attributed to a lack of education, insufficient risk management, and poor psychological control.

- The Ugly: Forex trading can be a high-risk endeavor. Without proper risk management, traders can lose substantial sums of money in a short period, particularly when trading with high leverage. There have been instances where traders have lost their entire account balances due to poor decision-making and lack of risk control.

Strategies Employed by Successful Traders

Becoming a consistently profitable forex trader takes time, dedication, and a keen understanding of market dynamics. Some strategies employed by successful traders include:

- Price action trading: This approach focuses on analyzing historical price data to predict future price movements. Traders use chart patterns, support and resistance levels, and candlestick formations to make trading decisions.

- Trend following: This strategy involves identifying and following established market trends. Traders use various technical indicators, such as moving averages, to determine the direction of the trend and potential entry and exit points.

- Range trading: When markets are not trending, traders can capitalize on range-bound market conditions by identifying support and resistance levels and trading within these boundaries.

- Position trading: This long-term approach involves holding trades for weeks or even months. Position traders rely on fundamental analysis to determine the underlying strength or weakness of a currency and make trading decisions accordingly.

- Scalping: This high-frequency trading strategy aims to exploit small price fluctuations, often within minutes or seconds. Scalpers enter and exit positions quickly, targeting small, consistent profits throughout the trading day.

Can You Make Money From Forex Trading?

The answer to the question, “Can you make money from forex trading?” is both yes and no. Successful forex traders do exist, and they consistently profit from trading. However, the majority of retail traders struggle to achieve consistent profitability, and many end up losing money.

To increase the likelihood of success in forex trading, aspiring traders must:

- Invest time in education: Understanding the fundamental principles of forex trading and gaining in-depth knowledge of the market is crucial. This includes understanding economic factors, technical analysis, and trading psychology.

- Develop a trading plan: Creating a well-defined trading plan, complete with risk management strategies, helps maintain discipline and consistency in trading.

- Practice with a demo account: Before diving into live trading, it is advisable to test your strategies and refine your skills with a demo account.

- Start small: Begin with a small trading account to limit potential losses while gaining valuable experience.

- Be patient and disciplined: Forex trading success doesn’t happen overnight. It requires patience, persistence, and a disciplined approach to trading.

Conclusion

While it is possible to make money from forex trading, it is not easy, and there are no guarantees of success. It requires a considerable investment of time and effort to learn the ins and outs of the market, develop effective trading strategies, and maintain strict risk management protocols.

For those willing to commit to the process, there are opportunities to profit from forex trading. However, it is essential to approach the endeavor with realistic expectations and a clear understanding of the challenges involved. By prioritizing education, developing a solid trading plan, and adopting a disciplined mindset, aspiring traders can increase their chances of success in the forex market.