Forex trading, short for foreign exchange trading, is the process of buying and selling currencies in the global market. This decentralized market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. When participating in forex trading, understanding the various types of orders is crucial to effectively manage risk and maximize potential gains. In this article, we will explore the different types of orders in forex trading, including market orders, limit orders, stop orders, and more.

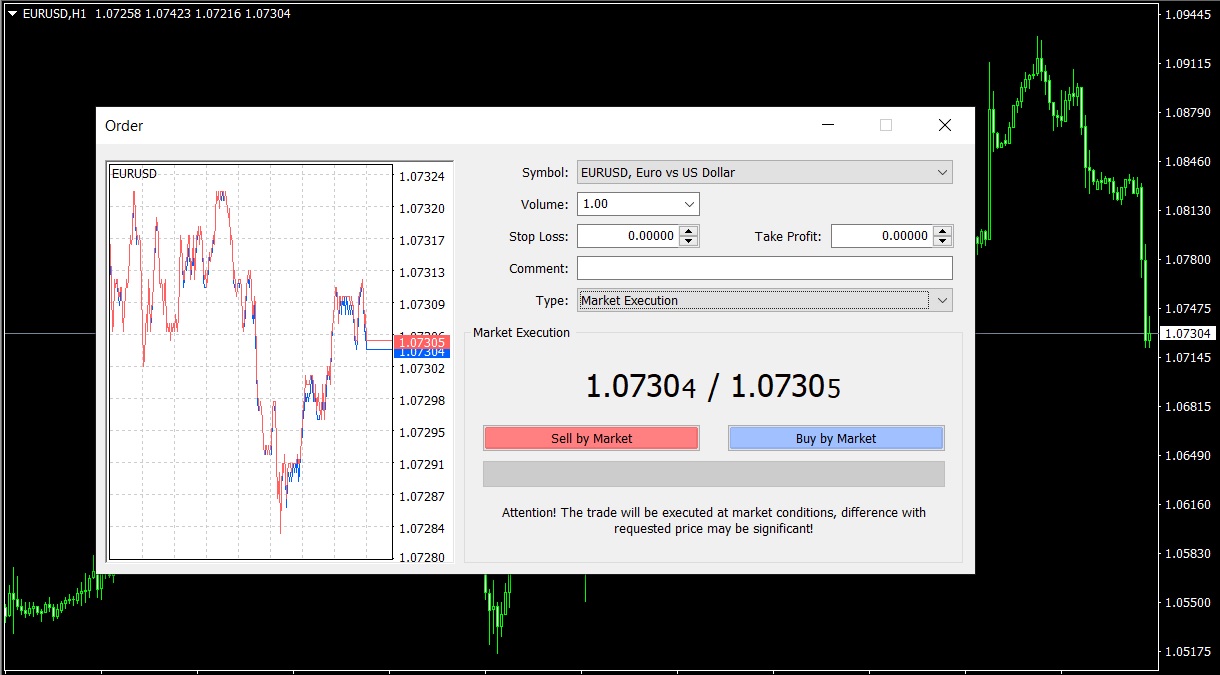

Market Orders

A market order is the most basic type of order in forex trading. It instructs the broker to buy or sell a currency pair at the best available price in the market. Market orders are executed immediately, providing the trader with a quick and efficient way to enter or exit a trade. However, the downside is that traders may experience slippage – the difference between the expected price and the actual price at which the order is executed – during periods of high market volatility.

Limit Orders

A limit order is used when a trader wants to buy or sell a currency pair at a specific price or better. It allows the trader to set a predetermined price level for their trade, and the order will only be executed if the market reaches that price. Limit orders provide more control over the execution price but may not be filled if the specified price is not reached.

- Buy Limit Order

A buy limit order is placed below the current market price, instructing the broker to buy the currency pair if the market drops to the specified price or lower. This type of order is used when a trader anticipates a currency pair’s price to decline before rising.

- Sell Limit Order

A sell limit order is placed above the current market price, instructing the broker to sell the currency pair if the market rises to the specified price or higher. This type of order is used when a trader anticipates a currency pair’s price to increase before declining.

Stop Orders

Stop orders are used to minimize losses or lock in profits by instructing the broker to buy or sell a currency pair when it reaches a specified price level. Once the stop price is reached, the order becomes a market order, executing at the best available price.

- Buy Stop Order

A buy stop order is placed above the current market price, instructing the broker to buy the currency pair if the market rises to the specified price or higher. This type of order is used to enter a long position in anticipation of a price increase or to exit a short position to limit losses.

- Sell Stop Order

A sell stop order is placed below the current market price, instructing the broker to sell the currency pair if the market drops to the specified price or lower. This type of order is used to enter a short position in anticipation of a price decrease or to exit a long position to limit losses.

Stop-Limit Orders

A stop-limit order combines the features of a stop order and a limit order, allowing traders to set both a stop price and a limit price for their trade. Once the stop price is reached, the order turns into a limit order, executing only at the specified limit price or better. This type of order provides more control over the execution price but may not be filled if the market moves quickly through the limit price without trading at it.

- Buy Stop-Limit Order

A buy stop-limit order is placed above the current market price, instructing the broker to buy the currency pair if the market rises to the stop price or higher, but only if the limit price or lower can be obtained. This type of order is used to enter a long position in anticipation of a price increase while ensuring a specific entry price or better.

- Sell Stop-Limit Order

A sell stop-limit order is placed below the current market price, instructing the broker to sell the currency pair if the market drops to the stop price or lower, but only if the limit price or higher can be obtained. This type of order is used to enter a short position in anticipation of a price decrease while ensuring a specific entry price or better.

Trailing Stop Orders

A trailing stop order is a variation of a stop order that automatically adjusts the stop price based on the market’s movement. It trails the market price by a specified number of pips or points, allowing traders to lock in profits while still benefiting from potential market trends. If the market moves in the trader’s favor, the trailing stop moves with it, maintaining the specified distance. However, if the market moves against the trader, the trailing stop remains fixed, effectively acting as a stop order. When the stop price is reached, the order becomes a market order, executing at the best available price.

- Buy Trailing Stop Order

A buy trailing stop order is placed below the current market price, instructing the broker to buy the currency pair if the market drops to the specified trailing stop price or lower. This type of order is used to enter a long position in anticipation of a price increase or to exit a short position, while capturing profits as the market rises.

- Sell Trailing Stop Order

A sell trailing stop order is placed above the current market price, instructing the broker to sell the currency pair if the market rises to the specified trailing stop price or higher. This type of order is used to enter a short position in anticipation of a price decrease or to exit a long position, while capturing profits as the market falls.

OCO (One-Cancels-the-Other) Orders

An OCO order is a combination of two separate orders, typically a stop order and a limit order, placed simultaneously for the same currency pair. If one of the orders is executed, the other order is automatically canceled. OCO orders are useful for traders who want to take advantage of potential market trends while managing risk, as they provide a means to both enter a trade at a desirable price and set a stop to limit potential losses.

Conclusion

Understanding and effectively utilizing the different types of forex trading orders is critical for successfully navigating the foreign exchange market. By familiarizing yourself with market orders, limit orders, stop orders, stop-limit orders, trailing stop orders, and OCO orders, you can better manage risk, capture profits, and adapt to changing market conditions. Developing a solid grasp of these order types will not only enhance your trading strategy but also contribute to your overall success as a forex trader. As you gain experience and confidence in the market, you can fine-tune your approach and leverage the full potential of these orders to optimize your trading performance. Remember, a well-informed trader is a more effective trader, so always take the time to learn and adapt to the ever-evolving world of forex trading.