In the labyrinthine world of Forex trading, where split-second decisions can be game-changers, traders often lean on indicators to guide their way. While Bollinger Bands have been a staple in traders’ toolkits for years, another lesser-known but highly effective alternative exists: the STARC Bands MT4 Indicator. STARC Bands, or Stoller’s Middle Range Channels, offer unique insights into market conditions and serve as a reliable guide for intraday trading strategies. This article aims to shed light on the features, functions, and trading strategies involving the STARC Bands indicator.

What Makes STARC Bands Different?

Understanding the Core

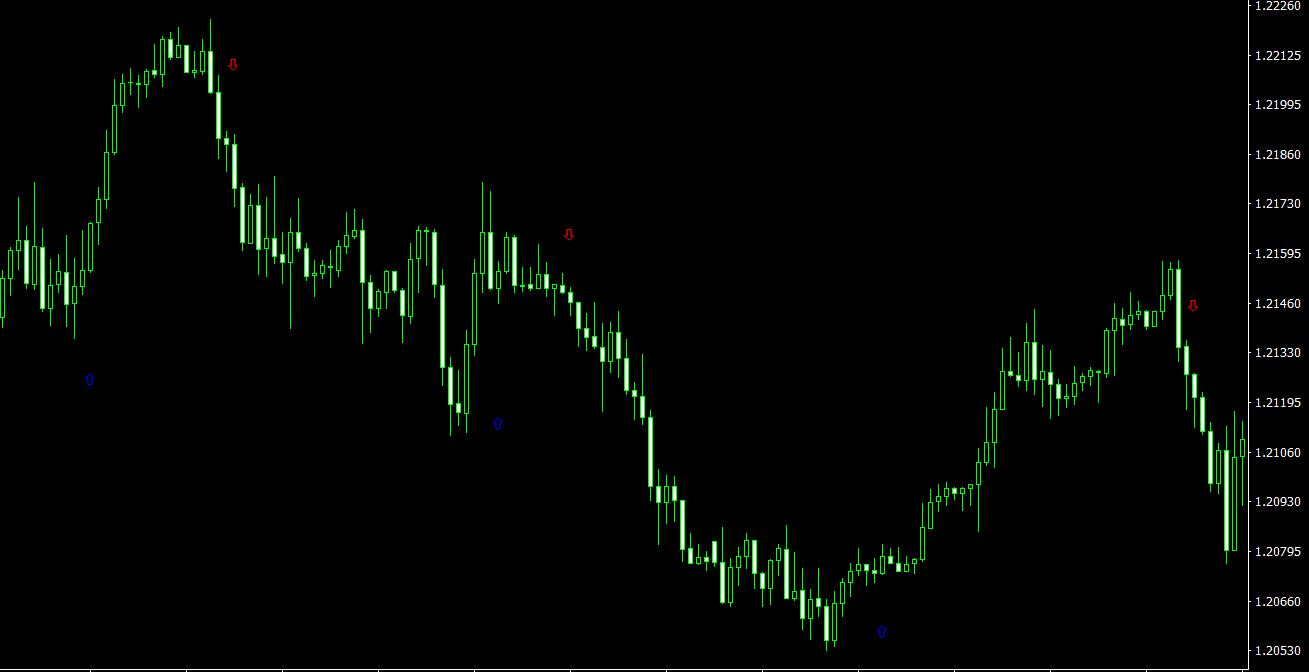

At first glance, STARC Bands might appear similar to Bollinger Bands. Both generate a range around a middle line, which adjusts according to market conditions. However, the difference lies in the calculations. While Bollinger Bands rely on closing prices and standard deviations, STARC Bands utilize the Average True Range (ATR) to gauge volatility. This approach makes STARC Bands more accurate in reflecting the real-world volatility of the market. The optimal ATR period for this indicator is typically set at 10.

Market Behavior and STARC Bands

In a stable market, STARC Bands tend to narrow. As market volatility increases, the bands widen, thus providing a visual representation of market conditions.

Strategies for Using STARC Bands

1. Following Price Movements

When using STARC Bands, a price crossing either the upper or lower band serves as a significant signal. Traders can interpret this as an opportunity to enter the market in the direction in which the price is moving. The caveat is that the trade should ideally be opened only when the price fixes or stabilizes outside the channel. In this strategy, setting a stop loss behind the middle line of the indicator is highly recommended.

2. Identifying Overbought and Oversold Zones

Another way to interpret STARC Bands involves changing the K indicator setting from 1.33 to 3. In this approach, if the price tests or reaches the upper or lower band, it is considered to have reached an overbought or oversold extreme. This could serve as a signal for a potential price reversal. For this strategy, coupling STARC Bands with Forex oscillators like the RSI indicator can provide extra validation for trading decisions.

Best Practices and Recommendations

Combining with Other Indicators

The STARC Bands indicator gains potency when used in conjunction with filtering indicators like Moving Averages or RSI. Such combinations can be particularly effective in intraday Forex trading strategies.

Managing Risks

It’s crucial to remember that like all indicators, STARC Bands are not foolproof. Therefore, traders should use risk management techniques such as setting stop losses, and also consider other indicators and market news for comprehensive analysis.

Conclusion

STARC Bands offer an alternative yet effective approach to understanding market volatility and trends, especially useful for intraday traders. Whether you are using it to follow price movements or to identify overbought and oversold zones, this indicator, when combined with other tools and risk management strategies, can be a robust addition to your trading arsenal. By understanding its functionalities and limitations, traders can make more informed decisions in the fast-paced world of Forex trading.

Features of STARC Bands MT4 indicator

- Platform: Metatrader 4

- Ability to change settings: Yes

- Timeframe: any from 1 Minute to Daily

- Currency pairs: any

In Starc_bands.zip file you will find:

- Starc_bands.ex4

Download STARC Bands MT4 indicator for free: